Dividend Stocks Court Rate Risk

High-dividend-paying stocks tend to be more sensitive to interest rates than their lower-yielding counterparts, but not for the reason you might think.

Rising interest rates can clearly hurt investment returns. As rates rise, the expected returns for all securities must increase to stay competitive, which often requires prices to fall.

While it is more difficult to estimate the interest-rate sensitivity for stocks than bonds because their cash flows aren't fixed, some stocks clearly have greater interest-rate risk than others. For example, high-dividend-paying stocks have tended to be more sensitive to interest-rate fluctuations than their lower-yielding counterparts.

It may be intuitive to surmise that this is because investors pile into higher-yielding stocks when interest rates fall to make up for lost income and move that money back into fixed-income assets when rates rise. But a closer look suggests that differences in cash flow volatility can better explain this relationship.

High-dividend-paying stocks have historically underperformed their lower-yielding and non-dividend-paying counterparts when interest rates were rising. The opposite has been true when rates were falling or constant. To uncover that relationship, I looked at return data from the French Data Library for non-dividend-paying stocks and dividend-paying stocks representing the 30% with the lowest yields, the middle 40%, and the 30% with the highest yields from May 1953 through December 2016. I ranked the monthly changes in the yield on the 10-year Treasury note and defined the quartile of months with the biggest jump in yields as periods of rising interest rates. The bottom quartile represents a falling-rate environment, while the middle 50% represents a constant rate environment. I then looked at how each of the four dividend portfolios performed in those three interest-rate environments. The table below shows the annualized returns for each portfolio.

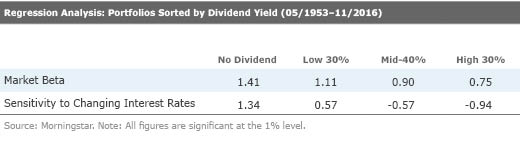

I also ran a regression analysis on these portfolios' excess returns using the market risk premium and changes in the 10-year Treasury yield as explanatory variables. This approach allows us to control for fluctuations in the market and isolate how changing interest rates affect the performance of each portfolio. The coefficients from these regressions, presented in the table below, indicate how sensitive each portfolio is to both changes in the market and interest rates. A positive number indicates that the performance of the portfolio moves in the same direction as the corresponding variable, while a negative number indicates an inverse relationship. For example, a market beta of 1 indicates that the portfolio increases 1% for each 1% increase in the value of the market. These results corroborate the findings above. Interestingly, non-dividend-paying stocks and low-yielding stocks tend to move in the same direction as interest rates (holding the market constant), while higher-yielding stocks tend to move in the opposite direction.

To interpret these results, it is important to realize interest rates don't change in a vacuum. They tend to rise when the economy is strengthening and fall when it is weakening. Companies that are less sensitive to the business cycle tend to have less cash flow growth during economic expansions to offset the negative impact of rising rates on their prices (so they underperform). But they tend to hold up better during economic downturns when rates usually fall.

Dividend-paying stocks tend to have more-stable cash flows than their non-dividend-paying counterparts (their lower market betas support this) for two reasons. First, these are generally more mature firms. Second, these companies wouldn't commit to regular dividend payments if they weren't confident in their ability to honor them throughout the business cycle. Consequently, their cash flows tend to be less sensitive to the health of the economy and interest rates than non-dividend-paying stocks'. With less cash flow growth to offset the negative effect of rising interest rates, high-yielding stocks behave more like bonds than do their stingy peers and are more likely to suffer when rates rise. But their stable cash flow also works to their advantage when rates fall.

