A Fund Family That's Taken a Lot but Delivered Little

Stadion Funds has collected almost as much in fees as it has delivered in gains and income for more than a decade.

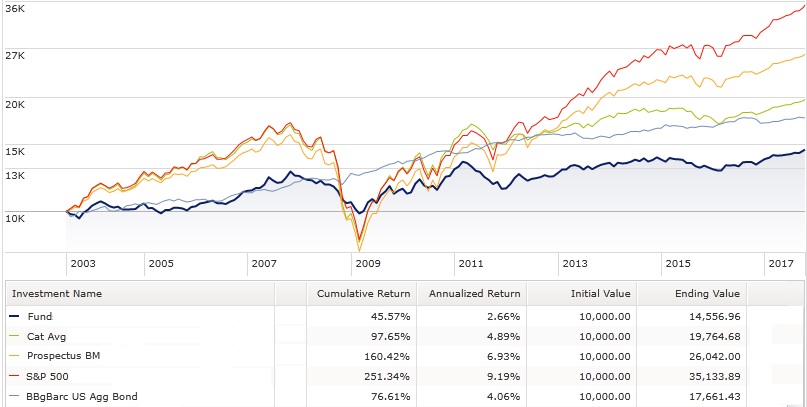

Imagine a fund that's performed like this one has:

Source: Morningstar Analysts.

As you can see, it has badly lagged its category average and prospectus benchmark as well as the S&P 500 and Bloomberg Barclays U.S. Aggregate Bond indexes. In fact, it's barely beaten inflation over the 14-plus years of its existence, a low hurdle indeed.

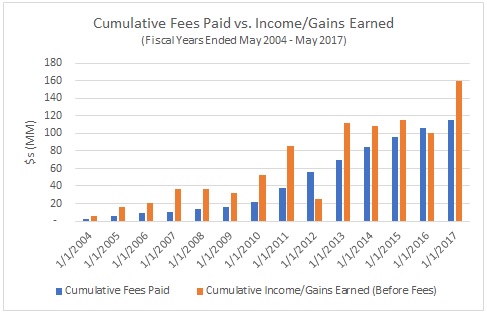

Now, what if I told you this fund has more than $650 million in assets and the firm behind it manages more than $3 billion in total? Or that the fund hauled in almost as much in fees ($115 million) as its shareholders reaped in income and gains ($160 million) over its lifetime, as shown below?

Source: Morningstar Analysts.

Would you believe me? "Nah," you’d say. "Can't happen. Not with passive funds eating active funds' lunch the way they have."

But you'd be wrong.

Wait, What? OK, so the above isn't a fund, singular. Rather, it's a composite (1) of funds from a single fund family--Stadion. But the numbers are real--the Stadion funds really have performed that poorly in aggregate over time. And the funds really have raked in those fees.

How did Stadion pull it off? We'll explore that question in greater detail, as well as the lessons it might hold for investors.

Full Disclosure Before you read any further, you should know that Stadion competes with Morningstar in certain areas, such as retirement "managed accounts." The Morningstar businesses that offer these other services are separate from research, where I sit. Furthermore, those businesses had no say in the decision to write this piece (which I made independently based on my own familiarity with Stadion) and didn't participate in any of the research that went into it. Nevertheless, it represents a potential conflict that you should be aware of.

Stadion: A Thumbnail Sketch Stadion is a very small player in the mutual fund business. The firm got its start in the early 1990s but didn't launch funds until 2003. (We'll delve into the timeline in a moment.)

Stadion's investing approach is probably best described as market-timing--it uses trend-following and technical indicators to "react" to the market, trading exchange-traded funds in rapid-fire fashion based on what its models are spitting out. This has translated to very high portfolio turnover and significant trading costs. (Stadion funds racked up around $11 million in brokerage commissions in aggregate from 2003 to 2017.)

