HSAs: Room for Improvement

Providers of health savings accounts need to up their game, according to our study.

This report was co-authored by Heather Larsen

When it comes to health savings accounts, or HSAs, investors have had few resources available to help them navigate hundreds of plan providers. This lack of information has likely contributed to their underuse as a savings vehicle despite their valuable tax benefits.

For the first time, Morningstar conducted an in-depth analysis of HSAs to provide a comprehensive resource for investors and employers selecting a plan. We evaluated 10 of the largest HSA plan providers in this report through two lenses: as spending vehicles to cover current medical costs and as investment vehicles to save for future medical expenses.

Our takeaway: Out of the 10 plans we evaluated, only one looks compelling for use as both a spending vehicle and an investment vehicle, suggesting there is much room for improvement across the industry.

How We Assessed the Plans HSAs are offered in conjunction with high-deductible health plans. They are tax-sheltered accounts for individuals to save for medical expenses that aren't covered by the health plan. Interest in HSAs is rising, but they remain a very underresearched corner of the market.

An HSA is triple tax-advantaged: Pretax dollars go into the HSA; the money grows on a tax-free basis; and withdrawals are tax-free as long as the money is used to cover qualified healthcare expenditures.

There are two compelling cases for people to use HSAs. First, investors can use them as a spending vehicle, depositing money into a checking account to use for near-term healthcare expenses. Because contributions and withdrawals for qualified medical expenditures are tax-free, workers can increase the buying power of their healthcare dollars. This is particularly beneficial for workers with limited resources.

Second, HSAs can be used as investment vehicles to save for future medical expenses. Fidelity estimates that retired couples can expect to pay more than $260,000 on healthcare in retirement. Considering that HSAs feature tax-exempt investment growth and interest, it would be optimal from a wealth-building standpoint for individuals to invest their HSA funds, pay for medical expenditures out of pocket, allow their investments to grow tax-free for many years, and “reimburse” themselves for their medical expenses many years later. Funds from HSAs can be used to pay Medicare premiums, for example, and HSAs can be used to fund long-term end-of-life care.

In our study, we analyzed HSA plans for both uses. There are hundreds of HSA providers. To keep the scope of this paper manageable, we focused on 10 of the most prominent providers. Together, this group covers a significant portion of the country’s total HSA assets balance, but no publicly available data exists to confirm the total assets in these plans. The providers we evaluated are Alliant Credit Union, Bank of America, BenefitWallet, HealthSavings Administrators, HealthEquity, HSA Bank, Optum Bank, SelectAccount, The HSA Authority, and UMB Bank. (HSA Bank is Morningstar’s HSA plan provider.)

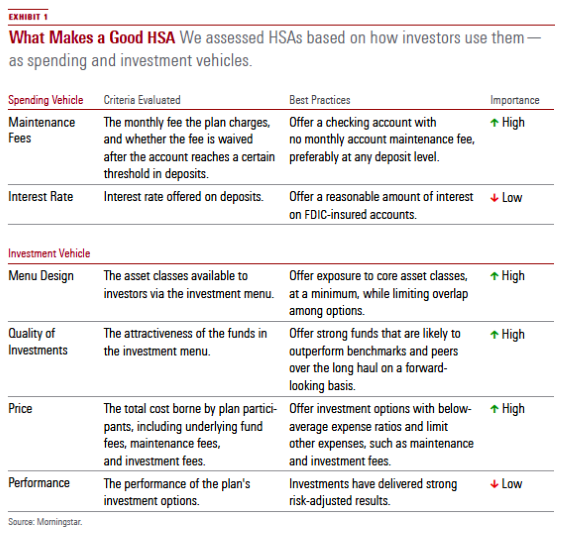

EXHIBIT 1 outlines the criteria we evaluated when determining our assessments of the spending account and investment account sides. It also includes what we consider to be best practices, as well as the importance of each component in determining our evaluation.

For our HSA plan assessments, we determined scores of positive, neutral, and negative for each criterion evaluated. We aggregated those scores and used the same three-tier scale to assess the plans overall.