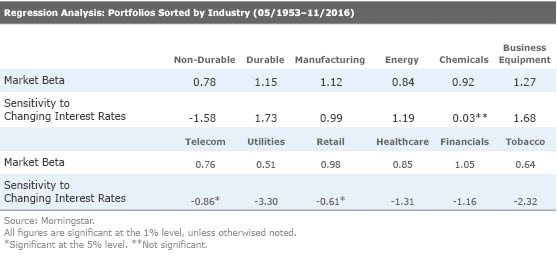

If this explanation is accurate, more-defensive sectors should underperform in a rising-rate environment and outperform in a falling-rate environment. That's exactly the pattern the data show. I ran the same regression as described above on several industry groups from the French Data Library from May 1953 through November 2016. The table below illustrates the results.

The healthcare, tobacco, non-durable, telecom, financials, and utilities stocks moved in the opposite direction of interest rates. Demand for healthcare, tobacco, telecom, and utilities is noncyclical. Many non-durable goods also experience relatively stable demand compared with purchases of durable goods, which consumers can more easily defer. Utilities were clearly the biggest losers when interest rates rose. This is because regulators often limit the prices they can charge and only adjust these rates with a lag after rising interest rates have eroded utilities' profitability. Unlike these defensive sectors, financial stocks' cash flows are closely tied to interest rates, but in contrast to other cyclical sectors, their cash flows may decline as rates rise. The cyclical durable goods, manufacturing, business equipment, and energy sectors tended to move in the same direction as interest rates.

I also ran this analysis on the S&P 500 sector indexes, from October 1989 through November 2016. The results from this sample are consistent with my findings for the longer period, though fewer of the relationships were significant. The defensive healthcare, utilities, and consumer defensive sectors tended to underperform as rates rose and outperform as rates fell. The cyclical tech and materials sectors followed the opposite pattern. This evidence suggests that stocks whose cash flows are more sensitive to the strength of the economy tend to outperform in a rising-rate environment and underperform in a falling-rate environment.

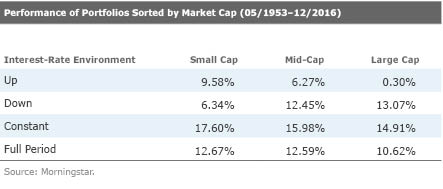

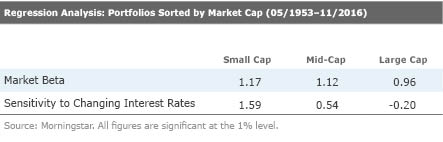

That might explain why small-cap stocks were historically less sensitive to changing interest rates than their large-cap counterparts. The table below illustrates how small-, mid-, and large-cap stocks performed during periods of rising, falling, and constant interest rates, assuming perfect timing of each of those environments. Small caps fared better than their larger peers when rates were rising but underperformed as rates fell. The results of the regression analysis support these findings and suggest that small-cap stocks even move in the same direction as interest rates, while rising rates tend to hurt large-cap stocks. That makes sense because small-cap stocks tend to be more highly leveraged to the fortunes of the domestic economy than their larger counterparts. Interest rates tend to rise as the economy strengthens, which probably disproportionately helps small caps. They are also less well positioned to weather recessions than larger-cap stocks, which may explain why they tend to underperform as rates fall.

But just because you can reduce interest-rate risk by shifting away from dividend-paying stocks, defensive sectors, and large caps doesn't mean you should. These tend to represent quality companies that exhibit less volatility over the full market cycle. Low-volatility strategies might also underperform in a rising-rate environment because their cash flows don't rise as much as their peers' during economic expansions, providing a smaller offsetting effect to cushion the blow of rising interest rates. Yet, just as high-dividend-paying stocks have historically outperformed their non-dividend-paying counterparts, low-volatility stocks have historically offered better risk-adjusted returns over the full market cycle. Investors who load up on volatile, non-dividend-paying stocks may reduce short-term pain while interest rates rise but end up with disappointing long-term performance.

Moderation is a better approach. If you are concerned about rising rates, it may be worth considering paring back on high-dividend strategies, though it certainly isn't advisable to avoid dividend-paying stocks altogether. Nor is it necessary to flee from low-volatility strategies. However, if you own

A version of this article was previously published on Aug. 28, 2013.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)