A Target-Date Fund Series Wins Gold

But another series loses its medal.

Target-date funds continue to cement their place as U.S. workers' retirement investment of choice. That became even more apparent in 2017, when target-date mutual funds saw another banner year of flows, taking in more than $75 billion in net new money, representing an almost 10% organic growth rate. Assets in target-date mutual funds now exceed $1.1 trillion as of the end of 2017.

We cover this crucial space within the investment industry in a few ways, such as our annual target-landscape papers (here they are from 2015, 2016, and 2017). In 2018, we'll release a number of new and innovative data points based on research from those papers; we think these tools will help workers, plan sponsors, and other investors better understand the nuances and driving forces that underlie target-date funds, ultimately helping all parties make better investment decisions.

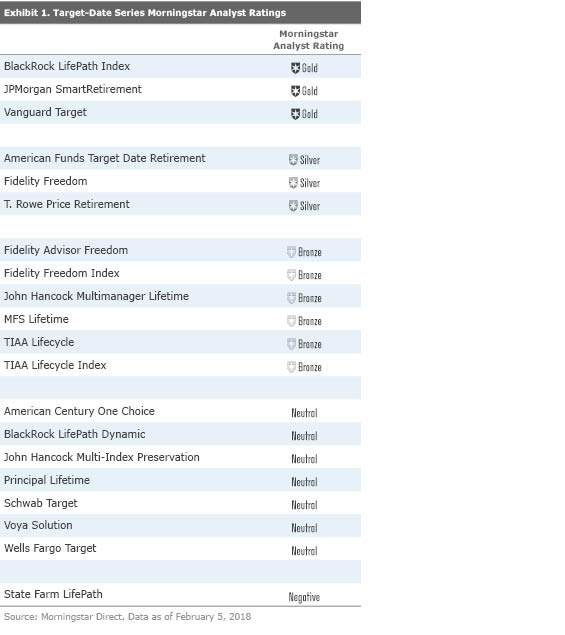

In the meantime, our manager research team continues to rate and provide our forward-looking views on these funds; our coverage of 20 of the roughly 60 target-date mutual fund series available in the United States represents almost 95% of those assets. Premium Members can find our ratings by looking up individual target-date funds or via series-level summary reports, available here. Exhibit 1 summarizes our current target-date fund series ratings.

JPMorgan SmartRetirement Upgraded to Gold JPMorgan SmartRetirement's January 2018 upgrade to a Morningstar Analyst Rating of Gold from Silver represents the most significant ratings change that came out of our annual target-date ratings review. It currently stands as the sole target-date series using actively managed underlying funds to receive a Gold rating. (Our other two Gold-rated series, Vanguard Target and BlackRock LifePath Index, both rely on passively managed underlying strategies.) We don't believe one is inherently better than the other, but we do think that issues such as underlying fund selection, monitoring, and quality mean that target-date series using actively managed funds have a higher burden of proof to demonstrate their excellence.

JPMorgan has demonstrated excellence in spades, highlighted by a highly regarded portfolio management team led by Anne Lester and Dan Oldroyd. This team was named Morningstar Allocation Fund Manager of the Year in 2014, and it was nominated again this January for its impressive results in 2017.

The team's consistent approach to asset allocation starts with a glide path based on participant-behavior research and long-term capital market assumptions. This results in a more conservative equity allocation than the industry norm during an investor's early savings years and shortly before retirement. The group also has an established tactical-allocation process in place: It follows a two-step approach, which the firm has used in its tactical offerings since 1999.

We also like the group's approach to manager selection. The team aims to combine managers with complementary styles and uncorrelated alphas, and the series' managers won't hesitate to remove an underlying fund if it's not meeting expectations. The underlying fund lineup is solid. During 2017, we upgraded the series' two largest underlying funds:

Overall, we rate 10 of the 25 underlying funds, and eight are Morningstar Medalists. That group as a whole has turned in strong results: Of the 19 funds with at least 10-year records, all but four outpaced their Morningstar Category norm during the decade through December 2017.

Principal LifeTime Downgraded to Neutral Our annual ratings review also resulted in the downgrade of the Principal LifeTime target-date series to Neutral from Bronze. These funds have seen a slew of adjustments in recent years. A number of those modifications made sense, though others were more questionable. Some of the latter appear driven by peer group and performance-chasing rather than sound investment merit. For instance, the managers reduced exposure to REITs in late 2016 and shifted to a U.S. REITs fund from a global one to better align with peers. While fundamentally driven change based on sound investment reasoning can add value to a strategy, a number of recent changes here tarnish our overall confidence in the series.

Still, the series' asset class diversification has some appeal, as the target-date managers reach beyond the set of asset classes commonly used by peers. Three globally diversified funds provide exposure to unique asset classes such as timber, master limited partnerships, infrastructure, and long-short strategies. That exposure may help reduce volatility, but it has also dampened returns in recent years. In addition, the esoteric areas add to the series' costs. Overall, these funds come with an above-average price tag relative to peers that also invest with active managers.

Senior Analyst Leo Acheson and Analyst Heather Larsen contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)