4 Short-Term Bond Funds to Calm Rising-Rate Jitters

Forget about calling the bond market bottom. These funds will let you rest easy.

Could 2018 mark the beginning of the long-anticipated bond market sell-off? By mid-January, the yield on the 10-Year U.S. Treasury note rose above 2.6% (its highest level since mid-2014), and the prognostications calling for higher yields in 2018 started rolling in.

The case for higher yields sounds reasonable enough. Developed-markets central banks, led by the Fed, have been taking steps to normalize monetary policy. The Fed has gradually hiked its target rate since December 2015 and signaled more hikes to come in 2018; it also began trimming the size of its bond portfolio starting in October 2017.

The European Central Bank and Bank of Japan haven’t advanced as far down this path but have been moving in the same direction since they’ve begun slowing their bond purchases. Meanwhile, a sizable planned increase in Treasury issuance in 2018, plus expectations for more robust growth and higher inflation, could all nudge Treasury yields higher.

We’ve seen this movie before, though. Many bond investors have positioned for higher yields at various times over the past several years, only to miss out when yields failed to rise or dropped further. As recently as early 2017, similar forecasts called for higher Treasury yields, which instead marched lower, boosting the Bloomberg Barclays U.S. Aggregate Bond Index to a healthy enough 3.5% return for the year, outgaining its 2.6% yield at the start of 2017.

There are compelling and nuanced reasons to suggest that this time could be different, just as there are persuasive arguments supporting the view that today’s fears about rising rates could be overblown. U.S. Treasury yields are currently among the highest developed sovereign yields available, for instance, increasing their attractiveness globally, while the deflationary impact of technological innovation could keep a lid on inflation.

Because bond yield forecasts have been so difficult to get right in recent years (a Wall Street Journal headline from November 2017 declared last year's predictions "pathetically wrong"), we've often advised against shifting around portfolios to protect against the possibility of short-term pain in the bond market. As my colleague Sarah Bush recently wrote, no matter where yields go from here, intermediate-term bond funds still offer diversification benefits in an equity-heavy portfolio and make sense as a core part of a long-term asset-allocation plan.

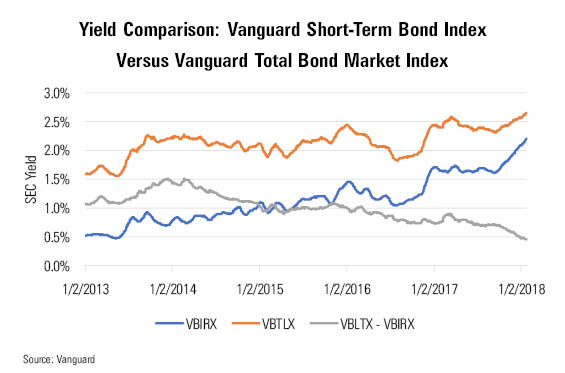

Still, it is worth noting that, as the Fed’s target-rate hikes have driven short-term bond yields higher and the yield curve has flattened, the value proposition for owning a short-term bond fund has improved. For example,

Another way of looking at it is that the short-term fund currently offers investors more yield per unit of duration (2.2% divided by 2.7 years, or 0.8%) than its intermediate-term counterpart (2.7% divided by 6.1 years, or 0.4%), which wasn’t the case five years ago, tilting this reward/risk ratio in short-term bond funds’ favor.

For investors who don’t want to take much interest-rate risk in their bond portfolios, here’s a list to consider. The temptation to reach for yield by taking more credit and liquidity risk has run high in the postcrisis years, so our favorites include funds that take a measured approach toward credit risk and haven’t strayed from that discipline. Relatively low fees also mean these don’t have to take excessive risks in order to clear a high expense hurdle.

For those comfortable with a more eclectic approach,

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)