November Fund Performance in 11 Charts

Munis slide in November; U.S. stock funds post big gains.

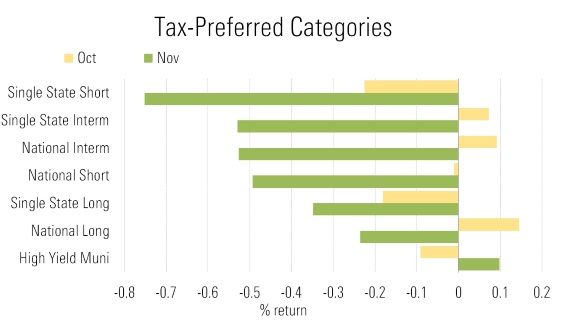

The usually placid municipal bond market took a hit in November, getting churned up in the wake of the advancing tax bill in Washington. U.S. equity funds, however, raced ahead as broad stock indexes hit new record highs amid expectations of stronger economic growth.

Foreign-stock funds also continued their gains. Taxable fixed-income categories, however, posted mixed returns.

Municipal-bond funds took a rare turn in the spotlight with only one category--high-yield munis--in the black.

- source: Morningstar Direct

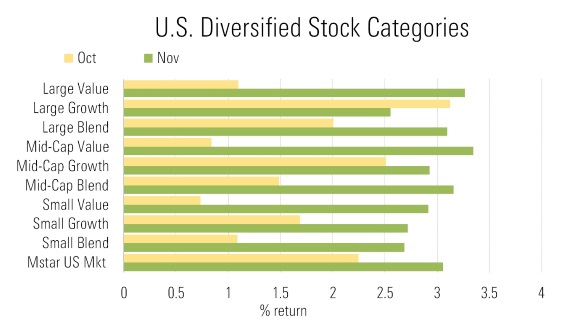

Investors in diversified stock funds, meanwhile, enjoyed yet another month of solid gains, this time led by value funds.

- source: Morningstar Direct

Mid-cap funds had a particularly good month in November.

- source: Morningstar Direct

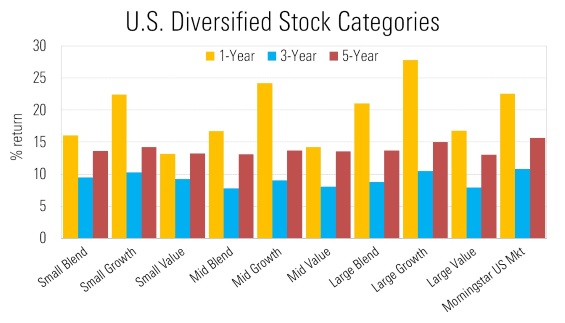

But growth strategies continue to hold big leads over blend and value strategies looking back over the last one- and three-year time frames.

- source: Morningstar Direct

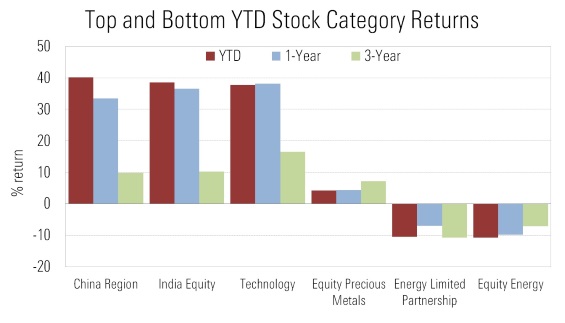

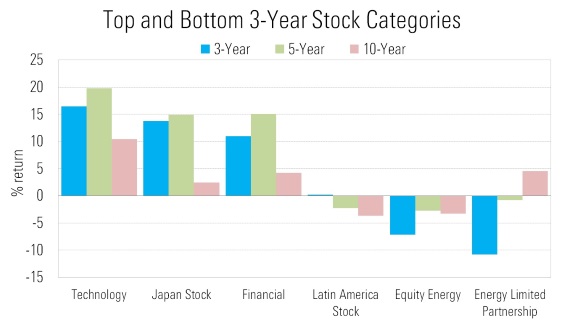

Looking across the whole spectrum of equity categories, two emerging-markets categories look on pace to finish out 2018 on top, but technology stock funds have had another strong year. Energy remains in the doghouse for both this year ...

