A New Way to Approach Alternative Funds

To fully understand alpha-seeking alternatives, bring beta on board.

Active fund selection is a part beta, partalpha decision.

For traditional asset classes, it is a fairly straightforwardprocess. Investors seek an alpha/betablend. In selecting an active large-cap manager, forexample, investors desire a skilled managerwho outperforms by investing in large-cap stocks.But alternative investments tend to blur thealpha/beta line, and too often, investors incorrectlybase their fund analysis on a belief thatalternatives lean closer to the manager skill/alphaside of the spectrum. This thinking can leadto a few key problems when selecting alternativesmanagers, because unlike the typical large-capfund, a pure-alpha alts fund has fewsubstitutes, and it is generally more expensive.Conversely, beta is straightforward exposureto an asset class. With beta’s lower cost and easeof comparability, it’s no wonder that fund investors are talking about beta again. Butherein lies a problem for alternatives: How do wego about selecting alts funds when theline between what is considered alpha and whatis considered beta is so tenuous?

Luckily—or unluckily, depending on your pointof view—evidence reveals alternative fundsto be closer to beta plays than alpha. As far backas the 1990s, hedge funds were consideredgreat diversifiers by many because of their lowcorrelations to traditional asset classes. However,two important findings changed that belief.The first was that hedge funds, because oftheir less-liquid nature, suffered from revaluationlags. Their holdings were thinly traded, andmarket movements took time to have an impacton a fund’s net asset value.

The second was the discovery that whilemany hedge funds offer investors uniqueexposures, such as momentum, those exposurescould be copied with passive—and cheaper—alternative beta strategies. Firms suchas Cliff Asness’ AQR Capital Management andAndrew Lo’s AlphaSimplex Group embodythis core alternative beta philosophy, and unlikehedge funds, their offerings are liquid.

So, many investors learned that there was morebeta in alternatives products than meets the eye.

But then came the 2008 market crash, touchingnearly all asset classes. Many liquid alternativesmutual funds, back-tests in hand, arrivedon the scene promising low market correlationsand touting the Herculean abilities of theirmanagers. You couldn’t blame investorsfor assuming that these funds were alpha plays.However, once track records were built up,much like their hedge fund brethren, it becameclear that what liquid alt funds were mostlydishing out was still beta, albeit in a different form.

It was a classic case of overpromising andunderdelivering, and it came back to bite liquidalt funds. If funds and their managers hadn’tset such high expectations, then perhaps investorsmight have seen performance in a more positivelight. But for a fund company to admit thatits alternatives product was mostly rejiggered betawould be akin to your coworker boastingabout how average his or her children are. It’s justnot something a proud parent would do.

That said, even in this ultra-low-cost passiveworld, we think liquid alternatives funds still canadd value—even though we also think thatmany of these funds truly are just average. Ourgoal is to reset how investors think of alternatives,so that investors’ perception of their performanceis more in line with reality and that simplercomparisons between funds can be made.

For the most part, liquid alternative fundsemploy fairly generic beta exposures that can bebroken down into traditional investing buildingblocks, such as equity and fixed-income exposure.1If investors widen their scope and comparealts to traditional asset classes, they may not needto bother with alternatives beta; instead, they maybe able to select simple and cheap beta.

Calibrating Our Approach to Alts We believe the focus-on-beta approach ishighly liberating, but it hinges on first determiningasset allocation. Simply put, this is a matterof where alternatives allocations are funded from.

As we will detail later, a long-short creditfund, for example, can offer more credit exposureand much less duration than a traditionalfixed-income fund. Allocating assets to one ofthese funds from traditional fixed-incomeofferings should be viewed as an asset-allocationdecision. But if the goal is to exchange aduration allocation for credit, we have a wholehost of available options. Sure, a long-short creditfund may be one option, but we mightalso achieve similar results with a traditionallow-duration high-yield bond fund or a bank-loanstrategy.

