9 Small-Cap Stocks With Wide Moats

These high-quality small-cap firms may deserve a place on your watchlist.

The prospect of earning a premium for investing in small-cap companies is compelling. The so-called small-firm effect posits that companies with smaller market caps tend to outperform the market as a whole.

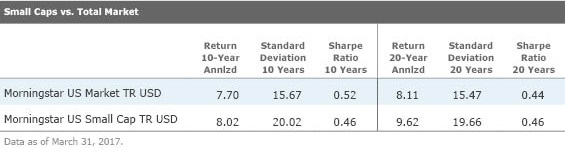

You can see from the index data that small caps have had a slight return advantage over the past 10- and 20-year periods; however, when that return is adjusted for risk (as measured by standard deviation) the advantage all but evaporates.

In 2015, AQR Capital released a study purporting that the key to harnessing small-cap outperformance could be to focus on quality firms. That study, titled "Size Matters, If You Control Your Junk", revealed that a significant size premium is evident if you exclude "junky" companies and focus on high-quality firms in the small-cap universe. This premium is "stable through time, robust to the specification, more consistent across seasons and markets, not concentrated in microcaps, robust to non-price based measures of size, and not captured by an illiquidity premium," the study's authors state.

So how do we define quality? My colleague Ben Johnson, director of global ETF research for Morningstar, explains that quality may be the "fuzziest" factor in the investing world, as there is no one agreed-upon definition for it, nor is there clear consensus that it is a true stand-alone factor. But, he says, common criteria that asset managers and index providers use to define quality stocks include consistent profitability, growth, and solid balance sheets.

The cornerstone of Morningstar equity analysis involves identifying economic moats, or structural barriers that protect companies from competition. The same qualities that imbue a company with an economic moat are synonymous with quality: We look for companies whose returns on invested capital are likely to exceed its weighted average cost of capital in the future. In addition, we also look for firms that appear to have at least one of the five sources of sustainable competitive advantage (intangible assets, cost advantage, switching costs, network effect, or efficient scale).

It's difficult to identify smaller-cap firms that exhibit moat-worthy characteristics. Strong and enduring competitive advantages are promising for any company, but they are particularly attractive for smaller companies with long growth runways, as they have the ability to compound shareholders' capital at high rates of return over long periods of time.

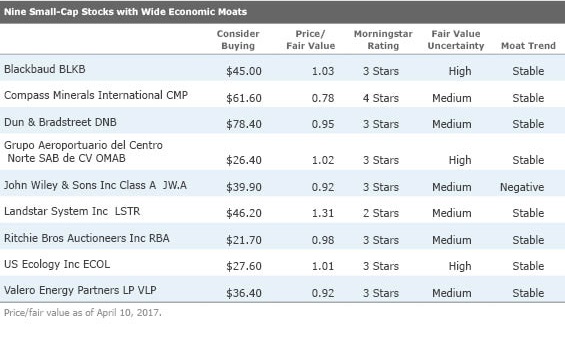

We have identified nine small-cap firms with wide economic moats, meaning that we think they have advantages that will allow them fend off competitors and remain profitable for at least 20 years.

Note that with the exception of

If a few of the stocks pique your interest, save them in a watch list. Our Portfolio Manager tool makes it very easy to set one up: Just click here, select "New Watch List" under the "Create" tab, enter the tickers, name your watch list, save, and you're done. (The share number, purchase price, and commission fields can be left blank.) You can customize your watch list alerts to tell you about price swings or, if you're a Premium Member, you can be alerted whenever a new fair value estimate or Stock Analyst Report is published.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)