Venture Capital Outlook: Dry Powder for Late-Stage Deals

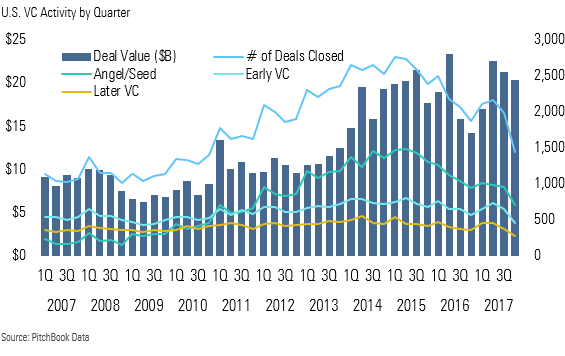

We expect to see a further bifurcation of VC activity between the late stage and the softening angel and seed space.

- Heading into 2018, we expect to see a further bifurcation of VC activity between the late stage and the angel and seed space. VC deal activity in the earliest stages is beginning to soften, which could alleviate the recent upward pressure on valuations. On the contrary, however, we believe the large pool of capital available for late-stage deals may very well translate to strong competition and higher valuations.

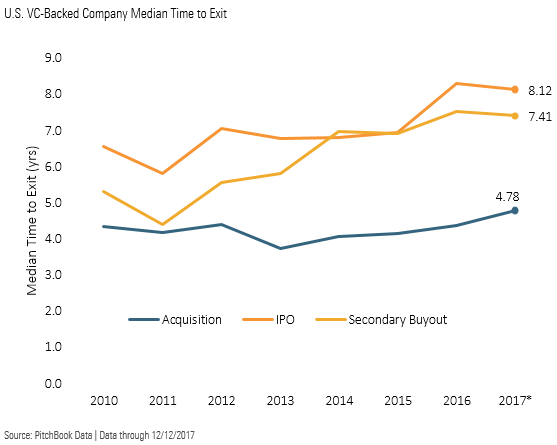

- Lengthening hold periods have encouraged investors to seek out more creative ways of finding liquidity outside the most prevalent strategic acquisition route--such as IPOs and PE buyouts. In addition, we'll continue to keep a close eye on the use of special purpose acquisition companies (SPACs) and direct listings to access the public markets.

- We expect to see further growth in the direct secondary market from both institutional investors and employees as a result of extended hold periods. The rise of various exchanges and brokerages has led to a proliferation of easy access points to this market, which we see as a driver for the aforementioned parties to utilize such liquidity options.

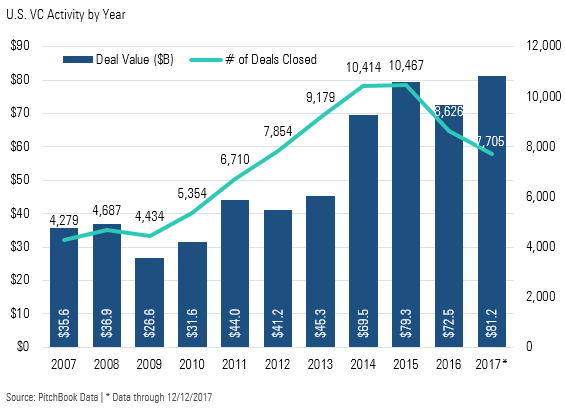

Deal sizes have spiked in 2017 as trendlines of deal count and deal value have diverged. On a year-over-year basis, capital invested has increased roughly 12%, while deal count has slipped approximately 11%. We expect this dichotomy to continue as the softening in angel and seed deal counts illustrates a segment looking for its identity after a period of extreme exuberance from 2011-2015.

Further, we've observed a subsequent slowdown in fundraising activity of smaller funds operating at the seed stage. With competitive pressures waning, we see bargaining power potentially tilting in favor of the investor, which should translate into a reversion of median pre-money valuations in that space toward the $3-$4 million range of 2010-2012.

On the other end of the spectrum, capital remains plentiful to fund large, late-stage companies, which should support large check sizes and prop-up valuations at the top end of the market. This trend will also be underpinned by the deployment of record amounts of dry powder held by VCs--currently $93 billion.

These different dynamics are what we see as a bifurcation of "traditional" VC dealmaking (i.e., providing funding for young and small startup businesses) and the new late-stage/growth equity hybrid that facilitates massive funding rounds for relatively mature private companies. For instance, participation in WeWork's $3 billion Series G round in August functions very differently from a $500,000 seed investment.

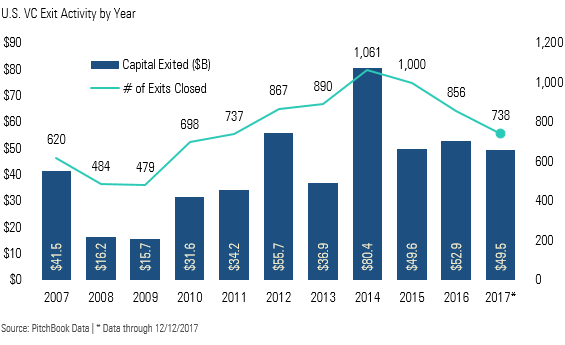

At just under $50 billion, exit activity in 2017 has come in relatively flat on a yearly basis. However, despite aggregate exit value remaining high, total exit volume has continued to pace lower. Due to this, the extension in the median time to exit is a trend that we're continuing to monitor closely. In addition to the potential pressure on GPs to return capital back to LPs, the phenomenon on delayed exits has also increased the need for founders to achieve liquidity for their employees, many of whom are heavily compensated through stock options.

More traditional alternatives to strategic acquisitions--IPOs and private equity buyouts--have taken a greater percentage of the VC exit market recently. With a slowing pace of strategic acquisitions, PE buyers have stepped in to pick up some of the slack as they become more comfortable with software and technology as an area to deploy their dry powder. VC-backed IPOs have also gained momentum in 4Q 2017, driving full-year capital raised by IPOs to just shy of $10 billion.

We expect the current state of hold periods and VC-backed exits to continue driving a hunt for alternative liquidity solutions. The direct secondary market represents an attractive liquidity option, allowing some investors, founders and/or employees to realize their stakes without requiring a complete exit.

Last, we've also seen an increase in the access points available to utilize such transactions (e.g., exchanges, brokerages). This speaks to the continued maturation of the secondaries space, which we believe will underpin sustained, if not higher, use of the strategy to achieve liquidity.

Quarter-End Insights

Stock Market Outlook: A Dearth of Opportunity Amid the Rally Credit Market Insights: Flattening Yield Curve Impacts Performance Basic Materials: The Most Overvalued Sector We Cover Energy: A False Sense of Security for Oil Markets Communication Services: A Deal Eludes Sprint and T-Mobile Consumer Cyclical: E-Commerce a Key Threat for Some, But Not All Consumer Defensive: Hungering for Top-Line Gains Financial Services: Asset Managers Are Forced to Adapt Healthcare: Pick Carefully as Valuations Head Higher Industrials: Pockets of Uncertainty Present a Few Opportunities Real Estate: Slow but Steady Climb Continues Technology: Most Bellwethers Are Overvalued Utilities: A Weak December Could Foreshadow a Tough 2018 Private Equity Outlook: Eyewatering Acquisition Multiples Crypto Asset Outlook: Installation Phase

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)