We refer to these alternatives to alternatives as“next-best options.” Next-best options are not onlyhelpful because they can be thought of aslower-cost substitutes, but like alternatives, theyalso can be diversifying. Alternatives can begreat diversifiers, but they don’t have a monopolyon diversification. While imperfect substitutes,next-best options can help investors considerlow correlations in the appropriate context, and wecan use this concept to quantify if an alternativefund is worth its added cost.

Finally, traditional assets can be used tobuild best-fit portfolios of stocks and bonds. Theseportfolios can be used as benchmarks torepresent a fund’s asset-class exposures (beta);any outperformance, or underperformance,relative to the benchmark may signify a manager’sskill (alpha). To perform this analysis, we builtsimplified factor models that represent aninvestor’s choice between an alternatives fund anda custom combination of traditional asset classes.While we aren’t the first to perform this typeof work, our application varies slightly. Instead ofusing these models to select individual funds,we aggregate our data to make a holistic determinationon each category—we believe certaincategories simply offer more attractive opportunitiesthan others for investors choosing betweenalternatives and traditional funds.

The Bits and Pieces of Alts Many of the fundamental building blocksof alternatives funds are traditional asset classes.Long-short equity funds, which bet both forand against stocks but generally are only around50% to 60% of assets net long, are an easyexample because they can be benchmarkedto a simple portfolio of stocks and cash,with the appropriate mix depending on thefund's beta.

A bitter pill to swallow, however, is thatmany long-short funds fail to beat that benchmark(they don’t generate alpha), even before themassive fee hurdles these managers would haveto overcome to beat a low-cost next-best option.

The average fee for funds in the MorningstarCategory of long-short equity funds was 1.86%, as of year-end 2017. The average fees2 forlarge-blend and ultrashort fixed-incomefunds were 1.02% and 0.52%, respectively, for 2017.This comparison shows it can be far cheaperto lower beta using cash. A long-short equity fundwould need to outperform a combined feehurdle by approximately 1 percentage point tojustify the greater cost. While we will detail laterwhich alternative categories we do believehave the potential to generate alpha, for now it'simportant to understand what exactly constitutesalpha and what might be mistaken as alpha.

Let’s move to a slightly more complicatedMorningstar Category: long-short credit funds.These funds are the fixed-income variant tolong-short equity funds and can go long and shortvarious bonds. The products have a very low(nearly zero) duration profile. Being long one bondand short another with a similar durationwould equate to having no duration. A cursoryanalysis may reveal these funds to be lowlycorrelated to bonds. And, indeed, they are—sortof. Their correlation to the Bloomberg Barclays U.S.Aggregate Bond Index averages around 0.24.

There’s a problem with this comparison, however:It isn’t valid. Long-short credit funds takeon little duration risk, and interest-rate movementsexplain approximately two thirds of the volatilityin the U.S. aggregate bond index. So, if weused this index as our benchmark, we wouldbe led to believe that long-short credit managershad a high degree of alpha.

In fact, we believe a better comparison wouldbe against the Bloomberg Barclays U.S. CorporateHigh Yield Bond Index, because long-shortcredit funds take on a fair amount of credit risk.Here, the correlation with the index nearly doublesto 0.48.

As we can see, understanding the inner workingsof a fund is key, because sometimes we mightmistake beta as alpha. In this case, longshortcredit funds offer a beta play on credit.3

But even the high-yield index comparisonisn’t perfect, because the high-yield index doeshave a few years of duration. So, whatare long-short credit funds’ closest substitutes or,more specifically, their next-best options?

Low-duration credit funds such as high-yieldand bank-loan funds would be a great placeto start. Nontraditional bond funds are similar; theytend to have less duration. But they are moreunconstrained. They can bet on a wide arrayof assets, from currencies to sovereign emergingmarketscredits. That diversification shows;the funds are only 0.12 correlated to theU.S. aggregate bond index. However, against thehigh-yield index, they post a correlation of 0.67.