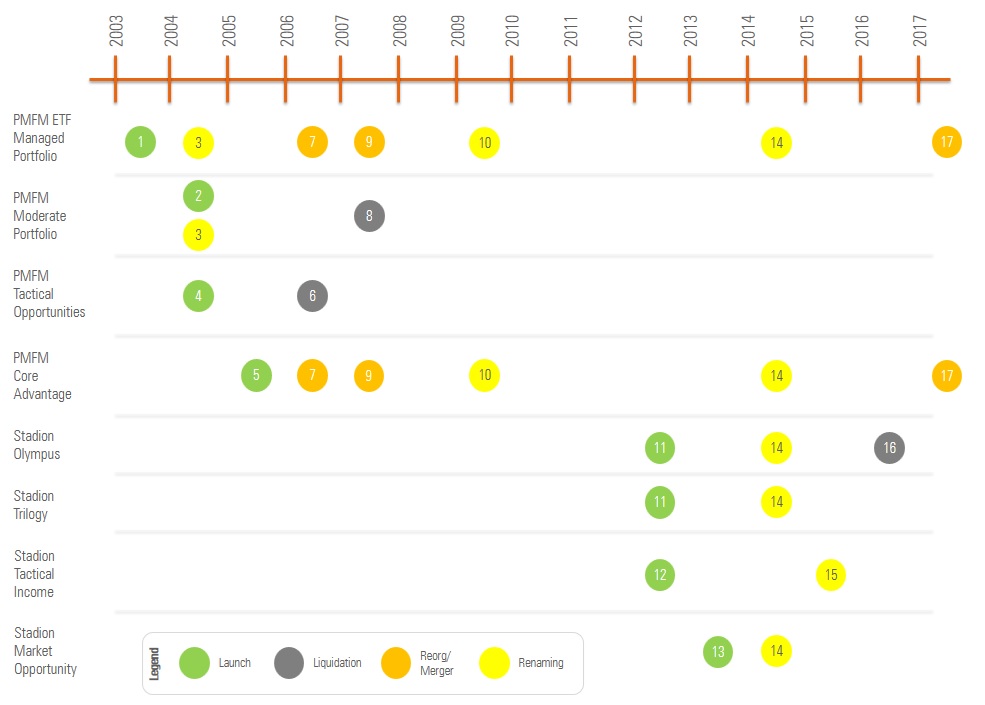

Launches, Restructurings, Renamings Galore As shown in the annotated timeline below, Stadion got its start in the fund business back in 2003, when it launched what was then called the PMFM ETF Portfolio Trust.

Source: Morningstar Analysts.

Timeline

- June 2003: PMFM ETF Portfolio Trust launched.

- March 2004: PMFM Moderate Portfolio Trust launched.

- September 2004: PMFM ETF Portfolio renamed PMFM Managed Portfolio; PMFM Moderate Portfolio renamed PMFM Tactical Preservation Portfolio.

- September 2004: PMFM Tactical Opportunities launched.

- June 2005: PMFM Core Advantage launched (through merger of MurphyMorris ETF).

- September 2006: PMFM Tactical Opportunities liquidated.

- September 2006: Advisor share class of PMFM Managed Portfolio and PMFM Core Advantage converted to A share class.

- July 2007: PMFM Tactical Preservation Portfolio (formerly PMFM Moderate Portfolio) liquidated.

- October 2007: Investor share class of PMFM Managed Portfolio and PMFM Core Advantage converted to A share class; pre-Sept. 15, 2006 track record deleted.

- June 2009: PMFM Managed Portfolio renamed Stadion Managed Portfolio; PMFM Core Advantage renamed Stadion Core Advantage.

- April 2012: Stadion Olympus and Stadion Trilogy launched.

- December 2012: Stadion Tactical Income launched.

- April 2013: Stadion Market Opportunity launched (through adoption of Aviemore ETF Market Opportunity).

