Harley's Commitment to Wide Moat a Plus for Investors

Outreach and international expansion stand to bolster the company's brand intangible asset.

Despite the heightened competition resulting from a foreign exchange differential that has benefited its overseas peers, we think

We expect faster growth from Harley's focus on domestic outreach and penetration of international markets, which are key to market share gains and higher unit sales, helping close the gap from baby boomers aging out of the customer base. When headwinds dissipate over the next few years, we think Harley's top position in the U.S. heavyweight motorcycle market will be apparent and the tilt to consumer-led product development will support our demand forecast. Average unit growth of 3% and price increases of 2% over the next decade should lead to normalized EBIT margins that are higher than forecast 2016 levels, expanding 230 basis points to 19.2% over the next decade, helped primarily by the leverage of selling, general, and administrative expenses. Rising operating profitability will improve returns on invested capital, which we expect to rise to more than 26% over the next five years.

Brand Intangible Asset Intact, and Trend Remains Stable Harley-Davidson's brand intangible asset remains the basis of our wide economic moat rating. While the cost structure has contracted materially over the past six years, the brand is what allows Harley to maintain premium pricing on its units and create underlying demand thanks to the Americana that the business represents. This has yet to be replicated on a broad scale by any domestic competitors. Further, we believe that the aspirational nature of the product and the subsequent pricing power have evaded international competitors, as product differentiation is generally lacking in lower-priced models where these firms compete.

We contend that much of Harley's success has been predicated on a symbiotic relationship with the company's dealer network, which has been trimmed in recent years to reduce dealers that were underperforming and could have had less incentive to protect the perception of the Harley brand intangible asset. This implies that the remaining dealer base includes only those that are selling units at a reasonable clip and generating consistent profits at the retail level, creating a steady income stream for those franchisees. These successful dealers are probably the ones that will remain the most engaged with the brand, protect Harley's aspirational positioning, and ultimately ensure that the product is perceived properly by end users.

Additionally, we believe retailers' willingness to stock units of any brand is contingent on the ability to stock inventory closer to demand, the support of compelling floorplan financing programs, and the original-equipment manufacturers' ability to facilitate strategic incentives and rebates to drive incremental sales when necessary. Harley is the only operator in our powersports coverage list with a dedicated network of its own. This relationship has been elevated in recent years with better inventory-management systems, helped by internal financing arm HDFS, which finances more than half of domestic bike sales. A small new entrant or a player that uses a shared distribution network would probably face difficulties in replicating this symbiotic relationship; ultimately, these competitors would be unable to coddle dealers the same way Harley-Davidson can.

The brand does not carry enough weight to hold prices and share at all points of the economic cycle, though. In 2015, Japanese competitors used the foreign exchange differential to dump units on the U.S. market at lower local prices, while benefiting from the strong U.S. dollar and euro conversion into the yen-reported income statement and balance sheet. This resulted in Harley losing some share in the U.S. and European markets, leaving in question the ability of the brand to support higher pricing independent of economic cycles, particularly when foreign exchange rates are volatile.

However, we think that Harley is unlikely to continue to cede share, despite some cyclical and secular headwinds as the heavyweight motorcycle behemoth attempts to return to peak shipment levels by growing into new demographic and geographic arenas. Factors that we have assessed include changes in the competitive environment and consumer preferences, which could provide some temporary headwinds, as well as the potential of domestic outreach consumers and opportunity for international growth, which could offer promising tailwinds that we believe outweigh the aforementioned headwinds.

We don't think that either unit sales or operating margin growth is over for Harley in future periods, but customer acquisition will need to be smarter and product development will have to be increasingly dynamic to drive sales growth. Innovating tailored products that cater to evolving demand to entice outreach without alienating core consumers will be difficult but necessary to incite excitement around new model years and stimulate demand from consumers outside of the core rider.

