Confronting Retirement in a Low-Yield World

With required minimum distributions on the horizon, this portfolio gets a remix to tee up distributions and improve tax efficiency.

Editor's note: This article is part of Morningstar's 2017 Portfolio Makeover Week.

In many respects, Stephen and Diane exemplify the brave new world of retirement.

At 70 and 69, they only fully retired one year ago. Stephen was a manager in a large corporation, while Diane worked part time in marketing. The fact that they delayed retirement beyond the traditional 65 is part of a broader trend in the U.S. Between 2000 and 2016, the percentage of people older than 65 who were working full or part time jumped from 13% to 19%. Some older adults are working longer out of financial necessity, but some workers are continuing to work longer by choice: They realize the health and quality-of-life benefits that can accrue through pursuing meaningful, challenging work throughout their lifetimes.

Stephen and Diane's concerns about their investments also put them in line with many of their peers. Although they've enjoyed solid returns over the past several years, they wonder if their portfolio is too aggressive given their life stage. Now that Stephen has crossed the 70-year mark, required minimum distributions are on the way, and RMDs from Diane's traditional IRA won't be far behind. The pair wonders how best to position their IRAs to meet RMDs, as well as what to do with distributions they won't need for living expenses.

Stephen and Diane's situation differs from many of their peers' in one key respect: While many of today's workers will need to rely on Social Security and their portfolios to cover all of their cash-flow needs in retirement, Stephen has a generous pension from his former employer that, along with Social Security for both of them, covers most of their fairly modest living expenses currently. (They spent $67,000 last year, their first full year of retirement.) Yet as reassuring as that is, if Stephen passes away before Diane, Diane's income from his pension and Social Security would drop by more than a third.

In addition to a comfortable retirement, Stephen and Diane would like to travel, and have budgeted $4,000 to $5,000 a year for trips. In addition, they'd like to move to a new home in a community closer to one of their two adult children. That home is more expensive than their current one: If they decide to make the move, they'll need to kick in about $120,000 more of their own funds. Carrying costs on the new house--thanks in part to higher property taxes--would also run about $4,000 per year higher than what they're currently paying for housing.

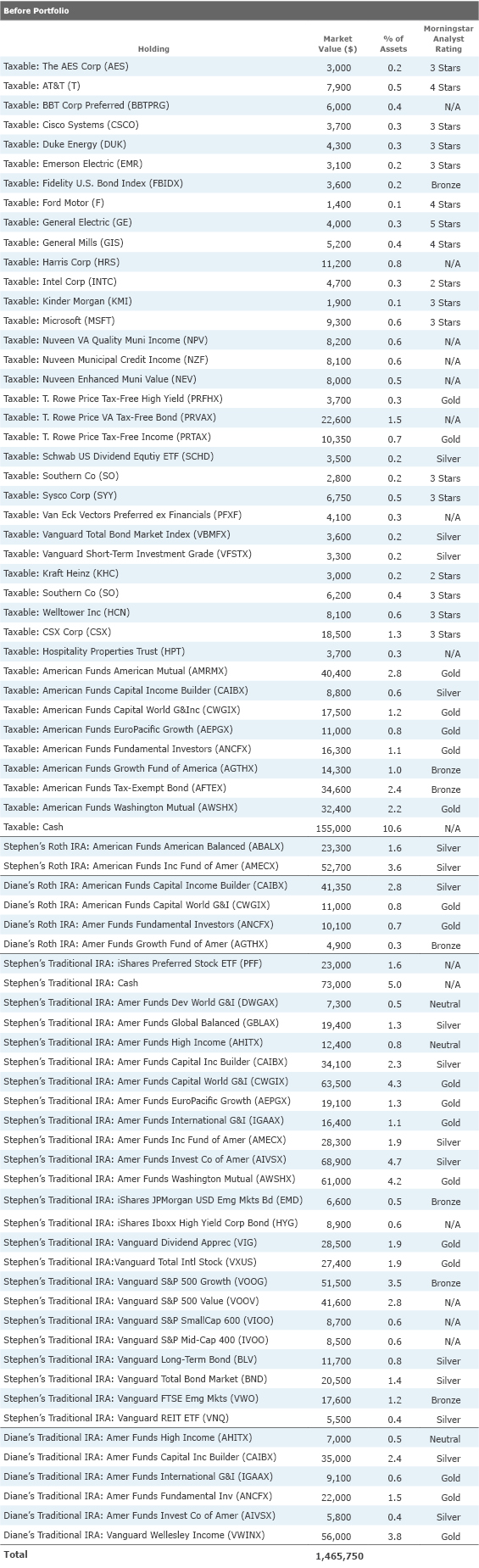

The Before Portfolio Stephen and Diane have a lot of holdings: 77 in the "before" portfolio, a combination of individual stocks, mutual funds, and exchange-traded funds. Their portfolio has a decided focus on income, especially in the taxable sleeve: It includes yield-rich individual stocks from the energy and telecom sectors, closed-end municipal bond funds that use leverage to magnify their payouts, and several preferred-stock holdings.

The total portfolio's asset allocation is roughly two thirds equity and the remainder in cash and bonds. They hold their assets in three main account types: a joint taxable account, traditional IRAs, and Roth IRAs.