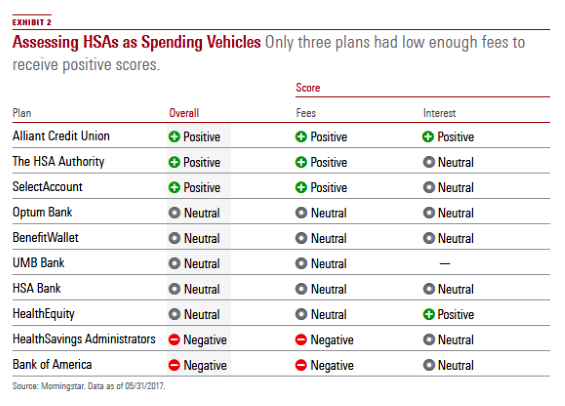

HSAs as Spending Vehicles On the spending-vehicle side (EXHIBIT 2), we focused on maintenance fees. We also considered, to a lesser degree, the interest rates offered by plans' checking accounts. Interest earned on HSA deposits is minimal given low interest rates.

Fees Fees represent the most important consideration when selecting a plan to use as a spending account. Plans with no fees received a positive assessment, while plans that charged fees but offered to waive them after a certain threshold in deposits received a neutral assessment. Plans that charged fees no matter the balance received a negative assessment.

Much like the 401(k) market, fees vary wildly from one provider to another. Monthly account-maintenance fees represent the most common expense borne by participants, so we focused our analysis on these levies. Other fees such as debit card replacement fees, returned check fees, check orders, overdraft fees, and excess contribution fees are commonly assessed and are important for participants to keep in mind.

Interest Most HSA providers pay interest on deposits on the checking account portion of the HSA. These are the only returns that workers using HSAs exclusively as spending vehicles will receive. Accountholders with greater account balances can usually receive higher interest rates. Investors can also juice returns by selecting a non- FDIC-insured account. Because earning a meaningful interest rate would require either an account balance that is much larger than average or greater risk-taking, we placed little emphasis on these higher-rate options when evaluating plans from an interest-rate perspective.

Positive<\br> The HSA Authority, SelectAccount’s FreeSaver tier, and Alliant Credit Union are excellent options for accountholders using their HSAs as spending vehicles. Their lack of a monthly maintenance fee stretches users’ healthcare dollars further than other HSAs. Additionally, Alliant Credit Union deserves further praise for offering one of the most competitive interest rates of the plans we studied: 0.65% for balances of more than $100. Combined with zero monthly fees, Alliant Credit Union is the most compelling option for someone looking to use their HSA primarily as a spending vehicle.

Neutral UMB Bank, HSA Bank, Optum Bank, HealthEquity, and BenefitWallet all charge monthly account-maintenance fees but provide an opportunity for those fees to be eliminated when the account size has crossed a certain threshold. This is not ideal for those who have recently opened accounts and have small balances, or for those who will use their HSAs and do not expect to accrue large balances. A person holding a balance of $2,000—the industry average— would be unable to escape the fees assessed by Optum Bank, HSA Bank, and UMB Bank. BenefitWallet is the most attractive of this bunch; it waives fees for accountholders with just $1,000.

UMB Bank does not disclose interest rates on its website. However, given that fees take precedence when evaluating plans for use as a spending account, we assigned it an assessment based on the maintenance charge.

Negative We cannot recommend using HealthSavings Administrators and Bank of America for accountholders who intend to use their HSAs solely as spending vehicles. Both of these providers charge a monthly fee (Bank of America, $4.50; HealthSavings Administrators, $3.75), which will take an outsize bite out of relatively small account balances, and neither of them offers to waive this fee for accounts that have accrued a certain balance. They also offer uninspiring interest rates on FDIC-insured deposits.