Over the past 15 years, the company has experienced two other share loss cycles. In both cases, share losses were recovered within two years. In 2001, Harley's market share declined to 45% from 49% in 1999 and revisited the 49% share rate again by 2003. Its domestic market share remained around 49% until 2008, when market share fell to 42% over the course of one year. This was reversed in 2009, when Harley's domestic market share bumped back up to 50%, surpassing previous levels. In 2008, the company was a victim of the U.S. recession, and we suspect that consumers demanded more value from their products, putting the importance of brand on the back burner temporarily. Globally, this led to consumers seeking out lower-priced bikes, probably with smaller displacements, which was a market segment Harley wasn't participating in. We think the company's past success in not only recovering to prior market share levels but surpassing previous market share peaks speaks to the staying power of the brand and consumers' willingness to spend on a product they perceive well, despite temporary periods of price sensitivity.

We believe protecting the brand premium is the proper strategy to ensure that Harley's product positioning remains intact over the long term, and intangible asset brand strength will support the wide moat rating. Harley has clearly held a high perception in the market, pricing touring and cruising bikes at the high end of peer levels while still increasing volume: For model year 2015, Harley's touring bikes were priced at a 9% premium on average to the nearest competitor, and cruisers were priced in line with the nearest peer, by our calculation.

During 2015, in response to competitive pressures, the company lowered its full-year shipment guidance in April and then again in October. These reductions were undertaken in order to help Harley ship in correspondence to retail demand, which should limit dealers' excess inventory at retail and prevent unnecessary discounting to clear stale inventory, which could jeopardize premium brand positioning. In 2016, shipments are set to rise only modestly (1%-3%) in order to avoid flooding the market with units that cannot sustain price increases.

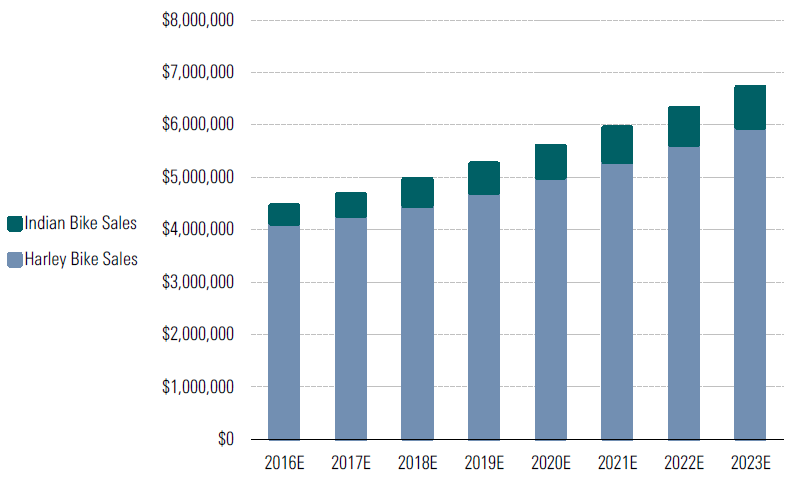

Resurrection of Indian Provides Iconic American Heritage Alternative Outside of market share degradation from foreign exchange uncertainty, which is largely out of Harley's control, the other factors we view as most threatening to Harley's brand position are the competitive landscape and changing demographic preferences. Polaris' resurrection of the Indian brand has given U.S. loyalists another choice in the domestic heavyweight bike market. Indian has long been the only domestically produced motorcycle competitor to Harley in the United States. Over the past 100-plus years and under several owners, Indian's brand building occurred in fits and starts. The lack of consistency in the product line and quality alienated both existing and potential consumers, driving Indian sales down to $11 million in the year before Polaris' 2011 acquisition. However, having started in 1901, Indian remains the oldest American manufacturer of motorcycles (Harley began in 1903). It could take some time for Polaris to assure riders that the brand is truly here to stay and that quality had been reformed. But we think the brand and quality awareness surrounding Polaris products has given confidence to potential riders that this Indian owner is not likely to fail or walk away from the brand the way many other small manufacturers did, potentially leading to a more intense competitive landscape.

Furthermore, we suspect that Polaris' dedication to the heritage of the brand has shone through in the styling, and the company has made efforts to prevent alienating its core customer. This allowed Polaris to ramp Indian shipments up significantly in 2014 and 2015. If the Indian brand can grow above 20% year on year through 2018, it would help Polaris reach its prior goal of $375 million in revenue at the Indian brand between 2018 and 2020.