Alternatives to Alternatives By using correlations as a guide, and understandinga bit about what's going onunder the hood of funds, we can find manyexamples of assets that we'd considercomparable to alternatives, or next-best options.Once we realize where the core risks (thebeta exposures) of alternatives truly lie, examplestend to crop up all over.

While we don’t think there are prefectsubstitutes lying in plain sight, we do think thatreasonable substitutes abound. As mentioned,for low-duration, credit-sensitive funds likelong-short credit and nontraditional bond funds,a low-duration high-yield or bank-loan fundmight fit the bill, as bank loans also offer creditexposure without duration. Categories suchas option-based strategies conceptionally may bea bit trickier; strategies such as covered callsoffer both income and equity risk. However, wefind that many of these strategies still havea beta of around 0.5 to the S&P 500. While thereare no perfect substitutes, it may help to lookat these strategies against the broader backdropof other income-producing strategies that bearequity risks, such as high-dividend stocks,REITs and master limited partnerships, or possiblypreferred stock.

To identify other next-best options for alternatives,we look at the betas, correlations, andreturn expectations. For example, multialternativecategories are filled with an amalgamationof various strategies, but they are generally fundsof alternative funds. So, while no single next-bestoption is available, it can be helpfulto benchmark this group to a low-risk, low-returncategory, such as a conservative multiassetcategory. Given the average multialternative fundprovides a 0.25 beta to equities, a categorythat has between 15% and 30% equity exposureisn’t a bad comparison in our opinion.

The Value of Low Correlations To calculate if a lowly correlated alternativesfund's higher fees are justifiable, we offer a simple,back-of-the-envelope technique. To makethis work, we need to compare an alts fund to itsnext-best options.

The conventional approach would be to add allthese asset classes to an efficient frontier. But anefficient frontier leaves no leeway for intuition.If alternatives are even slightly less correlated thanour next-best option, all else equal, the frontierwill cast aside our cheaper, passive option.Our goal instead is to calculate the low correlationbenefit of alternatives, or essentially the maximumamount an investor should be willing to pay.

For example, we could start by building twovery simple portfolios, both with a 90% allocationto a 60/40 stock-bond mix (i.e., the stockallocation would be 54% of portfolio assets, bonds36%) and 10% allocated to either an alternativefund or our next-best option. In this example,we’ll use a long-short credit fund and a bank-loanfund, respectively. To keep everything very simple,we assume that both the long-short creditfund and the bank-loan fund will return 3.5% andhave a standard deviation of 3%. (The processstill works if we relax these assumptions.) Afterlooking at historical data, we conclude thebank-loan fund will have a 0.55 correlation to the60/40 allocation versus 0.3 for the alternative fund. Everything is the same between these twoportfolios except the alternative fund hasa 0.25 lower correlation to the 60/40 allocation.

Bank-loan funds have an average fee of 0.85%.What should an investor be willing to payfor the lower correlation benefit of the long-shortcredit fund? To find out, we calculated the Sharperatio on both portfolios. We mathematicallyback out the fee for the alternatives fund as if theSharpe ratios of the two portfolios were the same.This would be the maximum anyone would wantto pay for the long-short credit fund. However,we’d argue that investors should pay much less tohave an adequate margin of safety. We foundthat the most an investor should pay for the 0.25lower correlation was 1.4%, given our assumptions.The average long-short credit fund costs 1.35%.But 20% of the funds in the category charge lessthan 1%, so lower-cost options certainly exist.

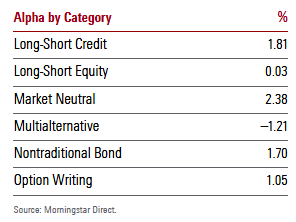

Improving the Odds Now, we turn to alpha. Some alts funds willjustify their fees. To improve our chances of findingone, we can average each alternative category'salpha. Our study used a Fama-French threefactormodel for equitylike categories, a two-factor(credit and duration) model for bondlikecategories, and a mix for multialternative funds.We only looked at funds with at least a threeyeartrack record and included dead fundsto avoid survivorship biases. We ran our calculationsfrom inception.

