Under the Hood at Vanguard Charitable

Vanguard Charitable's donor-advised fund has low fees and topnotch underlying investment offerings, but donation minimums are higher.

Donating money to charities through donor-advised funds has become increasingly popular over the past decade. According to data from the National Philanthropic Trust's Donor Advised Fund Report, overall assets as of the end of 2017 surpassed $100 billion for the first time.

One of the biggest advantages of a donor-advised fund from a strategic tax-planning perspective is their flexibility: You make donations to the account and receive immediate tax benefits for doing so. But then you're allowed to disburse the money from the accounts according to your own timetable. As of now, there is no set time frame during which you have to pay out the funds; the donation you make can sit in the donor-advised fund account indefinitely. In fact, you can pass the account along to your heirs. In other words, you can choose to pay out a donation to an approved charity right away, or invest the money in the donor-advised fund account and let it grow tax-free until you want to pay it out. Either way, you get an immediate tax deduction. And though you cede control of the assets, you retain advisory privileges over how the account is invested, and how the fund distributes money to charities.

Because the funds in donor-advised accounts aren't used simply as way stations for getting money immediately into a charity, my next question was, how do the underlying investment menus rate? And how much will investors end up paying in fees and expenses? (Investors in donor-advised funds pay annual administrative fees on account balances, and investors also pay fees on the underlying investments. Though not typically onerous, all of these fees eat away at the overall charitable donation, and direct investments to charity would not face the same fee burden.)

How Does Vanguard Charitable Stack Up? Minimum donation level required to set up an account: $25,000 Minimum additional contribution: $5,000 Minimum gift to charity: $500 Annual administrative fees: 0.6%; expense breaks on balances greater than $500,000

Per Vanguard Charitable's website, qualifying accounts with ongoing balances of more than $1 million are eligible for select status, which entitles the account holder to reduced administrative and investment fees and an enhanced level of service.

One thing that many investors will notice is the higher initial donation level--it is 5 times higher than that required by Fidelity Charitable and Schwab Charitable (at $5,000 each). The minimums for additional contribution and gifts to charity are also 10 times higher than at the Fidelity and Schwab DAFs.

"Having a higher minimum leads to higher-impact philanthropy," said Rebecca Moffett, chief strategic planning officer at Vanguard Charitable. "If you can make the commitment to meet that initial donation and remain committed over time, you will maximize your total charitable impact."

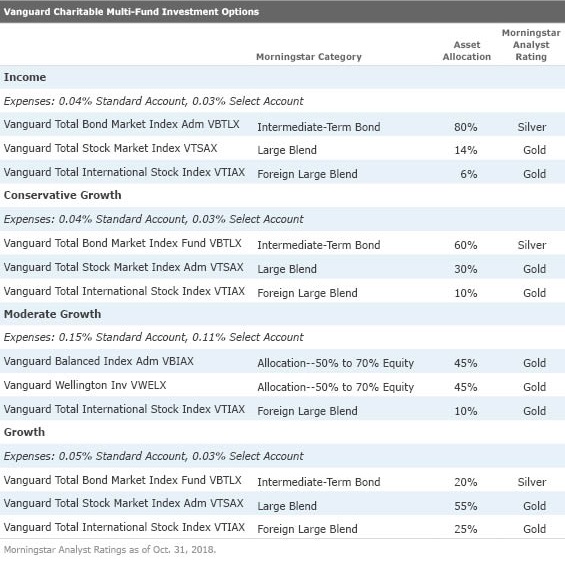

Multifund Investment Options Vanguard Charitable offers five multifund investment options: gift preservation is the most conservative, followed by conservative growth, moderate growth, growth, and finally total equity, which is the most aggressive option. The multifund investment options are made up of a few in-house funds in static allocations; investment professionals at Vanguard set the asset allocation and rebalance the funds daily, according to Vanguard Charitable.

For investors who prefer an all-in-one, hands-off investing experience, Vanguard's multifund investment options are hard to beat. The investment pools are made up of topnotch funds (mostly index-trackers) and feature rock-bottom fees. The donor would choose the investment pool that is most appropriate for his time frame and risk tolerance--more aggressive, equity-heavy allocations are best for investors with long time horizons. The investment team from Vanguard will undertake the task of rebalancing the portfolios back to the target allocations on an ongoing basis.

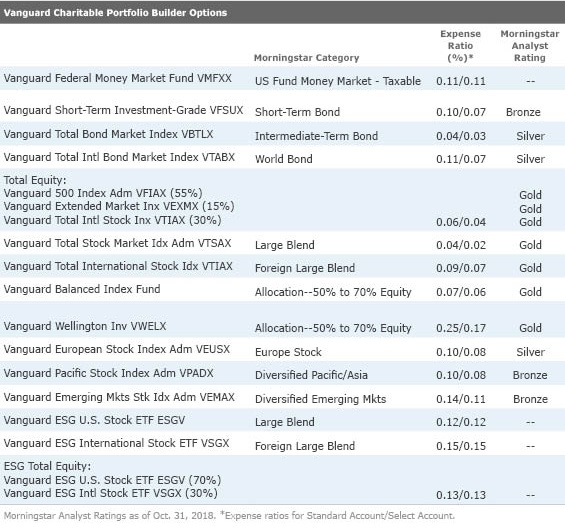

Single Fund Investment Options For investors who prefer to be a little more hands-on with their investment selection and allocation recommendations, Vanguard Charitable also allows donors to customize a portfolio from a menu of Vanguard index funds that have extremely competitive expense ratios. (The single fund options also can be used in combination with the multifund options listed above.)

Overall, it's a pretty sensible lineup that covers most of the bases. Arguably, though, it would be more efficient for investors to get their international diversification through Gold-rated

Further, the investment menu would be more well-rounded if it contained some exposure to asset classes that are not represented in broader index funds, such as high yield (despite its name,

The investment lineup was recently expanded to include two new ESG focused equity index funds, Vanguard ESG U.S. Stock ETF ESGV and Vanguard ESG International Stock ETF VSGX.

The Investment Fund for Foundations Multiasset Fund Lastly, donors with higher account balances (ongoing account balances of $100,000 or more) can invest in Vanguard Charitable's TIFF Multiasset Pool, the primary benchmark of which is CPI + 5% per annum.

According to Vanguard Charitable, this option is best suited to those who are pursuing long-term giving strategies, similar to endowments. The multiasset pool's current allocation is 65% equity-oriented investments, 20% diversifying strategies (such as hedge funds), and fixed income, including cash.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)