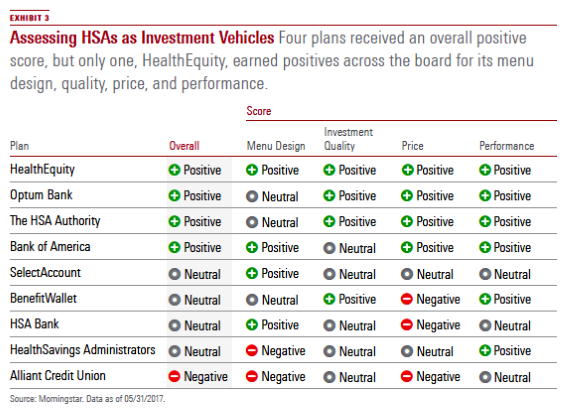

HSAs as Investment Vehicles When evaluating plans as investment vehicles ( EXHIBIT 3 ), those with two or more positive scores and no negative scores for menu design, quality of investments, and price received an overall assessment of positive. To earn a negative assessment, a plan would have to score negative in two of the three areas. Plans that landed in between received a neutral assessment.

Because performance is backward-looking, we gave it little consideration when evaluating plans.

We break down each component that makes up the overall score. UMB Bank would not share its investment menu with us, so we excluded that plan from the investment vehicle evaluations.

Menu Design An HSA plan's investment menu should offer a comprehensive set of options so that do-it-yourself investors can build well-rounded portfolios. "Core" asset classes should include large-cap equities, small- and mid-cap equities, international developed or world equities, U.S. diversified bonds, and either a cash-equivalent or short-term bond strategy. We also believe it's prudent to offer multiasset-class funds, which offer built-in asset-class diversification, for hands-off investors who wish not to construct or closely monitor their portfolio.

HSA plans should also resist offering overlapping investment strategies. Many studies have shown that an investor with too much choice often makes poor investment selections or succumbs to decision paralysis. Instead, plans should offer one best-in-class option within each asset class. Of course, there are some exceptions to that rule. In some cases, it’s reasonable to offer an active and a passive manager, or a more aggressive strategy to balance a more conservative one, within one asset class to meet the needs of different investor types.

Plans in our study that receive positive scores offer investment strategies in core asset classes and have limited redundancy of investment options. Neutral plans often omit one core asset class or have moderate overlap among offerings. Negative-scored plans typically have an unreasonably large lineup or they omit multiple core asset classes.

Positive Bank of America, SelectAccount, HSA Bank, and HealthEquity designed robust menus for investors. All four plans offer exposure to core asset classes while limiting overlap among choices. Within the domestic-equity space, each plan uses active funds and offers broad-based index options for participants who want to minimize investing costs. Investors can also choose from a nice mix of value and growth U.S. stock strategies, at least one foreign developed-equity fund, and an intermediate-term bond fund.

Although these plans certainly have sensible lineups, some overlap exists. For example, HSA Bank offers two S&P 500 funds (Victory S&P 500 Index MUXAX and

Neutral The HSA Authority almost received a positive score for menu design. However, it has slightly too much overlap among options. For example, it offers nine large-cap equity funds and three balanced funds that feature active underlying managers. Modestly narrowing the lineup would improve the plan's appeal.

BenefitWallet and Optum Bank receive neutral scores for omitting critical asset classes from their investment lineups. BenefitWallet’s menu lacks a diversified U.S. bond strategy.

Negative Two plans receive negative scores for having overwhelming lineups. HealthSavings Administrators has a gigantic investment roster of 494 total investment options. The plan offers seven investment menus. Six menus feature options from one fund family—T. Rowe Price, TIAA, Franklin Templeton, Vanguard, DFA, and MFS. Only Vanguard offers a comprehensive investment lineup; the other fund families omit anywhere from one to four core asset classes. Investors cannot mix and match investments among the menus, giving them mostly incomplete toolkits to work with. The seventh menu, Investor Select, features more than 400 unique funds from more than 40 different fund companies. With multiple layers of required decision-making and mostly incomplete investment lineups, the plan's setup is far from ideal.

Alliant Credit Union also represents an egregious example of providing too much choice, where plan participants must comb through 125 investment options. The plan has nine large-blend U.S. equity strategies, eight intermediate-term bond funds, and five real-estate strategies, to name a few of the many overlapping areas.