- March 2014: Stadion Managed Portfolio (formerly PMFM Managed Portfolio) renamed Stadion Managed Risk 100; Stadion Core Advantage (formerly PMFM Core Advantage) renamed Stadion Tactical Defensive; Stadion Olympus renamed Stadion Defensive International; Stadion Trilogy renamed Stadion Trilogy Alternative; Stadion Market Opportunity renamed Stadion Tactical Growth.

- April 2015: Stadion Tactical Income renamed Stadion Alternative Income.

- December 2016: Stadion Defensive International (formerly Stadion Olympus) liquidated.

- April 2017: Stadion Managed Risk 100 (formerly PMFM Managed Portfolio and Stadion Managed Portfolio) merged into Stadion Tactical Defensive (formerly PMFM Core Advantage and Stadion Core Advantage).

The timeline yields several insights into how Stadion has managed its fund lineup over time. First, while the firm hasn't offered many funds at any given time, it has frequently launched, liquidated, reorganized, and renamed funds. Taken together, this has had a disorienting effect, making it difficult to piece together a chronology of the firm's performance history. Second, Stadion has bought track records (through adoptions of funds, which were structured as mergers) and, on one occasion, appears to have wiped clean a portion of a still-operating fund's track record (thanks to a series of share-class conversions).

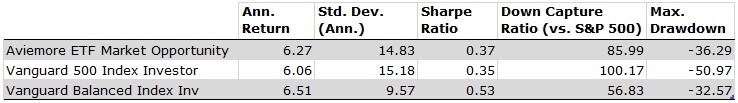

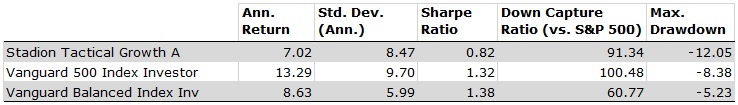

Brightening the Corners The April 2013 adoption of Aviemore ETF Market Opportunity is a case in point. At that time, the firm's lineup was flagging, as Stadion Managed Portfolio and Stadion Core Advantage had missed most of the market's post-2008 upside while skidding to losses in 2011. In the Aviemore fund, however, Stadion found a potential winner, as it had been a respectable performer from its April 2004 inception until it was brought into the fold at Stadion, as shown in the table below.

Source: Morningstar Analysts.

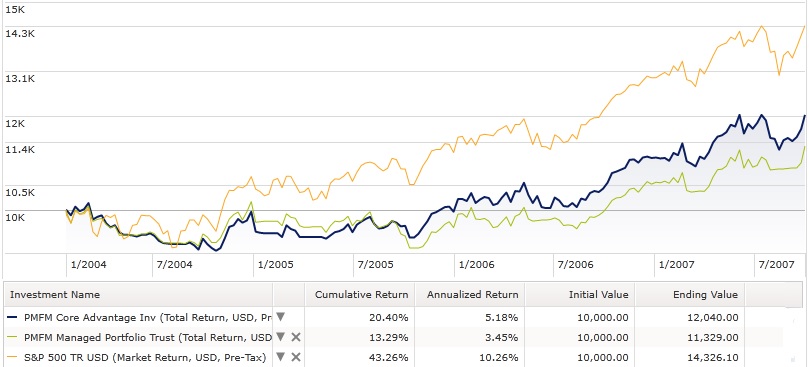

While Stadion succeeded in selling the Aviemore fund after adopting it (inflows rose sharply in 2014 and 2015), performance began to slump not long after. The fund's post-adoption record is shown in the table below.

Source: Morningstar Analysts.

(Note: Stadion Tactical Growth ETFOX boasts a 5-star Morningstar Rating. This rating is based on the fund's performance versus its peers in the rather diverse tactical-allocation Morningstar Category. In general, that category is littered with expensive, risk-averse funds that have performed dismally, which means that a fund can excel by sheer virtue of having been more heavily exposed to the market. That's what the Stadion fund appears to have managed to do, as evidenced by its higher volatility and upside and downside capture ratios. But that still hasn't been enough for it to keep pace with its prospectus benchmarks or the simple 60% U.S. stocks/40% U.S. investment-grade bonds mix. Moreover, given that the star rating is based on a fund's trailing three-, five-, and 10-year risk-adjusted returns, it's worth remembering that the majority of the fund's rating is attributable to the track record it amassed prior to joining Stadion in April 2013.)

