ETF Capital Gains Distributions Are Few and Far Between in 2017

The tax-efficient nature of ETFs continues to benefit investors.

A version of this article appeared in the December 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Generally speaking, exchange-traded funds are more tax-efficient than actively managed mutual funds. This is a consequence of their underlying strategies as well as their novel structure.

As expected, capital gains distributions among ETFs will be generally few and far between in 2017. Of the 1,244 funds covered in this summary, only 98 (7.9%) will distribute capital gains this year. Furthermore, only 27 of these 98 funds' distributions amount to more than 2% of their Nov. 30 net asset value. The majority of those distributing gains in 2017 are stock funds, with a few bond funds sprinkled around the edges.

Capital Gains Culprits Through early December, 11 ETF sponsors had published estimates of capital gains distributions for 2017. This list includes: BlackRock/iShares, Vanguard, State Street Global Advisors, PowerShares, Charles Schwab, First Trust, WisdomTree, Van Eck, Guggenheim, Deutsche Asset Management, and PIMCO.

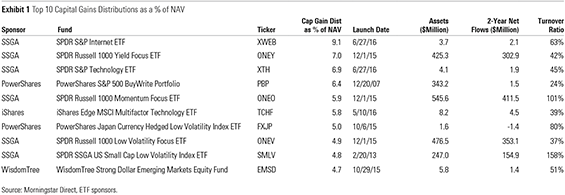

Exhibit 1 lists the top 10 ETFs ranked by estimated capital gains as a percentage of their Nov. 30 NAV. Note that these numbers are only estimates; final values are subject to change. For the sake of consistency, gains were calculated as the maximum estimated distribution divided by each fund's NAV as of Nov. 30, 2017.

This lineup is strikingly different from 2016's, which was dominated by currency-hedged funds. But as the dollar declined in 2017, the forward contracts that these funds use to hedge their currency risk were no longer profitable, and thus currency-hedged funds dropped from the list. Funds with the largest estimated distributions for 2017 (as a percentage of NAV) are predominantly stock funds. Eight of the top 10 funds are less than two-and-a-half years old. Youth plays a part in explaining why they landed on this list. These budding funds were born into a bull market, and during their short lives they accumulated decent capital gains. But assets also grew from one-directional flows. This has limited these funds' chances to purge stocks with a low cost basis through in-kind redemptions.

Realized capital gains, by definition, are triggered when holdings that have appreciated in value are sold. Therefore, funds with higher turnover have a greater chance for realizing capital gains when they rebalance their holdings, especially in the absence of redemptions. Some of these ETFs, like SPDR Russell 1000 Momentum Focus ETF ONEO and SPDR SSGA US Small Cap Low Volatility Index ETF SMLV, feature high turnover ratios--owing to the makeup of their underlying indexes--increasing their chances of making distributions.

Other funds have unique circumstances that put them on this list. For example, PowerShares S&P 500 BuyWrite Portfolio PBP uses options, which cannot be purged through the in-kind redemption process. And WisdomTree Strong Dollar Emerging Markets Equity EMSD holds stock from countries that don't allow in-kind redemptions.

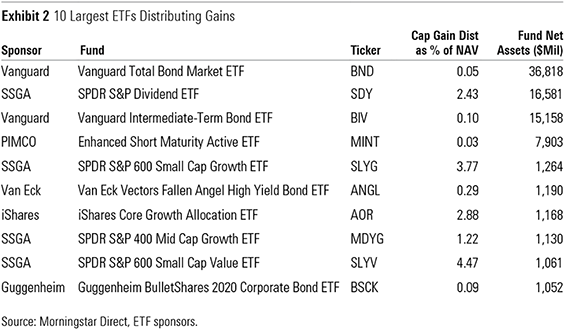

Which Big ETFs Are Expecting Capital Gains? A decent number of ETFs in Exhibit 1 are smaller funds: Five of the top 10 have assets of less than $9 million. Therefore, their distributions are likely to affect a smaller number of investors. Switching our focus to the biggest funds with capital gains paints a better picture of which ones are likely to have an impact on the largest number of investors. Exhibit 2 summarizes the largest ETFs by assets under management that are expected to make distributions for 2017.

These 10 funds collectively capture 81% of the assets of all funds expected to make distributions. Half of this cohort is made up of bond funds, each with distributions amounting to less than 0.3% of NAV. The remaining five funds were subject to a combination of steady inflows, strong positive returns, and high turnover.

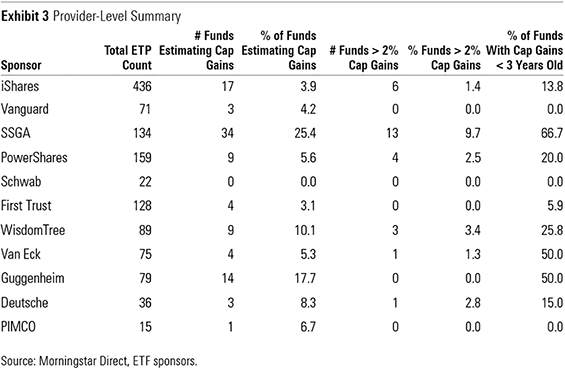

ETF Sponsor Report Cards Some fund families were more susceptible to capital gains distributions than others this year. Exhibit 3 lists the 11 sponsors covered in this summary and the number of funds from each firm expected to make distributions. The number of funds less than three years old with capital gains is also included to show the impact that funds' age had on distributions.

Collectively, iShares, SSGA, First Trust, and WisdomTree offer 787 of the 1,244 ETFs covered, or 63%. They also sponsor 64 of the 98 ETFs (65%) estimating capital gains payments. There are some notable differences among fund providers. State Street, WisdomTree, and Guggenheim all had 10% or more of their funds expecting to pay distributions. Some of this may be due to the nature of the strategies (high turnover) or the age and conditions surrounding specific funds, as was shown in Exhibit 1. Other factors may be differences in how sponsors manage tax lots within their funds and the extent to which they take advantage of in-kind redemptions.

At the other end of the spectrum, Schwab, PIMCO, Vanguard, and Deutsche had the fewest number of funds making distributions. Schwab stood out, as none of its ETFs will distribute gains for 2017. PIMCO and Vanguard are collectively projecting that four ETFs will make distributions in 2017, all of them bond funds. The expected distributions from each of these four funds will weigh in at less than 0.5% of NAV, so the pain should be limited. Fixed-income ETFs such as these can realize capital gains when they purchase bonds below par value and hold them to maturity.

The Big Picture Overall, ETF investors have plenty to be thankful for when it comes to the tax efficiency of the funds they own. The in-kind redemption structure of ETFs can make them a more tax-efficient vehicle, but remember: They aren't immune to distributing gains. This year, many funds that were born into a bull market, have seen generally positive flows, and are underpinned by high-turnover indexes have featured prominently on the list of those distributing capital gains. Fixed-income funds have also been regulars on this roster. This is because the bonds in their portfolios will naturally mature, which can result in recognizing gains in the cases that the bonds were added at less than par value.

Investors who wish to avoid capital gain distributions can improve their chances by following some simple rules:

- Stick to funds that are more mature and have seen a decent mix of market conditions.

- Avoid funds that use derivatives.

- Avoid funds with high turnover.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)