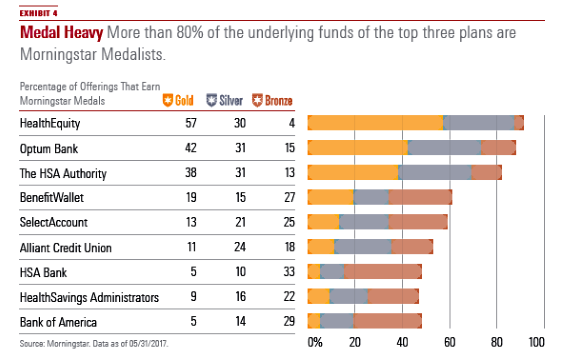

Quality of Investments HSA providers can improve their plans' appeal by offering strong underlying strategies. To evaluate plans' managers, we leveraged our forward-looking mutual fund ratings, called the Morningstar Analyst Rating for funds. To determine scores for quality of investments, we subtracted the percentage of options that receive Neutral and Negative ratings from the percentage that receive Gold, Silver, or Bronze Morningstar Medals. If that number was equal to or greater than 50%, the plan received a positive score for quality of investments. The remaining plans earned neutral scores. To receive a negative score, a plan would have to offer a significant number of Negative-rated funds; fortunately, no plan does.

Generally, the plans included in our analysis have populated their investment menus with solid managers (EXHIBIT 4). Four out of nine plans that we evaluated earned positive scores for quality of investments.

Positive HealthEquity has the strongest lineup. The plan delivers across asset classes; 21 of the 23 funds are Morningstar Medalists, including 13 Gold-rated funds. Each designated core asset class features a Gold-rated fund, improving the plan's appeal. The plan uses only Vanguard funds, with low-cost, broadly diversified index funds representing 65% of choices. It's the only plan that offers more index options than actively managed strategies.

Optum Bank and The HSA Authority also stand out from the crowd. In both plans, Morningstar Medalists account for at least 80% of options, with Gold-rated funds representing about 40% of choices. The plans’ heavy tilt to the Vanguard fund family explains this; roughly half of the underlying funds in each plan are Vanguard offerings, most of which earn Gold or Silver ratings. Strong active managers from fund families such as Dodge & Cox and American Funds round out the plans.

BenefitWallet distinguished itself by selecting solid active managers from a diverse set of fund families. That said, the plan offers

Neutral Morningstar Medalists represent between 47% and 58% of options at SelectAccount, HSA Bank, Alliant Credit Union, and HealthSavings Administrators. However, these plans offer a handful of Neutral-rated funds, which dims their appeal. SelectAccount and HSA Bank offer relatively compact lineups of 20 to 25 options. Bronze-rated funds represent 25% or more of options at both plans; we expect these funds to outperform peers over the long haul, but we don't have as much conviction in them as compared with Gold- and Silver-rated funds.

Alliant Credit Union and HealthSavings Administrators have vast lineups. Alliant Credit Union has 133 options, and HealthSavings Administrators offers more than 400 unique funds. Offering such wide-ranging lineups makes it hard for their funds to stand out as a group. We also don’t rate more than one third of options at each plan, and both providers have at least one Negative-rated fund.

Bank of America has the least impressive lineup of all plans we analyzed. Currently, 48% of options earn Morningstar Medals, though 29% receive Neutral ratings. Investors can find stronger rosters elsewhere.

Price To evaluate the cost of investing in an HSA plan, we began by assessing underlying fund fees. To make an apples-to-apples comparison across plans, we calculated the average expense ratio of each plan's underlying funds in four broad asset classes: large cap, small cap, foreign large cap, and intermediate-term bond. To calculate the average retail fund fee, we used primarily A share classes, which tend to be the most widely owned share classes among retail investors. A shares include 12b-1, or distribution, fees; in many cases, retail investors can find funds without 12b-1 fees, but we didn't include most of those options in the calculation. Therefore, the median retail fund fee that we use in this paper has an upward bias.

