A Closer Look at Schwab's Donor-Advised Fund

We examine Schwab Charitable's ongoing fees and underlying investment offerings.

Donating money to charities through donor-advised funds has become increasingly popular over the past decade. According to data from the National Philanthropic Trust's Donor Advised Fund Report, overall assets as of the end of 2017 surpassed $100 billion for the first time.

One of the biggest advantages of a donor-advised fund from a strategic tax-planning perspective is their flexibility: You make donations to the account and receive immediate tax benefits for doing so. But then you're allowed to disburse the money from the accounts according to your own timetable. As of now, there is no set time frame during which you have to pay out the funds; the donation you make can sit in the donor-advised fund account indefinitely. In fact, you can pass the account along to your heirs. In other words, you can choose to pay out a donation to an approved charity right away, or invest the money in the donor-advised fund account and let it grow tax-free until you want to pay it out. Either way, you get an immediate tax deduction. And though you cede control of the assets, you retain advisory privileges over how the account is invested, and how the fund distributes money to charities.

Because the funds in donor-advised accounts aren't used simply as way stations for getting money immediately into a charity, my next question was, how do the underlying investment menus rate? And how much will investors end up paying in fees and expenses? (Investors in donor-advised funds pay annual administrative fees on account balances, and investors also pay fees on the underlying investments. Though not typically onerous, all of these fees eat away at the overall charitable donation, and direct investments to charity would not face the same fee burden.)

How Does Schwab Charitable Stack Up? Minimum donation level required to set up an account: $5,000 Annual administrative fees: the greater of $100 or 0.6%; expense breaks on balances greater than $500,000

Schwab Charitable offers three investment pools: the pre-allocated pools, single asset class pools (index and actively managed), and the professionally managed account option that is available to those with accounts exceeding $250,000.

One feature I like about the Schwab Charitable website is this asset allocation calculator, which helps investors determine the right asset mix based on their time horizon, risk tolerance, and investing knowledge level.

Pre-Allocated Pools The pre-allocated pools are designed to offer diversified exposure to multiple asset classes in a single investment. There are four pre-allocated investment tracks with Schwab Charitable: conservative, balanced, socially responsible balanced, and growth.

The conservative pool uses

Manning & Napier's fundamental research is applied to both equities and corporate bonds and seeks to uncover three types of companies. "Strategic profile" picks are industry-leading firms with sustainable competitive advantages and reliable cash flows (similar to Morningstar's economic moats). "Hurdle rate" stocks are expected to emerge as industry leaders following a cyclical slump. "Bankable deal" picks are deep-value opportunities that the managers think are set for a turnaround. If the managers can't find sufficient opportunities in stocks, the fixed-income team invests the assets in bonds. The bond team determines the duration, yield-curve positioning, and security selection of fixed-income allocation.

The pre-allocated balanced pool uses

The socially responsible option in the pre-allocated investment pools is Pax Balanced Fund Individual Investor Class PAXWX; the fund invests 50% to 75% in stocks, with 25% to 50% in bonds. The managers typically devotes 15% to 20% of the assets to foreign stocks and 20% to 25% of the assets to smaller-cap names, so this fund can function as an all-in-one hybrid vehicle. Though we don't currently assign an Analyst Rating to the fund, its performance over most time periods has been middling or below average, though it tends to hold up well in tough markets such as 2008, 2011, and 2015. Its fee level is average.

The growth pool allocates its assets to American Century Investments One Choice Portfolio: Aggressive Investor Class AOGIX, which falls into the Allocation--70% to 85% Equity category. These portfolios are built using an assortment underlying American Century mutual funds diversified across a mix of stocks, bonds, and cash equivalent investments. We do not currently assign an Analyst Rating to this fund, but we do cover eight of the top 10 underlying funds (which is more than three quarters of the fund's assets). Of those eight, two are awarded medalist ratings by our manager research analysts: Bronze-rated

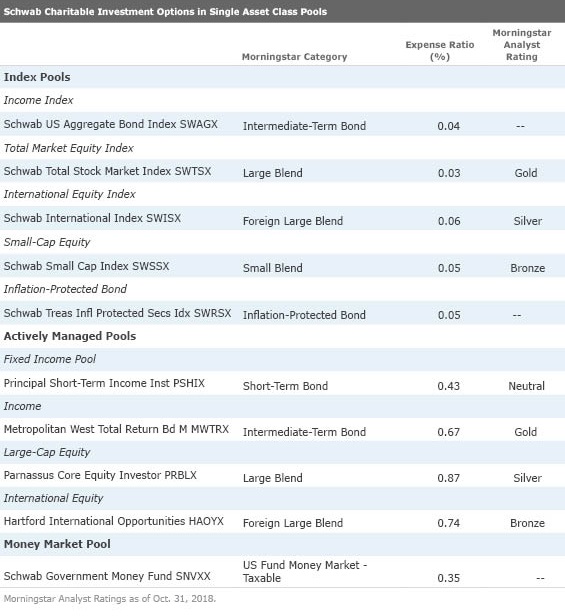

Single Asset Class Pools Schwab Charitable also offers single asset class pools that feature Schwab index funds (which often have extremely competitive expense ratios) and actively managed options from other asset managers. These pools can be used in combination by investors who prefer to be more hands-on with their investment selection and allocation recommendations.

Schwab's index-trackers offered are priced very competitively and cover a lot of ground: Schwab US Aggregate Bond Index SWAGX tracks the Bloomberg Barclays US Aggregate Bond Index;

The actively managed options are fairly solid overall, with one exception: We think investors could find better short-term bond options than

Gold-rated

Silver-rated

Professionally Managed Account Lastly, donors with account balances of more than $250,000 can select an independent investment advisor to actively manage a customized investment portfolio (subject to Schwab Charitable investment policies and oversight, per the Schwab Charitable website). The portfolio may comprise individual stocks, mutual funds, exchange-traded funds, and fixed-income products. Schwab also states that independent investment advisors for the "largest accounts" may recommend allocations to alternative investments such as hedge funds, private equity/venture funds, real estate funds, and real asset funds.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)