Here are the results of our study:

The results jibe with many well-establishedinvestment truisms, such as that equity investingtends to be a zero-sum game. We statedthat long-short equity managers as a whole don’tadd much alpha in the period we studied. Indeed,the average long-short equity fund generatednearly zero alpha. Markets are extremelycompetitive, and adding the ability to sell stocksshort doesn’t appear to give managers a newcompetitive edge; shorting is just as difficult, if notmore difficult, as long bets.

Another investment mantra for many is that thereare more active opportunities in fixed income.We also found this to be the case with alternatives.But we were a bit surprised by the results.We expected to see some modest alpha for thenontraditional bond category, as certainfunds take on international exposure that isn’tfully captured by our simple models. However, wewere surprised to see long-short credit fundsgenerating approximately 1.8% alpha. That group ismore U.S.-centric, so the results are compelling;however, the category is small, so sample size maybe a factor.

Our results also showed that market-neutral fundsgenerated the highest alpha at around 2.4% peryear. A few caveats are necessary, however. Wereport all these numbers gross of fees4 because webelieve it's important to first establish whichcategories might have an inherent advantageto offer manager skill, and which do not. Includingfees can cloud that picture. But fees are still animportant consideration. For market-neutral funds,fees tend to be high, averaging around 1.76%.However, it's important to stress that lower-costoptions exist and paying over two thirds thecategory's historical alpha in fees wouldn't likelybe advisable. Finally, returns in this spacetend to be mostly alpha, meaning that while inother categories investors can still generatereturns absent of alpha, in market-neutral land,alpha generation tends to drive returns.

Multialternative funds take on an array ofexposures and international positions, as well.While we wouldn’t have been surprised tosee the category generate zero alpha, perhaps ourmodels’ negative 1.2%-per-annum assessmentis too bearish. These funds can have momentumand other features baked in that we left outfor simplicity (and momentum has performedpoorly recently). Still, the negative alpha isn’t ideal,especially once fees are accounted for.

Finally, option-based funds in our study generatedabout 1% alpha, better than long-short equity,but worse than fixed-income categories that generatedlower returns overall (so alpha per unitof returns is higher for fixed income). With feeshovering around 1.55%, these funds appear to becharging a lot more than they’re worth.

Alpha as a Guide Investors can use these category averagealpha figures to help guide their investmentdecision-making process. Categories withless-than-stellar track records of generating alphashould be viewed more cautiously, whilethose with higher potential could have moreopportunities. As mentioned, however,alpha is only part of the story. The full spectrumof opportunity should be thoroughly scrutinizedwhen analyzing alternatives. For example,the diversification power of other assets shouldalso play a key role in decision-making.That is why the ability to separate alpha potentialfrom passive beta exposures is so important;it helps to broaden the opportunity set. Similarly,categories such as market-neutral can offerhigher alpha potential but have lower-returnprofiles overall, so while alpha may be agood way to measure risk-adjusted outperformance,alpha alone can't tell us how to makeasset-allocation determinations.

1 The free cash flow yields/sales ratio is cash from operations minus capital expenditure divided by sales.

2 Fee data throughout come from Morningstar Direct as of Dec. 31, 2017.

3 Beta here really only tells us half the story. The Greek letter is meant to signify an asset class’ sensitivity to the market. So, a beta of 0.5 to high yield can be interpreted to mean that thesefunds will gain or lose at half of the rate of high yield. Missing in beta, however, is how strong this relationship truly is, or its R-squared. In this case, that relationship is quite strong, asaverage R-squared values clock in at 0.72 for the category, relative to high yield.

4 We chose to run our study gross of fees because fees can muddy the performance appraisal waters. By casting fees aside, it is easier to discern the categories where managers have addedalpha. Armed with that information, investors can better gauge what fee levels are more appropriate.

This article originally appeared in the February/March 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d71f7d0c-3ecd-4473-9a14-3aa8da05a4fc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d71f7d0c-3ecd-4473-9a14-3aa8da05a4fc.jpg)