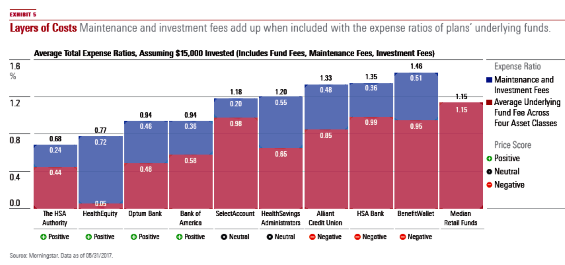

Average expense ratios across the four broad asset classes range from 0.05% to 0.99%; the plans’ underlying fund fees compare favorably versus retail mutual fund peers. However, HSA plans tack on additional fees that investors must take into consideration. Most plans charge maintenance fees to cover general administrative costs. Moreover, the majority of plans charge an investment fee to participants who invest in the mutual fund lineup. Maintenance and investment fees are typically dollar-based fees. To incorporate these expenses into our analysis, we converted dollar-based fees to percentage terms, assuming an account balance of $15,000, which, according to Devenir, was the average balance in HSA accounts that had investment assets as of year-end 2016.

We layered each plan’s additional fee, in percentage terms, onto the average underlying fund expense ratio across the four asset classes to determine an average total expense ratio for each plan (EXHIBIT 5). To assess whether these prices represent a good value proposition, we compared plans’ average total expense ratios with the median fees charged by similarly managed retail mutual funds. Plans with below-average fees versus retail mutual fund peers earn positive price scores, those with middling expense ratios receive neutral price scores, and plans with high expenses garner negative price scores.

Positive The HSA Authority, Optum Bank, HealthEquity, and Bank of America boast below-average fees relative to retail mutual funds, earning those plans positive price scores. The plans have gained a cost advantage by offering low-cost index strategies. HealthEquity has unusually cheap underlying fund fees, as it uses strictly index funds offered by Vanguard in the four core asset classes. Passive strategies represent 65% of the plan's fund choices, which is significantly more than all other providers. The plan tacks on more fees than any other provider we evaluated, charging a maintenance fee of $47.40 per year plus an investment fee of 40 basis points. Still, thanks to extremely low underlying fund fees, the plan's total expenses land well below the median charged by retail mutual funds.

The HSA Authority, Optum Bank, and Bank of America offer a mix of active and passive strategies within the core asset classes. The plans’ underlying fund fees across the four areas range from 0.44% to 0.58%. The HSA Authority charges $36 a year in dollar-based fees, translating to an expense ratio of 0.24% assuming a $15,000 investment, which is lower than most plans. Bank of America charges $54 in annual fees, and Optum charges $69. The plans’ expenses look less attractive than the other two plans with positive price ratings, but overall the options are still priced below average versus the median retail fund.

The HSA Authority, Optum Bank, and Bank of America offer a mix of active and passive strategies within the core asset classes. The plans’ underlying fund fees across the four areas range from 0.44% to 0.58%. The HSA Authority charges $36 a year in dollar-based fees, translating to an expense ratio of 0.24% assuming a $15,000 investment, which is lower than most plans. Bank of America charges $54 in annual fees, and Optum charges $69. The plans’ expenses look less attractive than the other two plans with positive price ratings, but overall the options are still priced below average versus the median retail fund.

Neutral With average total expense ratios across the four core asset classes equal to about 1.2%, which includes underlying fund, investment, and maintenance fees, both HealthSavings Administrators and SelectAccount have fees that are comparable to retail mutual funds. As a result, the plans receive neutral price scores. HealthSavings Administrators charges reasonable underlying fund fees, but it adds a hefty $45 annual maintenance fee. Plus, investors who select MFS, DFA, Vanguard, Franklin Templeton, or the Investor Select lineup of funds must pay an additional 25 basis points annually. SelectAccount uses predominantly active managers, so its underlying fund fees run relatively high. The plan charges an $18 investment fee, and maintenance fees can range from $0 to $48. However, to have access to the plan's investment options, investors must pay at least $12 per year in maintenance fees, bringing the plan's minimum total annual fee to $30.

