The Lesson of Hard Knocks: Part 2

The details of my virtual financial-advisor experience.

Thanks, I Guess Two weeks ago, I revisited my participation in a fund-selection contest that began in 1993 and ended seven years later. That column’s main points were: 1) sometimes, finding the right asset class is much more important than landing the right (or wrong) portfolio manager; and 2) good luck to financial advisors who find themselves having to explain that to clients.

I figured that article ended the matter, as I could not find my recommended portfolio using a Google search.

Happily, a reader named Nick Willett located what I could not. This left me no choice but to revisit the decisions, painful as that process might be.

Ouch, indeed. Well, let’s see what I did and what might be gained from that experience.

As the contest originally was designed to last for 20 years, I decided at the beginning to hold mostly equity funds, tilted toward those securities that showed best in the academic research: smaller and/or value-oriented stocks. From there, I chose actively managed funds that had outgained their peers despite being conservatively run and which were offered by high-quality organizations.

Costs Matter Sounded good. Felt good. What I had not yet realized, however, was the importance of fund costs for equity funds. I had no excuse for not knowing that. I covered many Vanguard bond funds in my role as mutual fund analyst and constantly credited those funds' successes to their unusually low expenses. But somehow I had not extended that lesson to stock funds.

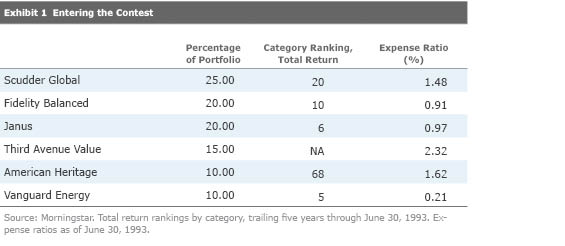

Below was my initially recommended portfolio, as retrieved by that dratted Nick. The table shows the allocation to each fund, its total return ranking for the trailing five years (relative to category), and the previous year’s expense ratio.

Four of the six funds had excellent five-year track records at the time of their selection. The fifth, Third Avenue Value, was a young fund, but its portfolio manager (Marty Whitman) had a sterling reputation and a long track record. Thus, when making my picks, I had faithfully followed my formula.

The sole exception was American Heritage, a longtime loser that had recently reversed its fortunes under new management. (Its five-year performance was mediocre, but its three-year numbers were stellar.) In reviewing that fund, my Morningstar colleague Amy Arnott wrote that American Heritage was either one of the industry’s “greatest turnaround stories” or a “colossal fluke.” That latter indeed proved the case.

In 1993, I paid the expense ratios scant attention. That Vanguard Energy was cheap was accidental; I had pick that fund for its portfolio, not for its thrift. Today, cost would be my starting point. A 2.32% expense ratio? Begone! I would also eliminate Scudder Global and American Heritage out of hand and look skeptically at the remaining two funds. Why pay 90 basis points when good active funds are available at half the cost and passive funds less than that?

But this was 1993, and I figured that skilled portfolio managers from companies that had many successful funds--Scudder, Janus, Fidelity, and Vanguard all possessing sterling records--wouldn’t have much difficulty overcoming their expense hurdles, particularly if the markets were strong, so that a percentage point or even two would seem unimportant in the grand scheme of things.

(Another error--a percent is a percent is a percent. The effect does not change, whether the markets soar, creep, or collapse.)

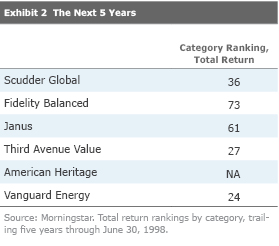

Mean Reversion Think again. This is how the funds looked for the next five years, expressed as category total-return rankings.

Nothing terrible, but the twin benefits of having previously strong results and being sponsored by the industry’s leading firms did not create anything remarkable, either. Three of the funds performed moderately well after I had selected them, two were modestly worse than their rivals, and one disappeared off the face of the earth.