Stephen's traditional IRA--the one that will soon confront RMDs--is the largest pool of assets. It consists of mutual funds and exchange-traded funds. Among its largest positions are some fine funds from the American Funds family, as well as several low-cost Vanguard index funds.

The couple's taxable account is their next-largest asset silo. That account has the most explicit income focus, featuring 21 individual stocks, municipal bond funds, and some broadly diversified mutual funds. Among its largest positions are various American funds, all of them highly rated by Morningstar's analyst team. The couple also hold $155,000 in cash in this component of the portfolio.

Finally, Diane owns her own traditional IRA, and the pair each has Roth IRAs, too. These accounts are populated with various American Funds offerings and Vanguard funds. Most of these holdings receive high ratings from Morningstar's analyst team.

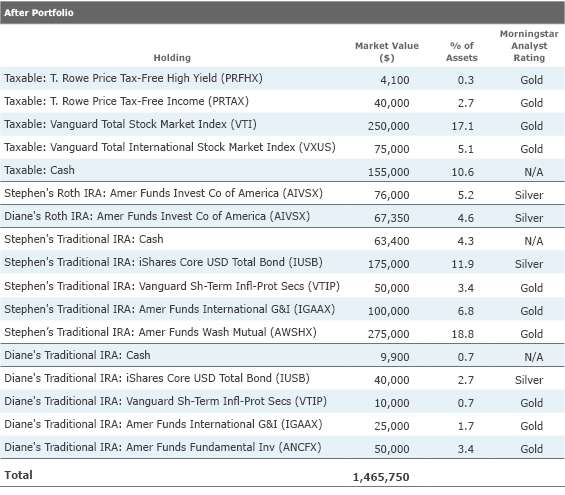

The After Portfolio From the standpoint of portfolio sustainability, Stephen and Diane are clearly in good shape. Thanks to Stephen's pension, their current withdrawal rate from their nearly $1.5 million portfolio is $15,000 at the high end--just about 1%. Even if they steer $120,000 of their portfolio balance toward their new home--and sign on for higher home-related outlays going forward--their withdrawal rate is still low. The plan also looks good when we stress-test Diane's income without the benefit of Stephen's full pension: Even with a significantly higher withdrawal of $35,000 to $40,000 per year, she would still be well within the limits of sustainability. Stephen also has two life insurance policies, the proceeds from which would more than make up for the pensions shortfall.

That said, Diane and Stephen could make some changes to their portfolio. While their portfolio's asset allocation isn't unreasonable (41% U.S. equity, 21% foreign stock, 18% bond, 16% cash, and 4% other), I'd like to see them position their traditional IRAs to tee up income for their RMDs while also simplifying it. Rather than stretching for current income to meet RMDs, I like the idea of building a portfolio that's well diversified across asset classes, then harvesting distributions with a mixture of income distributions and withdrawals of appreciated positions. Holding about two years' worth of distributions in cash will enable Stephen (and eventually Diane) to stay a step ahead of RMDs so they never risk tapping pulling their RMDs from depreciated positions. (It's also worth noting that "in-kind distributions," discussed here, can make sense in situations like Stephen and Diane's.)

With that general framework in mind, Stephen's IRA is light on core, high-quality fixed-income exposure. Because it's so comprehensive and low-cost,

Because their taxable portfolio will focus on equity index exposure (more on this below), I retained several of their fine American Funds holdings for their IRA portfolios. Stephen and Diane have already paid sales charges on these positions and won't pay additional transaction costs to transfer to different funds, and I think a modest bet on low-cost active management is reasonable for a portion of their portfolio. American Funds have also historically held up well relative to their peers on the downside. That said, going all index with this portion of their portfolios--using total U.S. and international stock market trackers --would be fine, too.

With their taxable holdings, I sought to downplay income production, because their RMDs will provide them with all they need and then some for the foreseeable future. They'll be reinvesting any unneeded RMDs into their taxable account. Focusing on investments that limit dividend and especially ordinary income distributions helps reduce the tax drag on the taxable portfolio, and broad equity index funds fit the bill. For example,

In addition to boosting positions in tax-efficient total market index funds in the taxable portfolio, I maintained the sizable cash stake in this portion of the portfolio to accommodate their future home purchase. And while I retained some exposure to the two fine T. Rowe Price muni bond funds, I scaled back the positions in the leveraged municipal bond funds.

Of course, making over a taxable portfolio can entail triggering taxable gains. Stephen and Diane will want to review the tax implications before selling any appreciated positions. They may well have the opportunity to reposition with fewer tax costs if the market--and in turn their gains in their existing positions--declines. Consulting with a tax advisor can help them figure out the best course of action here.

Because their Roth IRAs are relatively small at this point, I stuck with a single equity fund for each, the stalwart

Their total "after" portfolio's asset allocation is 44% U.S. equity, 16% foreign stock, 20% bond, 18% cash, and 2% other.

One key risk factor for Stephen and Diane's plan--as is the case with so many retirees today--is that they don't have long-term care insurance. Unfortunately, purchasing insurance at their age can be extremely expensive; depending on their health, it may be unavailable. I'd recommend that they think through an action plan on this front--either carving out a long-term care fund and segregating it from the rest of their portfolio or investigating some type of long-term care coverage such as a hybrid annuity/long-term care policy. This article discusses the pros and cons of long-term care hybrids.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)