With average total expense ratios across the four core asset classes equal to about 1.2%, which includes underlying fund, investment, and maintenance fees, both HealthSavings Administrators and SelectAccount have fees that are comparable to retail mutual funds. As a result, the plans receive neutral price scores. HealthSavings Administrators charges reasonable underlying fund fees, but it adds a hefty $45 annual maintenance fee. Plus, investors who select MFS, DFA, Vanguard, Franklin Templeton, or the Investor Select lineup of funds must pay an additional 25 basis points annually. SelectAccount uses predominantly active managers, so its underlying fund fees run relatively high. The plan charges an $18 investment fee, and maintenance fees can range from $0 to $48. However, to have access to the plan’s investment options, investors must pay at least $12 per year in maintenance fees, bringing the plan’s minimum total annual fee to $30.

Neutral With average total expense ratios across the four core asset classes equal to about 1.2%, which includes underlying fund, investment, and maintenance fees, both HealthSavings Administrators and SelectAccount have fees that are comparable to retail mutual funds. As a result, the plans receive neutral price scores. HealthSavings Administrators charges reasonable underlying fund fees, but it adds a hefty $45 annual maintenance fee. Plus, investors who select MFS, DFA, Vanguard, Franklin Templeton, or the Investor Select lineup of funds must pay an additional 25 basis points annually. SelectAccount uses predominantly active managers, so its underlying fund fees run relatively high. The plan charges an $18 investment fee, and maintenance fees can range from $0 to $48. However, to have access to the plan's investment options, investors must pay at least $12 per year in maintenance fees, bringing the plan's minimum total annual fee to $30.

Negative Alliant Credit Union, HSA Bank, and BenefitWallet look unattractive from a fee standpoint. HSA Bank and BenefitWallet have average expense ratios of 0.99% and 0.95%, respectively, across the four asset classes. Alliant Credit Union's underlying funds fees look more reasonable, at 0.85%. Nonetheless, all three plans charge hefty dollar-based fees. Each plan layers on between $54 and $77 a year in maintenance and investment fees. That's equivalent to an additional 0.36% and 0.51% on top of underlying fund expenses, assuming a $15,000 investment, which is a tough hurdle for active managers to consistently overcome.

Performance To evaluate the performance of HSA plans, we assessed the Morningstar Ratings assigned to plans' underlying funds. The Morningstar Rating for funds, commonly referred to as the star rating, is a backward-looking metric that brings together the performance and risk of a fund relative to its peers into one quantitative evaluation. We calculated the average overall star rating of each plan's underlying funds to determine performance scores. Plans with an average star rating of 3.5 or greater receive positive performance scores, and plans with an average star rating between 2.5 and 3.5 earn neutral performance scores. An average star rating of 2.5 or less would merit a negative performance score, but no plan fell to that threshold.

Positive Six plans earned a positive performance score. HealthEquity and The HSA Authority have average star ratings of more than 4. The plans use more passive strategies than all other providers we evaluated, with index options representing 65% of options at HealthEquity and 38% of investments at The HSA Authority. That has led to strong results, as active funds have struggled to outperform their index counterparts during the past several years. Optum Bank and Bank of America, which earn average star ratings of 3.88 and 3.67, respectively, have also benefited from significant usage of index strategies, which represent about one fourth of the fund roster at each plan. HealthSavings Administrators and BenefitWallet have come out ahead by selecting well-performing active managers; less than 15% of each plan's underlying managers follow passive strategies.

Neutral Alliant Credit Union, HSA Bank, and SelectAccount have respectable though not standout results, earning neutral performance scores. The three plans' average star ratings fall below the 3.5-star threshold required to receive a positive performance score.z

Just a Start Interest in HSAs is growing. Assets in HSA plans have nearly doubled during the past three years. At the end of 2016, there was more than $37 billion in HSA plans. Still, investors are just now getting up to speed on how HSAs work. Unfortunately, investors have few resources available to them to navigate the hundreds of plan providers that exist.

This report is only a start, and based on our findings, there is much room for improvement across the industry. Out of the 10 prominent plans we evaluated, only The HSA Authority looks compelling for use as both a spending vehicle and an investment vehicle—two important reasons why a person would use an HSA. On the spending side, only three plans earned positive assessments. For use as an investment vehicle, only four plans earned positives.

We hope that by shining a light on the components of HSAs, we will encourage plan sponsors to improve their offerings.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)