Bond ETFs Don’t Keep the Taxman Away

Despite their structural tax advantages, bond ETFs can still expose investors to significant tax liabilities.

This article is part of Morningstar's Guide to Passive Investing special report.

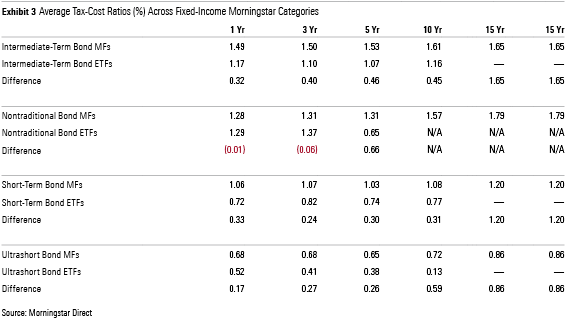

While equity exchange-traded funds have a clear edge over actively managed stock funds on tax efficiency, the picture is slightly different for fixed-income funds. Here, I'll discuss some of the important issues investors should keep in mind when assessing the tax efficiency of fixed-income ETFs.

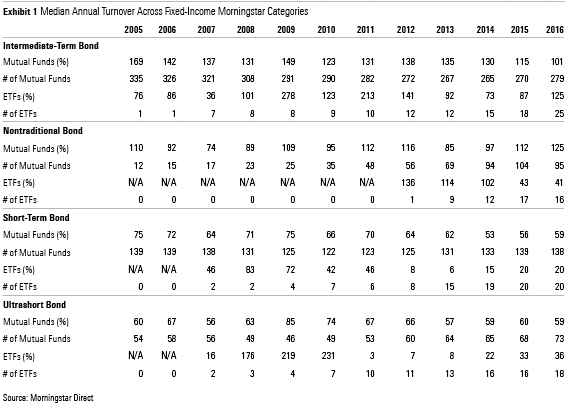

As is the case with stock ETFs, market-cap-weighted index funds account for the lion's share of fixed-income ETF assets. These funds' turnover tends to be lower than their actively managed mutual fund peers. They share this common source of tax efficiency with their counterparts in the stock space.

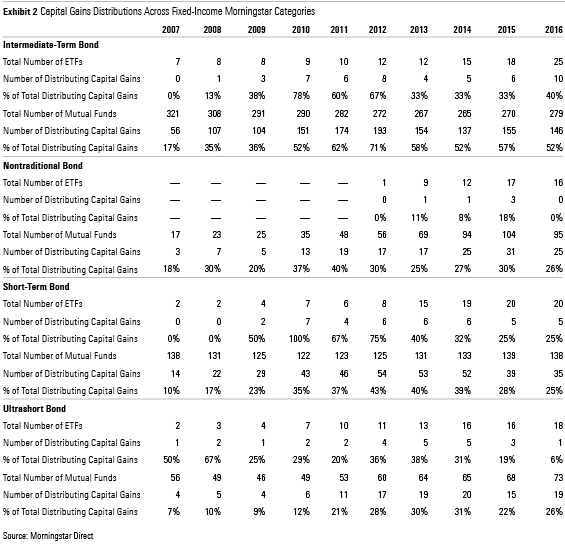

However, there have been and will always be exceptions. Specifically, there have been periods when fixed-income ETFs' turnover has far exceeded that of their mutual fund competitors. These episodes have been marked by relatively higher percentages of ETFs distributing capital gains, as shown in Exhibits 1 and 2. The following examples further illustrate these instances.

In 2009 and 2010, ETFs in the intermediate-term bond Morningstar Category experienced higher-than-normal turnover owing to large issuance of U.S. agency mortgage-backed-securities. This drove material changes to the indexes underpinning most of the ETFs in the category. Following the financial crisis, investors' appetite for these securities increased as the housing market improved. Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), and Government National Mortgage Association (Ginnie Mae) backed residential MBS underwriting surged from $1.1 trillion in 2008 to $1.7 trillion in 2009 per the Securities Industry and Financial Markets Association data. As large amounts of new issuance flooded the market, all the relevant indexes such as the Bloomberg Barclays U.S. Aggregate Bond Index updated their constituents accordingly. This index is arguably the most popular bond index tracked by bond ETFs, and MBS accounted for approximately third of the index at that time. Accordingly, the issuance activity triggered a significant shift of the market's composition, resulting in a flurry of trading and associated capital distributions. As a result, the percentage of intermediate-bond category ETFs distributing capital gains jumped from 13% in 2008 to 38% in 2009, eventually reaching 78% by the end of 2010.

Sometimes large inflows coupled with lower supply can result in high turnover. When there is not enough supply of the securities making up indexes, ETFs are forced to do cash creations and redemptions rather than in-kind processes. Cash creations and redemptions refer to ETFs directly buying and selling the required securities in the open market. Following the record issuance of $1.7 trillion in 2009, the new supply of agency MBS started to decrease. It went down to $1.4 trillion in 2010 and further dropped to $1.2 trillion by 2011. From December 2010 to January 2013,

The non-traditional bond category is home to a number of ETFs underpinned by non-market-cap-weighted indexes, and many of them use derivatives. Higher turnover and derivative use tend to lend themselves to capital gains distributions. For example, ProShares Inflation Expectations RINF seeks to provide exposure to 30-year break-even inflation expectations. The fund invests in 30-year Treasury Inflation-Protected Securities and uses derivatives to obtain short exposure to U.S. Treasury bonds. These derivatives are generally short-lived instruments, as they expire after some agreed-upon horizon. When the contract expires, the fund must engage in new contracts to maintain its desired exposure. Similarly, WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond AGZD uses derivatives to short interest-rate exposure to deliver duration-neutral exposure of the Aggregate Index. While these funds' long positions such as U.S. Treasury bonds stay in the portfolio for longer periods, the regular turnover of their derivative holdings lends itself to creating capital gains exposure.

Finally, ETFs in the short-term and ultrashort bond categories must regularly purchase new securities as their existing holdings mature. Also, they may opt to let bonds mature--potentially unlocking gains--as opposed to purging them from the portfolio prior to maturity, which may be either impossible or simply too costly. For example, in the short-term bond category,

Conclusion While ETFs' tax efficiency is regularly touted, there are always exceptions. It is true that ETFs' structure can have tax advantages. However, that advantage can be eroded by any number of external and internal factors. A surge in primary market activity in underlying fixed-income markets can force index-tracking ETFs to transact in significant volume. Some ETFs, especially those belonging to the non-traditional bond category, make use of derivatives, another common culprit in landing ETFs on the list of those distributing gains. Also, short-maturity focused ETFs will turn over their portfolios more frequently than other funds, in part because their holdings mature more rapidly and also because their portfolio managers may opt to hold bonds until maturity, as selling them prior would be cost-prohibitive. It is important that investors understand where fixed-income ETFs may fall short with respect to their tax efficiency.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)