Sustainable Funds: More Choices in More Categories Than Ever

But investors will pay a bit more than the lowest-cost index funds and must exercise some additional due diligence.

Investors have more choices than ever to invest in open-end and exchange-traded funds that practice sustainable investing. That's the main takeaway from my "Sustainable Funds U.S. Landscape Report," available here.

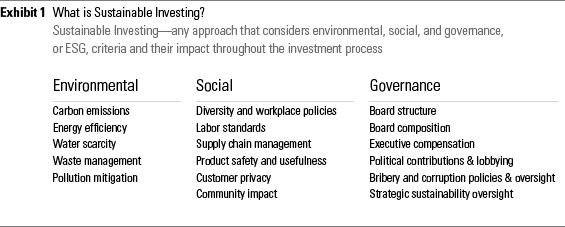

In the report, I define the sustainable funds universe in a way that makes it easier to find and understand these funds. Sustainable funds are often considered part of a broader group of so-called "socially conscious" or "values-based" funds, but there are important differences.

Sustainable funds are those that use environmental, social, and corporate governance criteria to evaluate investments or assess their societal impact. They may pursue a sustainability-related theme or explicitly aim to create measurable environmental or societal impacts, alongside financial return.

Source: Morningstar.

Sustainable funds can and should be distinguished from funds that simply employ values-based criteria, such as those that exclude so-called "sin stocks," like tobacco, alcohol, and gambling, or those that use faith-based criteria to restrict their investments.

Certainly, there are values-based elements to sustainable investing; namely, the recognition that investors can have an impact on the creation of a low-carbon global economy that works for more people. But sustainable investing also has a value-driven component that many investors find at least as salient: The idea that integrating ESG into an investment process can add valuable material information that might otherwise be overlooked in traditional financial analysis and thereby can reduce risk or generate alpha.

Fortunately, it is possible to distinguish between funds that employ sustainability criteria from those that merely exclude sin stocks or otherwise use faith-based criteria. Many funds now refer to sustainability or ESG or impact in their names, and those that do so define those terms in their prospectuses. Others may not call it out in their name but also make it clear in their prospectuses.

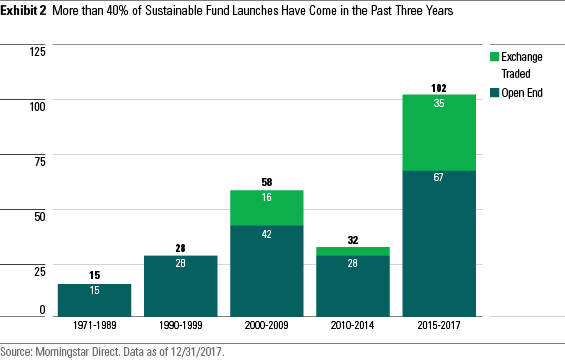

Based on my analysis of fund prospectuses (I started out by looking at all funds labeled "socially conscious" in the Morningstar database and any others that included the terms sustainability, sustainable, ESG, or impact in their names), I found 235 sustainable funds available to U.S. fund investors. A record 40 such funds were launched in 2017, including the first sustainable target-date series, global real estate fund, and floating-rate fund. This came on the heels of 36 fund launches in 2016. In just the past three calendar years, 102 out of the 235 funds in this universe have been launched. After two years of record flows, these funds have nearly $100 billion in assets.

With funds to be found in 56 Morningstar Categories, those building investor portfolios--or model portfolios--no longer have to limit themselves to partial solutions. In addition to many options in the U.S. Morningstar Style Box, world stock, and foreign-stock categories, there are now the global real estate and floating-rate funds mentioned above, 11 emerging-markets offerings, and 14 intermediate-term bond funds. Nuveen launched a series of ETFs that could form the basis of a sustainable-investing portfolio. The various NuShares ESG ETFs cover the U.S. style box, non-U.S. developed and emerging markets, and intermediate-term bonds.