Polaris' market share in motorcycles remains low relative to Harley. Even with Harley-Davidson's unit shipments declining 1% in 2015, the company still shipped more than $4 billion in bikes, or roughly 266,000 units. If we assume that Polaris generates around $250 million in Indian revenue, at an equal or slightly lower average price than Harley, this could represent around 16,000 units shipped for the Indian brand. While this doesn't materially chip away at Harley's market share (if we assume at least some of Indian's share is stolen from Harley but some has been taken from other competitors as well), we think it's still important to consider, since there was little domestic competition before 2014.

We anticipate that Indian will execute a slow share grab from Harley and other players over the next few years. If Indian can compete away another 10% of Harley's unit volume, or around 25,000 units, it can capture an incremental $400 million in sales, assuming the average prices of bikes grows at a low-single-digit pace. Even if we assume that Indian's growth slows to a high-single-digit or low-double-digit rate for the five years after 2018, this could represent around $750 million in revenue versus Harley's bike sales forecast of about $6 billion in 2023, indicating that the 10% share shift has probably occurred.

Even With Slower Long-Term Growth, Indian Begins to Represent a Bigger Part of Domestic Mix

$ in 000s. Source: Morningstar estimates.

Furthermore, while we believe autocycle products like BRP's DOO Spyder and Polaris' Slingshot cater to a different customer, we still see the possibility of incremental unit loss from riders who are willing to try a new product rather than a traditional heavyweight motorcycle. In Slingshot's first year, the brand shipped more than 5,000 units for roughly $125 million in sales during 2015. At launch, Polaris believed Slingshot could represent a $300 million-$500 million opportunity, which implies a significant share of the $1 billion three-wheel motorcycle market.

Spyder's 100,000th unit was assembled and sold in May 2015, implying an average of 12,500 units shipped per year since inception. While this share steal is smaller than what we expect for Indian over time, it's another competitor potentially chipping away at Harley's leadership position in the motorcycle market. Harley has indicated that some share loss was attributable to products like autocycles being added into the total market, artificially lowering its share leadership position in recent periods. If Polaris sold all of the Slingshot units it shipped to retail (let's use 5,000 hypothetically), it would probably have represented a 100-basis-point downshift in share during 2015, constituting one third of Harley's total 330-basis-point share loss for the year.

We think Harley can combat this category proliferation via its long-standing relationship with its consumers, which has offered the company the ability to learn about changing demands. This has permitted Harley to read trends more quickly as they occur, leading to the creation of updated models that resonate with consumer preferences faster, including with bikes not yet launched out of the electric Project LiveWire initiative. While these changes have been more visible domestically, we believe some newer product lines have better positioned Harley to defend itself in international markets, ensuring that it can capture unit growth.

Disparate Preferences Across Demographics a Concern We think shifting consumer preferences could provide some headwind to Harley, particularly with younger consumers; capital constraints and evolving preferences of millennials could lead to demand drivers that are different than in the past. Millennials are set to fill the shoes of the baby boomers in number and potentially in spending scale as the boomers age out of the motorcycle market. If all demographics were created equal, we would have no problem believing that millennials could fill the gap that the core consumers are likely to leave behind in their wake. But millennials as a group tend to be plagued by capital constraints that boomers have avoided, including crippling levels of student loan debt, stagnant wage growth over the past decade, and rising rent and healthcare costs. This cuts into the percentage of income that can be spent on discretionary items, making the relevance of Harley's brand more difficult to convey to consumers.

The Institute for College Access and Success estimates that nearly 70% of students who graduated from public and nonprofit colleges in 2014 had student loan debt, up from 65% a decade ago. The average amount of debt each borrower had was $28,950, up 56% from a decade ago and rising more than double the rate of inflation over this time. We think debt service has captured an increasing percentage of potential discretionary income from millennials, ultimately restraining purchases of big-ticket items like homes and motorcycles, at least temporarily. This, along with faster housing and medical expense growth and little wage inflation, could be a meaningful headwind in millennials' adoption of high-priced discretionary goods, and a portion of future Harley riders could be lost forever. However, we believe that some of these purchases are probably just delayed, and as millennials strengthen their personal balance sheets, they could begin to purchase units more quickly.

