Picking the Right Unconstrained Bond Fund Matters

Here are four Morningstar Medalists to consider for a supporting role in your portfolio.

Non-traditional-bond funds, also called "unconstrained" bond funds, are often touted as a hedge against rising rates. This is because these funds typically have a wide berth when it comes to duration positioning. Importantly, the funds can take a negative (or short) duration position.

Last summer, my colleagues analyzed the non-traditional-bond Morningstar Category and noted that while the funds largely did perform better than the average intermediate-term bond fund when interest rates rose, they also exhibited a greater correlation to risky assets, including equities and high-yield bonds. So, in large part, these funds have traded interest-rate risk for credit risk. This is an interesting observation and an important reminder when considering the role that these funds might play in your portfolio. A non-traditional-bond fund is almost certainly not a substitute for a more traditional core bond fund. It could, however, play a smaller role in an investor's overall bond allocation when the risks are considered carefully (including how much of a portfolio is already allocated to high-yield bonds and other credit-sensitive fare).

It's also important to note that just because the funds "on average" do a reasonable job of protecting against rising rates, the array of strategies employed by these funds means that the range of outcomes can be vast. Take the most recent period of rising rates, which is measured by an increase in the 10-year Treasury yield of more than 50 basis points. This happened between Nov. 4, 2016, and Dec. 16, 2016, when the 10-year rose 81 basis points. During this period, the average non-traditional-bond fund gained 0.22% compared with a loss of 3.40% for the Bloomberg Barclays U.S. Aggregate Bond Index and a loss of 2.90% for the average intermediate-term bond fund. That seems like a reasonable win for these funds, albeit over a short period, but looking at individual returns within the category is a reminder that all funds are not created equal.

Digging a bit deeper into the performance of unique funds in the category (using the oldest share class) during the period shows a wide range of returns. While the average non-traditional-bond fund gained 0.22%, the range between the top and bottom deciles was 250 basis points. This compared with the average intermediate-term bond fund's return of negative 2.90%, with a range between top and bottom deciles of 130 basis points. What's more, more than 40% of non-traditional-bond funds logged flat or negative returns during the period. This is especially surprising given the rally in credit and other risk assets last year (which continued in November and December) and given the typically large (sometimes over 50%) allocation to corporate bonds, including hefty allocations to junk-rated bonds, found in many of these funds. For comparison, the average high-yield bond fund gained 1.50%, and nearly every fund posted positive returns during the aforementioned period.

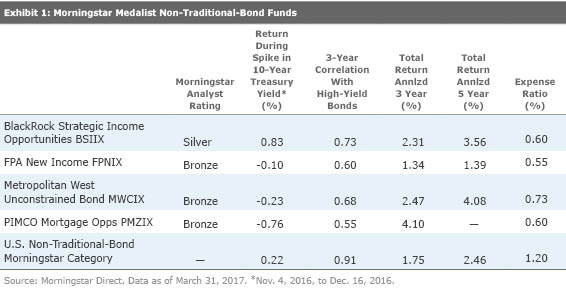

Non-traditional-bond funds have been billed as many things, and the wide variety of strategies makes this a difficult group to analyze and understand. Even harder is knowing how these funds fit in a portfolio. Because of the generally large degree of credit risk and typically high correlation with high-yield bonds, there is little to recommend these types of funds as a core holding. And given the dispersion of returns, picking the right fund makes all the difference. Only four non-traditional-bond funds rated by Morningstar Research Services earn medals, as shown in the table below.

Bronze-rated

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)