Why Have Investors Bailed on Low-Volatility Funds?

A bout of underperformance seems to have led many to jump ship.

A version of this article was published in the July 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

In May 2016, I called attention to the fact that investors had apparently fallen head over heels for low- and minimum-volatility exchange-traded funds and that valuations for these funds had grown rather ripe:

"For the year to date, the top-ranked ETF by net new inflows is

iShares Edge MSCI Minimum Volatility USA ETF

USMV. The fund has vacuumed up $4.7 billion in net new investor capital during the first four months of the year. As more money has piled into this fund and others like it, valuations have richened commensurately. At current levels, newcomers to the low-volatility party could be setting themselves up for disappointing future returns.”

From the end of April 2016 through June 2017, USMV underperformed

Source: Morningstar Analysts.

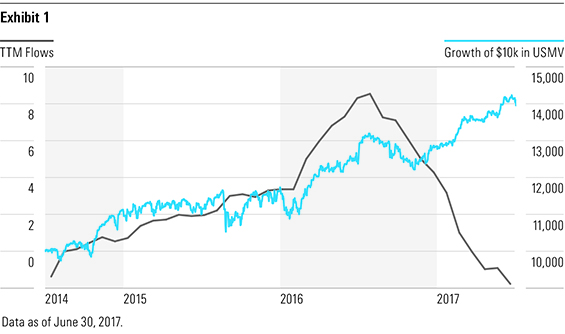

Apparently, some investors in these funds didn't get the memo. During the eight-month period spanning from August 2016 through March 2017, USMV and its chief rival,

It's awfully difficult to discern why so many turned sour on these funds. My best guess is their relative underperformance was the primary driver. For example, USMV lagged ITOT by nearly 7 percentage points during this span. But again, that is (in theory) what they signed up for.

The net result is another testament to the fact that we are our own worst enemies. From May 1, 2016, through June 30, 2017, USMV generated an annualized return of 12.61% for investors. Meanwhile, investors' collective cash-flow-weighted return was negative 0.63%. This yawning behavior gap shows there is ample room for improvement in the manner in which investors use these funds.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)