To cover any remaining gaps in equity coverage, investors can use the Morningstar Sustainability Rating to find funds that may not identify as sustainable/ESG by prospectus but have exposure to companies that do well on sustainability criteria.

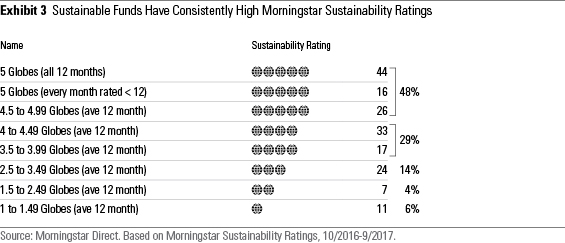

Speaking of the Morningstar Sustainability Rating, most funds in my prospectus-based sustainable funds group have excellent sustainability ratings. That's perhaps not surprising, but our globe rating provides an independent measure of a fund's sustainability, based on its portfolio holdings. Prior to the rating's existence, there was no way to evaluate sustainable outcomes either in funds that are consciously incorporating sustainability into their investment approach or in those that do not. More than 75% of sustainable funds have an average Morningstar Sustainability Rating of 4 or 5 globes over the past 12 months, and 25% of them have had perfect 5-globe ratings every month for the past year.

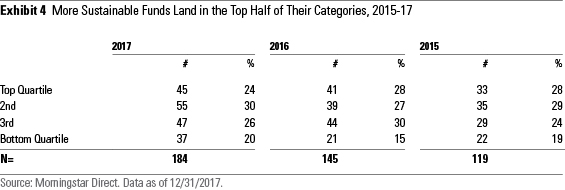

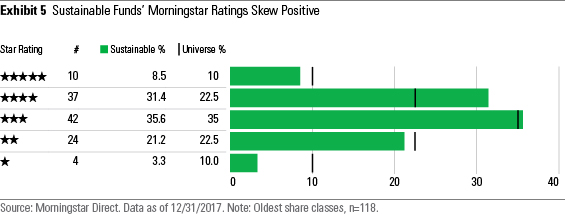

Sustainable funds as a group performed better than the overall fund universe in 2017. The returns of more than half of the funds, or 54%, ranked in the top half of their respective categories. That showing was consistent across stock and bond funds. And the group has performed similarly well in the past three calendar years, even as it has grown from 119 funds with full-year records in 2015 to 184 in 2017. From a longer-term perspective, sustainable funds have Morningstar Ratings that tend to skew more toward the top (4 and 5 stars) than the bottom (1 and 2 stars).

So, investors have more choices of sustainable funds than ever and can find sustainable funds in more categories than ever. Based on our globe rating, the funds do what they claim to be doing and their overall performance is good. What's not to like?

Well, I have a few caveats. First, even in my group of sustainable funds, there is considerable variation in how funds employ sustainability criteria. Some may integrate ESG analysis as a relatively minor component of their overall investment process. For others, sustainability is more central to the process. And others, more recently, have been adding measurable societal or environmental impact as an investment outcome, alongside financial return. It all requires additional due diligence on the part of investors, advisors, and gatekeepers.

Second, while many funds in the group are competitive on expenses, a sustainable fund will probably always be more expensive than the ultralow market-cap-weighted indexes that are so popular with investors today. It's easier than ever to find passive sustainable options, but the cheapest U.S. sustainability index fund has an expense ratio of 0.11% and the group ranges up to about 0.40%. That's not very expensive, but it's also not the 0.04% that the cheapest conventional index funds charge.

Finally, many of the funds lack so much as a three-year track record, or have tiny asset bases, or both. As noted above, 102 funds are less than three years old and 100 mostly overlapping funds have less than $50 million in assets. That's the amount many gatekeepers require as a minimum to get on a platform (the group of funds made available for purchase by advisors or direct investors). Many sustainable funds are dealing with this age-old problem of building enough assets to get onto platforms that will enable them to build enough assets to stay alive.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)