Be Mindful of Rich Valuations in Low-Volatility Stocks

If history is any guide, investors should expect future returns to be muted at best.

The article was published in the May 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

For the year to date, the top-ranked equity exchange-traded fund by net new inflows is

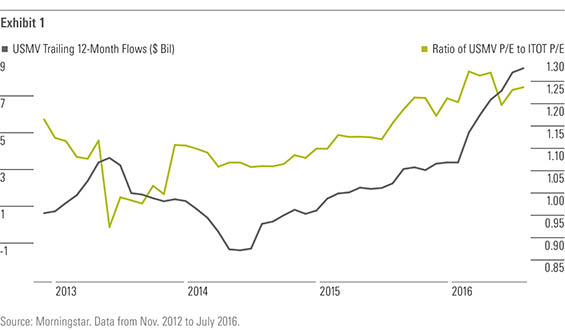

In Exhibit 1, I’ve plotted trailing-12-month flows into USMV on the left-hand vertical axis. As you can see, flows have been generally positive since USMV’s late-2011 inception. More recently, they’ve spiked higher. On the right vertical axis, I’ve plotted the ratio of USMV’s trailing-12-month P/E ratio to

Clearly, USMV has been getting relatively rich versus ITOT since the second half of 2013. The ratio of the two funds’ P/E ratios was 0.97 as of the end of August 2013--the last time it was below 1. As of the end of July, the ratio stood at 1.24. USMV’s valuation has also gotten richer in absolute terms. At the end of August 2013, the fund’s trailing-12-month P/E was 17.05. As of the end of July, it had expanded to 23.97.

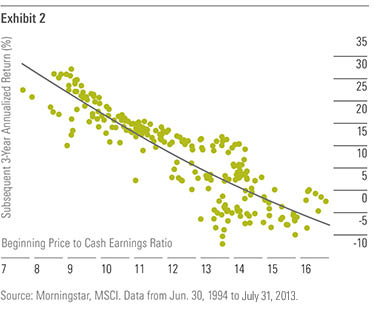

What does this mean for future returns? If history is any guide, investors should expect them to be muted at best. Exhibit 2 shows the historical relationship between the beginning value of the MSCI USA Minimum Volatility Index’s price/cash earnings ratio and subsequent three-year annualized returns. The pattern is clear: The richer the beginning valuation, the lower the ensuing return. As of the end of July, the index’s price/cash earnings ratio was 15.4--its highest-ever level. (Note that the index was launched on June 2, 2008. Here I am referencing a data set that includes back-tested data that begins in June 1994.) Dating back to June 1994, the index has managed to eke out marginally positive returns at best from current valuation levels and, more often than not, has wound up declining in value during the following three-year period.

While low-volatility strategies may very well offer superior long-term risk-adjusted (note that I did not say absolute) returns relative to a broad, market-capitalization-weighted index--valuations matter. These strategies' popularity may have pushed valuations to levels where it will take a long time for this proposition to pan out.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)