Stadion also succeeded, through some clever maneuvering, to largely wipe the slate clean at PMFM Managed Portfolio and PMFM Core Advantage in 2006. As detailed in the timeline above, the firm launched a new share class in September 2006 (A shares), into which it converted the funds' existing Advisor share classes and eventually, in 2007, the funds' Investor share classes as well. When this process was complete, the funds' pre-September 2006 track records vanished.

To illustrate, here's what the annual-report performance illustration looked like before Stadion made the change (in the 2007 annual report), with the deleted performance history outlined in red.

And here's how it looked after (in the 2008 annual report), once the pre-September 2006 performance history had been purged.

Stadion presumably took that step to tidy up the funds' track records, which to that point had been very poor, as shown below:

Source: Morningstar Analysts.

(Further complicating matters, Stadion also has changed the funds' prospectus benchmarks from time to time. For instance, in the years prior to 2007, it benchmarked PMFM Core Advantage and PMFM Managed Portfolio against an 80% S&P 500/20% Bloomberg Barclays U.S. Aggregate Bond blended index. But then in 2007, it switched to the S&P 500 alone. More recently, Stadion replaced the S&P 500 as the benchmark for Stadion Trilogy Alternative Return STTGX in favor of the HFRX Absolute Return Index, and swapped out the S&P 500 for a pair of Morningstar target-risk indexes as benchmarks for Stadion Tactical Defensive ETFRX and Stadion Tactical Growth.)

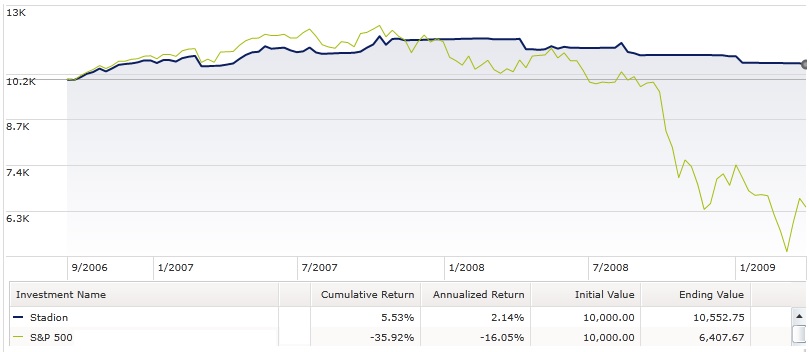

Jackpot If the Stadion funds' attempts to market-time largely fizzled, the firm succeeded in at least one respect--it spiffed up these funds' track records at just the right time. Indeed, once the financial crisis deepened and Stadion's funds remained in risk-off mode (which tended to be their default setting), they outperformed handily. That, in turn, attracted investors taken with the funds' ability to sidestep steeper losses in 2008 and early 2009.

Of course, what many of those investors probably didn't realize was that the track record they were seeing was incomplete. For instance, this is the performance history investors would have seen for Stadion Managed Portfolio circa early 2009:

Source: Morningstar Analysts.

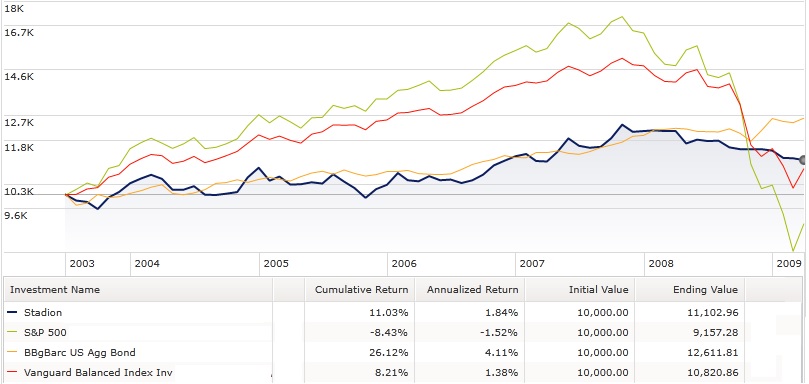

Measured from its new September 2006 inception date, the fund looks like a hero and, predictably, sold very well in the ensuing years. But measured from its original April 2003 launch date, a different picture emerges:

Source: Morningstar Analysts.

