When Stocks Corrected, Were Our Alt Picks Ready for It?

How our alternative Morningstar Medalists fared in the correction.

After a complacent 2017, liquid alternative funds have had a chance to show their mettle or lack thereof. From Jan. 26 through Feb. 8, the Dow Jones Industrial Index fell 10% and the S&P 500 fell just over 9%. It's a short period, but it's the type of painful decline that liquid alts are designed to help alleviate. While the correction may continue, it's a good time to check in on how liquid alternatives and our Morningstar Medalists--funds that we recommend after a thorough due-diligence process--have done during the sell-off.

In the following, we’ll take a category-by-category look at how liquid alternative categories and our medalists performed during the correction. We’ll also compare our medalists’ returns with the S&P 500 to see if they offered some protection. Why not compare them to bonds? Bonds are the original alternative investment to stocks. Most alternative strategies shouldn’t be funded from that asset class if the goal is to lower overall risk, since the majority of a traditional portfolio’s risk comes from stocks.

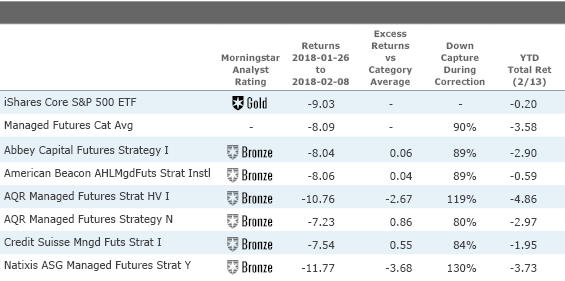

Managed Futures As my colleague covered in early February, managed-futures funds are trend followers, not trend predictors. The biggest risk to managed-futures funds is sharp reversals in trends, and that's what happened in February. Prior to this correction, the trend in risk assets, like equities and commodities, were all strongly positive, leading managed-futures funds to take long positions in them. Not surprisingly, the funds didn't fare that well during the correction. Still, the average fund and all but two of our medalists lost less than stocks during the period. Exhibit 1 shows the results of the category average and our medalists picks in the category.

- source: Morningstar Analysts

Although the category average return and most of our medalists outperformed stocks during the period, that’s probably little consolation to investors who expect managed futures to always do well during downturns given their strong track record in the financial-crisis and tech-bubble bear markets. The difference between this correction and those bear markets, aside from the depth, is the speed. Managed futures tend to do best when trends develop slowly and then accelerate, not when they quickly change direction.

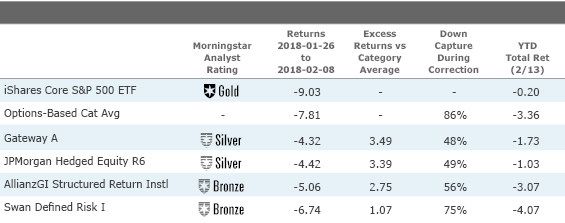

Options-Based

The options-based Morningstar Category was home to the biggest casualty of the correction, as $780 million

- source: Morningstar Analysts

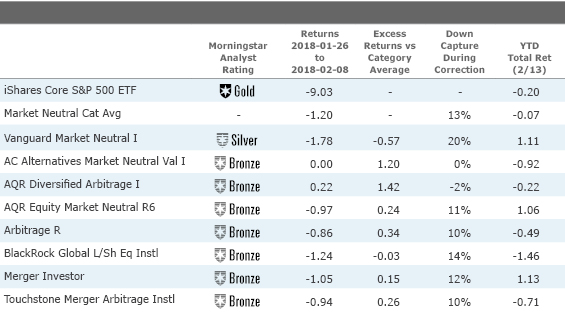

Market Neutral As a group, market-neutral funds were the best-performing alternative strategy. These funds make matching bets on long and short equity positions to isolate a manager's skill in picking stocks without taking on the overall market's risk. Some base their long and short picks on factors or fundamentals, while others take advantage of events like mergers and acquisitions. Isolating stock selection means the direction of a market-neutral fund's returns shouldn't be correlated with the market's direction. These funds also tend to have relatively low risk compared with stocks. While none of our medalists particularly zagged when the market zigged during this correction, overall they held up very well compared with other alternative strategies. Exhibit 3 shows the results.

- source: Morningstar Analysts

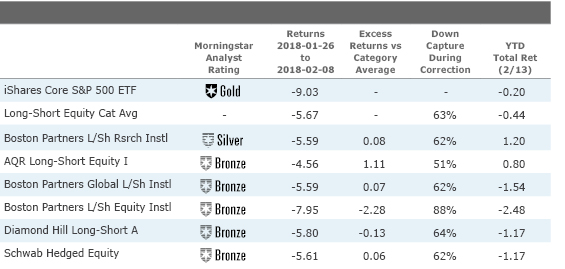

Long-Short Equity Long-short equity funds tend to have a high correlation to the broader equity market because of a net long bias. Funds in the category typically range from about 45% to 70% net long. Net exposures have been creeping up as the bull market in equities has persisted. The average long-short equity fund had a net long position of 63% as of the end of 2017; a year prior the average was 58%. Given that exposure, it's not surprising to see the funds tended to capture about 60% of the correction's downside, though it is a bit on the lower side of expectations. Exhibit 4 shows the results.

- source: Morningstar Analysts

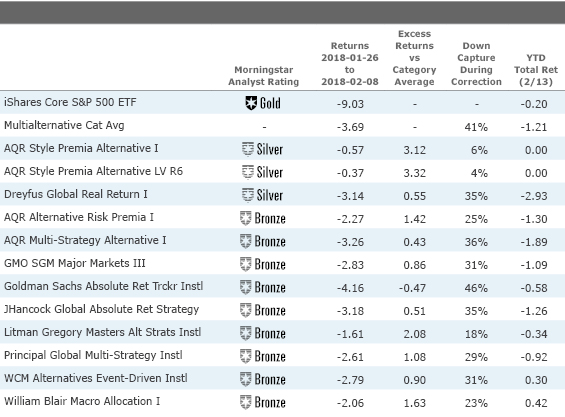

Multialternative The multialternative Morningstar Category includes a diverse mix of strategies, but most are either multistrategy funds of various alternative strategies or global macro strategies. The funds in the category tend to take on some equity market risk, with the notable exception of AQR's style premia and multistrategy funds, which are designed to be market neutral. Overall, our medalists fared well versus the category average, with only one falling below the norm during the period. Exhibit 5 shows the results.

- source: Morningstar Analysts

Conclusion Investors shouldn't extrapolate too much from any short-term performance period, but stress tests like the recent correction are good opportunities to spot-check a fund's performance relative to expectations. While none of our alternative medalists set off any alarm bells during the correction, these funds should really be judged over longer periods, ideally full market cycles, which is when the benefits of diversification should be strongest.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)