- source: Morningstar Direct

... and the past several years.

- source: Morningstar Direct

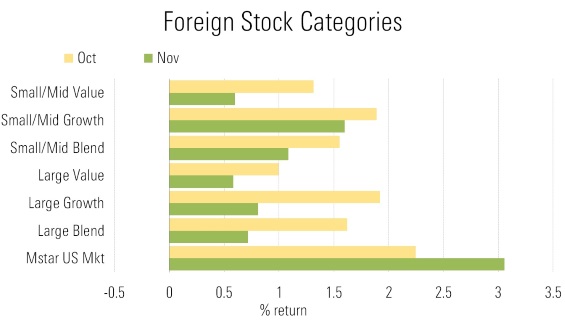

Among foreign-stock fund categories, November was another good month, but not as good as has been the case recently.

- source: Morningstar Direct

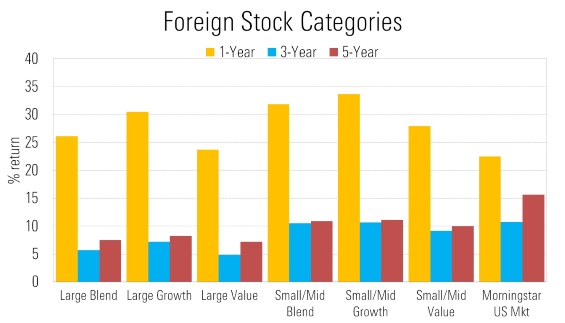

And for the past year, foreign-stock funds remain generally well ahead of the U.S. equity market.

- source: Morningstar Direct

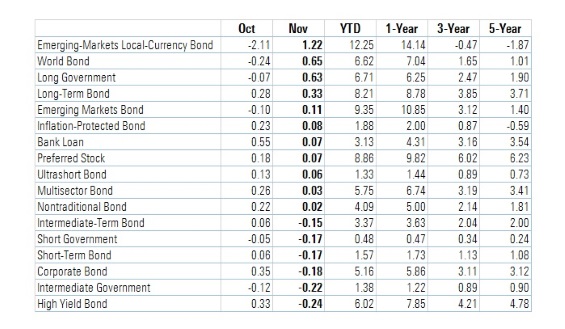

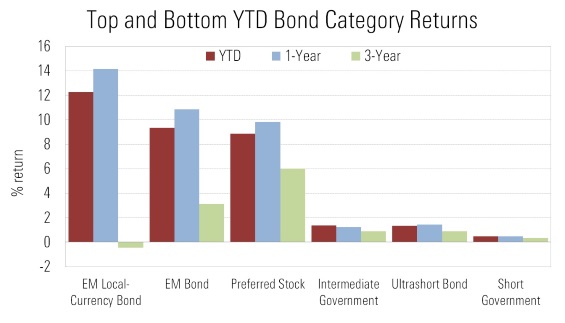

Back to fixed income, November was a mixed month with non-U.S. funds and longer-term funds faring better than short-term bond funds and high yield.

- source: Morningstar Direct

And for 2018, emerging-markets bond funds appear on pace to take the top spots in fixed income.

- source: Morningstar Direct

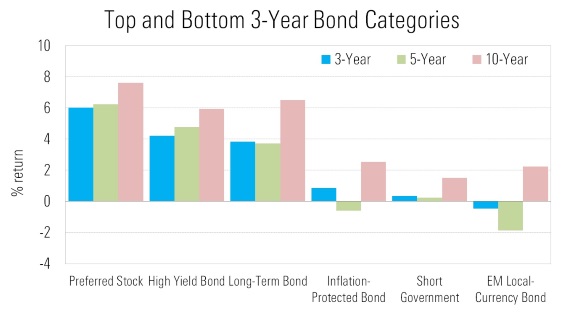

But longer term, high-yield and preferred stock funds hold their lead.

- source: Morningstar Direct

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)