3 ETF Investment Mistakes to Avoid

Watch for signs that a fund is too expensive, taking too much risk, or poorly constructed.

A version of this article appeared in the November 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

It is easier, and often more important, to avoid mistakes than to identify great investment ideas. Among the low-hanging fruit, you can improve your odds of success by avoiding strategies that cost too much, take too much risk, or are poorly constructed. Unfortunately, the exchange-traded fund landscape is littered with funds that suffer from these problems, and it's not always obvious which funds do. But you can identify them if you know what to watch.

Too Expensive

How do you know whether an ETF is charging too much? The most obvious cases are when two or more funds offer very similar exposure, but one charges a multiple of the cheapest option. For example, PowerShares Dividend Achievers ETF PFM and

Even when there are bigger differences between two similar funds, it is difficult to justify paying for the more expensive option.

BlackRock launched IEMG in 2012 with a low fee to compete with

Some funds may look distinctive on the surface but just repackage exposures you can get elsewhere more cheaply. For example, First Trust Large Cap Value AlphaDEX ETF FTA (0.62% expense ratio) follows a unique portfolio construction approach, but investors could get similar exposure more cheaply with a market-cap-weighted alternative.

FTA ranks the stocks in the Nasdaq US 500 Large Cap Value Index on their value characteristics and targets the highest-ranking 75%, offering a slightly deeper value tilt than most market-cap-weighted value funds. It then divides its holdings into quintiles based on their rankings and assigns larger weightings to the higher-ranked quintiles. All stocks in the same quintile receive the same weightings, which pulls the portfolio toward smaller-cap stocks.

So, while this fund falls in the large-value Morningstar Category, it has tended to behave more like a mid-value fund. During the trailing 10 years through September 2017, FTA beat market-cap-weighted

Too Much Risk It is hard to come back from a large loss. While it's necessary to take some risk to earn more than the paltry rates that Treasuries offer, the riskiest funds rarely offer commensurate compensation. Plus, riskier funds are tough to use well, as the pain of the losses they inflict can cause investors to dump them at the wrong time.

What constitutes too much risk varies across investors, but there are objective performance and portfolio characteristics investors can use to gauge a fund's risk. Although no two market downturns are exactly alike, a fund's performance during past downturns is a good measure of risk. Strategies that have significantly underperformed their category benchmarks during market downturns will likely continue to expose investors to greater downside risk. This data is available (labeled "downside capture ratio") on the Ratings & Risk page for each fund on Morningstar.com. This ratio shows how the fund performed in months when a broad benchmark (the S&P 500 for U.S. equity funds) was down. For example, PowerShares S&P 500 High Beta ETF SPHB had a downside-capture ratio of 159% during the trailing five years through September 2017, indicating that the fund lost 1.59 times as much as the S&P 500 in down months. That was one of the worst showings in the large-blend category.

Standard deviation of returns is also a useful risk metric available on the Ratings & Risk page. It shows how much a fund has bounced around. Funds with greater volatility tend to have greater downside risk than their less-volatile counterparts.

It is useful to pair this backward-looking risk data with an assessment of the composition of the portfolio, which can highlight risks that aren't always apparent in a fund's historical performance. Funds with concentrated exposure to individual stocks or sectors often take risks that the market does not compensate. That may not be a problem if investors keep allocations to those funds small, but concentration risk bears watching. If a fund invests more than half of its assets in its top holdings, it probably isn't well-diversified.

Aggressive style tilts, including value, growth, or dividend income, can also be a source of risk.

Poor Index Construction

While it is more difficult to objectively assess the quality of index construction than risk and fees, poorly constructed indexes are sometimes easy to spot. The most obvious index construction problems involve nonsensical stock selection and weighting criteria--those that lack sound economic rationale. ProSports Sponsors ETF FANZ is a prime example of a strategy that lacks sound economic rationale. It targets the stocks of companies that sponsor or broadcast major U.S. sports leagues and weights them equally. But there is no reason to believe sports sponsorship has any bearing on stock performance. The fund sweeps in an eclectic group of stocks, such as

Sometimes, an index's selection criteria pass muster, but its approach to weighting securities doesn't make sense. That's certainly the case for

So far, so good. But the index errs in weighting its holdings by the value of their per-share dividend payments. That's a terrible metric because it is linked to the number of shares outstanding, which bears no relation to firm value or the total value of the dividends each firm pays. So, if a stock splits its shares, its weighting in the index declines, even though that event has no impact on the firm's dividend policy or value.

While such a nonsensical weighting approach won't necessarily hurt performance, it can introduce some unintended biases. In this case, it pulls DVY into mid-cap territory and contributes to its large allocation to utilities stocks. As of this writing, the average market cap of the fund's holdings would be more than 5 times larger and its exposure to the utilities sector 14 percentage points lower if it weighted its holdings by market cap.

It's also important to be on the lookout for index strategies that are not designed for capacity because they can grow increasingly disadvantaged as they become more popular. Index reconstitution triggers a series of forced trades that can put upward pressure on the prices of newly added stocks and downward pressure on constituents slated for removal. This process is called rebalancing drag, and it can hurt the index's performance. The more money that tracks the index, or the less liquid its holdings, the larger the rebalancing drag. To mitigate drag and increase capacity, most indexes screen their holdings for liquidity and apply buffer rules to reduce unnecessary turnover, but some do a better job than others.

The Russell 2000 Index illustrates how rebalancing drag can hurt performance. At the end of May each year, it ranks U.S. stocks by market cap, targets those ranking between the 1,001st and 3,000th largest, and weights them by market cap. This gives it greater exposure to micro-cap stocks than many of its index peers, which tend to be more expensive to trade than larger stocks. And it requires only 5% of a stock's shares to publicly trade to qualify for inclusion, which can pull in some thinly traded names. Most other indexes require at least twice that percentage. Russell does apply modest buffers around its upper market-cap threshold to reduce turnover, but it doesn't apply any buffers around its lower bound, where trading tends to be more expensive.

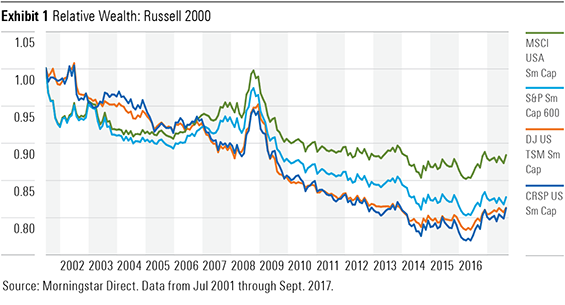

These limitations, coupled with the large pool of money tied to the index, have created a significant rebalancing drag that puts it at a disadvantage to its small-cap index peers. It has consistently underperformed the MSCI USA Small Cap, CRSP US Small Cap, Dow Jones U.S. Small-Cap Total Stock Market, and S&P SmallCap 600 indexes from July 2001 through September 2017, as shown in Exhibit 1. This underperformance could not be attributed to differences in size or valuations.

Summary

- Avoid funds that charge several times the fee of similar alternatives.

- Performances during market downturns, volatility, portfolio concentration, and style tilts serve as useful measures of risk. Avoid the riskiest funds in each category.

- Not all indexes are well-constructed. Worthy index funds should be backed by sound economic rationales and take steps to mitigate rebalancing costs.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)