Additionally, it's been noted extensively that millennials prefer to spend on experiences rather than material goods, making it even harder to fill the core consumer decline gap. We believe this could crimp Harley's ability to facilitate aggressive sales to these consumers. Success could be largely contingent on Harley connecting the dots for new customers between its bikes and the experience those bikes can provide. Resistance to product acquisition could persist, since millennials could have multiple real-life experiences for the price of one Harley, but we think demand could be swayed by understanding the value proposition--considering that owning a Harley could provide some of the experiences being sought by this cohort--as well as some of the more relevant product launches (including the Street and Rushmore in recent periods) catering to this cohort.

The urbanization of the U.S. consumer--as nonmetro populations shrink while metro populations rise modestly--bodes well for smaller bikes. We believe Harley's Street models cater well to these consumers, although the willingness to spend will ultimately decide who wins share in these urban markets. The Harley brand still carries an aspirational status, but the pricing on a Yamaha or Kawasaki could be compelling enough to capture new urban riders, who may be more hesitant to spend as much to capture the experience they are seeking out. We think Harley's customer-led initiative to identify and cater to evolving consumer trends will help ward off competitive threats, as the company will be able to respond to current consumers' demand in a more timely fashion, allowing it to capture incremental share of the heavyweight market over the next few years.

We think Harley has tried to remain relevant to millennials, so as these consumers' earnings power rises, the brand will remain front of mind. Besides customer-led product launches, Harley has more actively engaged in community outreach to its underpenetrated youth, women, and minority categories to build wider awareness of the brand and the products offered. Harley has also attempted to boost its brand relevance by participating with millennials in their preferred generational avenues, including direct marketing through the digital channel. Taking these types of steps could help Harley keep interest until the earning power of the millennial cohort catches up to its long-term potential, helping boost long-term unit sales potential as the cycle turns.

International Strategy Could Determine Whether Unit Growth Revs or Stalls We see offsetting tailwinds to our aforementioned concerns in the still-abundant potential of outreach consumers domestically and relatively underpenetrated international consumers. As U.S. unit growth has slowed, international retail sales have become a more important part of closing the gap in demand, rising to 39% of total bike shipments in 2015 from 33% on average over the prior decade at Harley and representing about 104,000 units in the most recent year. But while Harley might be a key player in the global heavyweight market, capturing 10% share in Europe and top-three share in Mexico and Brazil, it still sells significantly fewer units than some of its sport-bike-producing peers, like Yamaha, which sold 5.8 million bikes (across all engine displacements) versus Harley's 268,000 in total in 2014.

Yamaha cited the entire motorcycle market (all displacements, including mopeds at 50 cc and below) at more than 55 million units in its fiscal 2014 annual report. We believe to truly drive volume in many international markets around the globe, the only option is to offer lower-displacement products, which tend to be more affordable to those moving into the middle class. We doubt the first bike that constituents in these markets would try would be a Harley, given its premium pricing, and we don't believe Harley is attempting to compete in the entire marketplace, only the higher-displacement, aspirational segment. Sticking to this strategy stands to protect Harley's brand intangible asset and could prove lucrative, as it supports rising prices for its units.

With Harley holding its premium brand positioning firm as the cyclical environment rotates out of its current state to improving growth, the manufacturer stands to benefit from the resumption of rising unit demand. While Harley isn't likely be the share leader in most or all overseas markets because of its premium pricing, we still see broad promise for revenue and operating margins if the global economic environment stabilizes.

With international shipments of about 104,000 in 2015, moderate demand growth can be impactful on both the top line and operating margin. In fact, if international unit shipments rise just 4% on average over the next five years, overseas unit growth will rise more than 20% in total over that time frame, allowing Harley to gain operating efficiency in the distribution channel while building wider brand awareness in underpenetrated markets.

