What’s the Best Way to Build a Multifactor Fund?

Integration versus isolation: Weighing the benefits of these two factor combination methods.

A version of this article was published in the March 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

First came single-factor exchange-traded funds. These funds targeted individual factors associated with attractive long-term risk-adjusted returns. While many have become comfortable with the underpinnings of factors like value and momentum and how investors try to harness them in practice, it can be difficult to understand how to combine individual factor funds. More recently, fund providers have launched a bevy of multifactor funds that offer investors prepackaged factor combinations. Why might an investor opt for a fund that fuses factors together on their behalf? Can this add value relative to a do-it-yourself approach to mixing single-factor funds? And what is the best approach to combining factors in a multifactor framework? I'll set out to answer these questions here.

The case for diversification extends to factor investing. "The Case for Multifactor ETFs" in the July 2016 issue of Morningstar ETFInvestor details the benefits of spreading one's factor bets. Individual factors can underperform their factor peers and the broader market for prolonged periods of time. Combining factors with low correlations to one another will yield a more stable risk/return proposition relative to owning any one factor-focused fund in isolation. This may also yield all-important behavioral benefits. A smoother ride may help investors to stay the course when a particular factor experiences a dry spell. But factor diversification is easier said than done. When it comes to selecting multifactor funds, there are several decisions to consider:

1) Which factors are in the mix?

2) How are the fund's factor exposures measured and constructed?

3) How are weightings assigned to each factor?

4) How are these factors combined?

Generally speaking, the largest multifactor ETFs set out to exploit well-documented factors and measure them using sensible inputs. Most of these funds' underlying indexes then either equal-weight their factor exposures or assign them static weightings. There are also a handful of multifactor ETFs in the works that will attempt to time their factor exposures. Once these factor building blocks are chosen, defined, and sized, the next step is to determine how to best combine them.

Shaken, Not Stirred When it comes to combining factors, there are two primary approaches: isolated (which may also be referred to as portfolio mixing or blending) and integrated (also referred to as factor signal blending). The isolated approach builds separate single-factor portfolios and combines them into one portfolio. For example, Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC uses an isolated approach to combining factors. Proponents of the isolated approach tout its transparency and lower tracking error compared with the broader market. Investors won't stray too far from a market-cap-weighted benchmark and can better assess each individual factor's performance contribution. A drawback of this approach is that it results in relatively muted factor exposures, which somewhat diminish their potential to outperform the broad market.

The integrated approach ranks stocks based on a composite score that combines all factor signals simultaneously. For example,

Because these funds have short live track records, it can be difficult to determine which method (isolated or integrated) results in an optimal combination of factor exposures. Also, most multifactor funds differ across a number of dimensions, not just in their approach to factor combination. For example, GSLC and LRGF don't target the exact same factors and don't measure their shared factors identically. LRGF targets the small size premium while GSLC does not, and GSLC includes the low-volatility factor while LRGF does not. These differences make it difficult to assess the true impact of taking either an isolated or integrated approach to combining factors.

Isolate or Integrate? The closest approximation of an apples-to-apples comparison for assessing the relative merit of each approach centers around LRGF's benchmark. LRGF tracks the MSCI USA Diversified Multiple-Factor Index (DMF). The index targets stocks based on their exposure to the value, size, quality, and momentum factors. The index integrates factor signals to select and assign weightings to its holdings. Although LRGF launched in April 2015, MSCI publishes historical values for the index dating back to December 1998. We also have available historical values for each of the four single-factor indexes that proxy the factors targeted by the multifactor index. Thus, we can construct a hypothetical portfolio that equal-weights the single-factor indexes and match DMF's rebalancing dates (end of May and November) as a proxy for a version of DMF that employs an isolated approach to combining factors.

While this is a cleaner comparison than a side-by-side of LRGF and GSLC, there are a few caveats. Most importantly, DMF uses an optimizer to construct its integrated portfolio while our proxy portfolio does not. The optimizer aims to maximize the index's factor tilts while matching the risk level of its parent index, the MSCI USA Index. Also, the optimizer layers on constraints. For example, it limits DMF's turnover and individual stock and sector tilts relative to its parent index. It also limits the index's exposure to nontargeted factors. Additionally, it is important to note that DMF measures three of the four factors it seeks to exploit in the same manner as the associated single-factor indexes that form our proxy portfolio. However, DMF and the MSCI USA Momentum Index measure momentum slightly differently. Specifically, the momentum index risk-adjusts stocks' momentum scores while DMF does not. With the caveats covered, let's look at the results.

Exhibit 1 shows performance statistics for the MSCI USA Diversified Multiple-Factor Index (integrated approach), our isolated version of that index, and the parent index (MSCI USA). Neither approach clearly separates itself based on risk-adjusted returns. The integrated approach provided modestly higher returns each year, but also had greater risk than the isolated approach. The integrated approach's Sharpe ratio was modestly higher than that of the hypothetical portfolio employing the isolated approach. But the isolated approach offered a better trade-off between active risk and return, as evidenced by its higher information ratio. The integrated approach offers higher returns but with greater risk. So, neither approach is clearly superior.

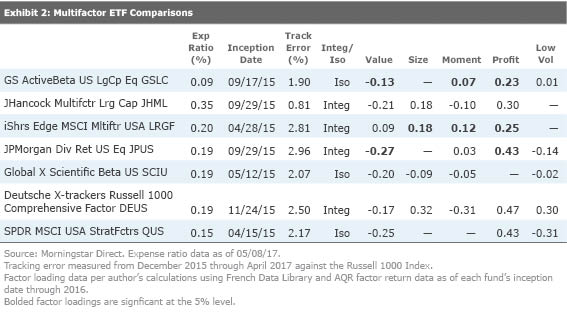

Let's now expand this analysis to the largest multifactor ETFs offering exposure to U.S. large caps. Using data from the French Data Library and AQR, I measured each ETF's factor loadings. Because each fund has a limited live track record, take these results with a grain of salt. I also included each fund's tracking error against the Russell 1000 Index since the earliest common inception date among the funds (December 2015). Exhibit 2 displays the results.

Over their (very) short lives, the multifactor ETFs employing an integrated approach to combining factors have experienced greater tracking error versus the Russell 1000 than those that use an isolated approach--with John Hancock Multifactor Large Cap JHML being a notable exception. JHML likely has lower tracking error relative to its peers because it includes more securities in its portfolio. Tracking error can be viewed as a proxy for these funds' potential to out- or underperform an appropriate benchmark. Given these funds' short live performance, it's difficult to assess their factor loadings. But a cursory review shows that integrated approaches typically demonstrate higher factor loadings and tracking error. The notable exception here is GSLC, which has shown significant loadings on the profitability and momentum factors over its short life.

Clearly, there it a lot to consider when selecting a multifactor fund. Deciding which factor combination approach--isolated or integrated--works best depends on what you want to accomplish. Consider an isolated portfolio approach if you favor transparency and lower tracking error, but know that you're forgoing more-pronounced factor tilts. For potentially stronger factor tilts and higher tracking error, consider a fund that uses an integrated approach. But remember that an integrated approach is usually more complex and opaque.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)