That was American Heritage--which turned out to be fluke rather than turnaround. Better for rock stars to burn out than to rust, but not so much mutual funds. And American Heritage most definitely burned out, flaming into nonexistence while being pursued by the SEC. That decision, actually, I do not count as a mistake. I selected American Heritage as a flier, knowing full well its dangers. One doesn't win contests without taking chances. I would not have recommended that fund to a client, had I been a financial advisor.

But I would have chosen those other five funds, which, if not terrible, were not remarkable, either. Had those five funds been cheaper, they all could have landed above their peer-group averages, except for Fidelity Balanced. But they cost too much--what manager skill existed was, in aggregate, erased by fund expenses.

That was when I directly learned a lesson that I have since re-learned on many occasions, although, I am happy to report, not for my own investments (which are miserly indeed).

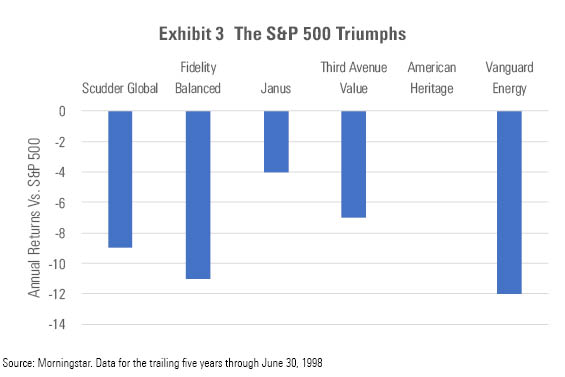

The Power of Luck Whatever disappointments I suffered when selecting managers were overwhelmed by the bad fortune of landing on the wrong side of the S&P 500. Immediately after the contest began, giant U.S. stocks skyrocketed, gaining over 19% annualized over the next five years. Pretty much every diversified portfolio was left behind because nothing else kept pace with blue-chip U.S. stocks.

The chart below shows how each portfolio fund fared against the S&P 500 over the ensuing five years. Recall that three of those funds had beaten their category averages and that two others weren’t far behind. My manager selection had not been as desired but it was far from disgraceful. However, the portfolio was routed by the S&P 500.

Ironically, my one and only low-cost fund fell the furthest behind, thus neatly illustrating the theme: In the contest’s initial five years, luck dominated. The more closely a contestant’s entry resembled the S&P 500, the better that contestant fared. Conversely, those who diversified sharply away from the S&P 500--into smaller companies or foreign securities or (God forbid) bonds--got swamped. End of story. No cost controls or success at manager selection could overcome that single huge factor.

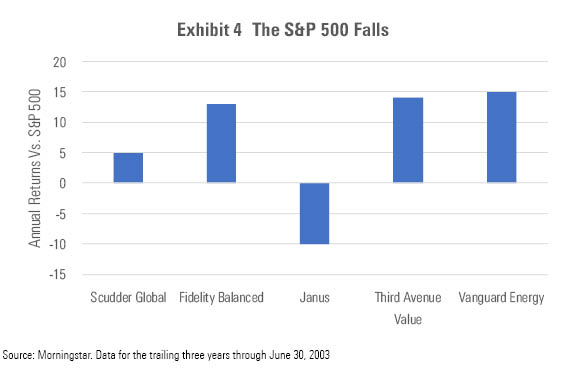

And then it reversed. The New York Times killed the contest in summer 2000 because, from its readers' perspective, all contestants had failed. Everybody had diversified, at least moderately, so that all portfolios lagged far behind the S&P 500. Then the index plunged. Over the next three years, most mutual funds made up much of their lost ground against the S&P 500. My portfolio was no exception.

John Coumarianos writes, “Your small-value bias was about to deliver boffo returns when the contest ended.” Indeed. However, continues John, “Advisors have to live in the real world where different strategies outperform for uncomfortably long periods of time. In other words, they have to live with career risk.”

Indeed again. An advisor who placed clients into my recommended portfolio (sans American Heritage) might well have been fired. Participating in that contest convinced me not only of the importance of fund costs but also of the danger to financial advisors of ignoring relative risk. Or, at the least, of not clearly setting client expectations. There is no fighting fortune when it turns its back.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)