While the Stadion fund outperformed the S&P 500 over this span, its performance was comparable to that of

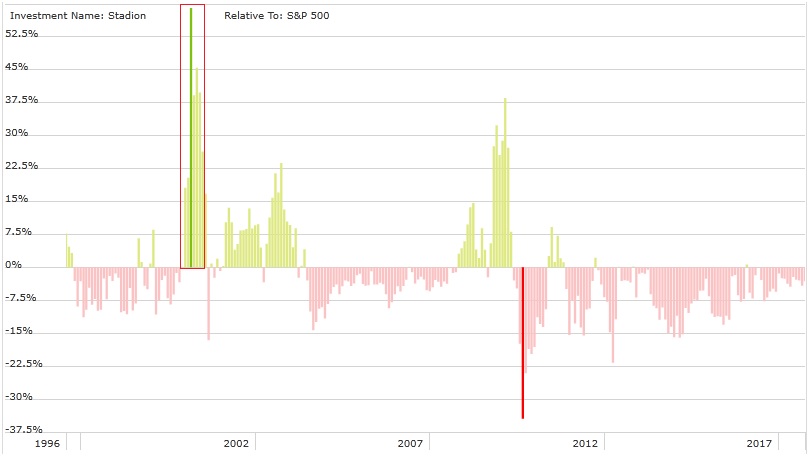

Tech Darling? In its defense, Stadion would likely cite this strategy's long-term record, which dates back to 1996 (the fund's inception was in 2003, but the separate-account version had already been around for seven years by then). However, that separate account's early record is very difficult to reconcile with the "risk-adverse" approach that Stadion repeatedly referenced in reports to shareholders (2).

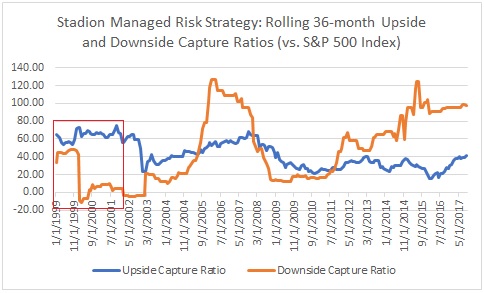

To illustrate, here are the rolling 36-month upside and downside capture ratios of the Stadion strategy from 1996 through 2017 (the separate account's record is used through 2003, the fund's thereafter).

Source: Morningstar Analysts.

What's most striking is the way the strategy's late-1990s performance (highlighted by the red rectangle in the chart above) flipped the script on "risk-adverse," as it appears the separate account participated to a meaningful extent in the market's upside. Upon closer examination, it becomes clearer why: The separate account notched a 63% gain in the six months ended Feb. 29, 2000, crushing the S&P by a whopping 55%. That showing topped all but a handful of the 4,300 other separate accounts that existed at the time, putting it in the company of go-go strategies that invested in the stocks of small, high-growth firms.

Source: Morningstar Analysts.

This is not the performance one would have expected of a supposedly defensive strategy, to put it mildly. It raises questions about the circumstances under which the separate account amassed its record in the late-1990s, and whether that performance is representative of the risk-minded approach later advertised, or was simply a lucky roll of the dice among many that weren't.

At the time, the separate account held around $42 million in assets, accounting for roughly 55% of the firm's assets. Using available data (in our separate account database or other public sources of information), it isn't possible to assess what other models Stadion was offering at the time or how those strategies might have performed.

Takeaways If Stadion doesn't excel at running money, which it appears not to, it certainly has shown a knack for survival (and collecting fees). But that's not nearly good enough, which is why investors are well-advised to give the firm and its funds a wide berth.

It's also a reminder that regulatory protections and transparency aren't a substitute for due diligence. In this case, Stadion appears to have followed the rules. But given the sheer number of fund launches, restructurings, renamings, and other changes, it's very difficult to construct a coherent picture of how well the firm has done for investors over time. Only through research could one piece this together to make a judgment.

Otherwise, it's about taking Stadion's word for it. And its performance as a manager and steward of capital doesn't justify that kind of faith.

Endnotes (1) I built a composite of all Stadion funds that existed at the relevant points in time going back to inception of the firm's first fund in 2003. I equal-weighted each Stadion fund every month and then calculated an average return for the composite for that month, repeating in successive months (through May 31, 2017, when the study concludes). I followed the same steps in building the composite category average and prospectus benchmark that's shown--for each fund included in the composite in a given month, I chose the corresponding category average and prospectus benchmark.

(2) The following are references Stadion made in its annual shareholder reports in describing its risk-aware approach to managing money:

"The risk indicators in our model have kept us from being fully exposed to the market, and as a result our portfolio has been less volatile than the major indexes, including the S&P 500. While this reduced exposure has caused the fund to underperform the S&P 500, we feel it is justified by the protection provided if the market breaks out of the trading range to the downside."--5/31/04 annual report.

"While our model has been historically successful in protecting from losses during severe market declines, our safety measures may cause our portfolios to underperform during rising markets."--5/31/05 annual report.

"We believe a defensive approach to the markets has been and is probably going to be a good approach for the foreseeable future."--5/31/06 annual report.

"As explained below, this past year was a challenging market environment for the Funds, primarily because during this period we were in fully defensive positions on two occasions because of downside market action. On both occasions, that downside market action triggered our risk adverse approach to managing money."--5/31/07 annual report.

"Once we hold an issue, we manage it based upon its performance; due to stop-loss protections built into our model, we generally will not continue to hold an asset that is not performing well. This approach is designed to help limit losses during significant market declines. This approach is defensive in nature and adheres to our overall philosophy that we can try to win by not losing."--5/31/08 annual report.

"Because of our risk adverse methodology, we will generally underperform during up markets because we will not remain invested when the market experiences a pullback, and therefore we drop behind. However, when the market experiences a bear market (there have been two bear markets in the last 10 years), we typically expect to outperform the major equity market indexes. In our view, there will be more bear markets."--5/31/10 annual report.

"In the last 112 years, there have been 33 bear markets (declines > -20% as measured by the Dow Jones Industrial Average). Thus we believe there are times when the best approach to the equity markets is to exit them."--5/31/12 annual report.

"By the end of May, Stadion's Managed and Core Advantage portfolios had risen, but at a rate considerably less than that of the S&P 500. This isn't surprising considering Stadion's unconstrained defensive approach is designed to mitigate catastrophic losses. As we seek to gain and protect assets over time, the Funds' holdings morph to these goals, defeating attempts to shove us into traditional style boxes. However, the Stadion Funds compare nicely to other actively managed risk averse strategies." -- 5/31/13 annual report.

"Remember, all markets move in cycles and at this point in time we believe that the need for risk management within a portfolio is as important now as ever. It is precisely why we have a full suite of investment strategies offering a defensive bias."--5/31/14 annual report.

"Anytime, but particularly now, Stadion avoids market prediction, favoring the science of processes designed to produce results over time versus in time since all markets inevitably move in cycles. Seven years of near uninterrupted favorable conditions tends to lead to the kind of 'recency' bias that favors emphasizing gain over protection through risk management. Our mission is to manage to market cycles via a full suite of investment strategies guided by a defensive bias. At Stadion we know the value of rising market gains is best assessed after the next market fall." -- 5/31/16 annual report.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)