We think three factors can support this growth internationally. First, the story in Latin America is not over. While Brazil, previously a promising market for Harley, has fallen from strength, Mexico has become an increasingly promising end channel, delivering GDP growth of 2.9% on average over the past four years, with another 2.9% average annual growth projected over the next four years, according to the World Bank (retail sales of Harley-Davidson bikes in Latin America during 2015 were 11,173 and could rise to 12,526 over the next four years if unit sales rise in tandem with Mexico's economic growth ahead, assuming Brazil demand remains stable at current levels). The continued growth of household consumption expenditures in Mexico indicates to us that the willingness to spend on durable goods, like motorcycles, has had support, and that in tandem with GDP growth, demand should not wane. Over the past decade, as a percentage of GDP, this metric has been between 66.2% and 68.5%, showing stability in consumer spending trends in Mexico.

Second, the easing of regulation in China (which currently represents less than 1% of unit sales) over time could offer meaningful support to Harley's brand-building in the region. Motorcycles are still banned or their usage is severely restricted in many cities, and a finite number of plates are allowed to be issued in order to control traffic. Additionally, the legal requirement that customers scrap their motorcycle after 13 years, independent of pollution production, has tempered demand. Harley's diligent work with local authorities will be a slow and laborious process in the acceptance of bikes in cities, which should eventually pay dividends for the company as more cities allow motorcycles back on their roads.

If any of the aforementioned regulations are repealed or reformed, it offers Harley the ability to tap into the wealthy consumer in China. Boston Consulting Group has estimated that the number of millionaires in China at the end of 2014 topped 4 million. If Harley can capture even 1% of those 4 million wealthy consumers, it would offer an incremental 40,000 in unit sales, up from nearly negligible sales now.

And finally, while market share in Europe has surpassed 10% over the past six years, we believe customer-led initiatives, which have led to the production of lower-priced and smaller-framed bikes, could be perceived as more suitable to European consumers. In the past, European consumers have preferred lower-displacement bikes--nearly half of the bikes registered in the United Kingdom in recent years were under 500 cc, with Germany and France exhibiting similar preferences. However, with new lower-priced and smaller-chassis models like the Street, Harley has a better chance of tapping into the European option set and becoming a more relevant player, in our view. Over the past decade, European sales of Harley grew from 33,000 units to 40,000 units before falling back to 38,000 in 2015, despite an economic recession, a competitive environment, and a fragmented manufacturing set. If new product styling and positioning could allow Harley to steal moderate market share and grow to just the 12% share from 10.5% in 2015 (and 12% on average over the previous five years), it would offer the company an incremental 13,000 in unit sales.

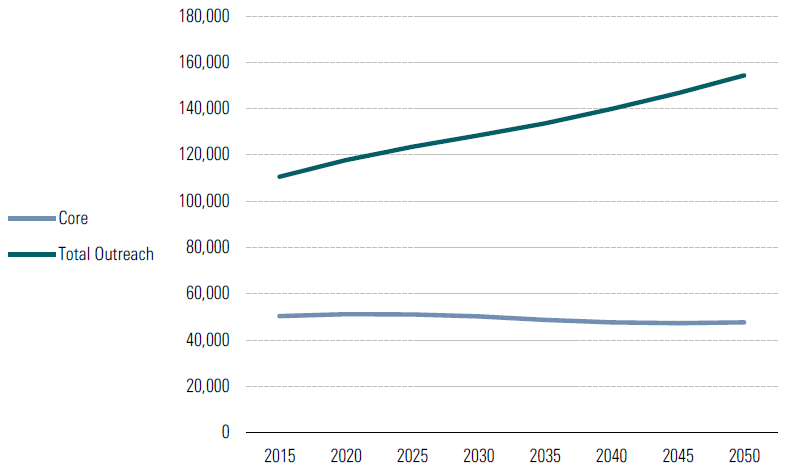

Potential of Outreach Consumer Promising for Unit Volume Growth For Harley, the outreach market segment was nearly untouched five years ago but has come to represent 35%-40% of domestic sales; in 2015 this represented approximately 60,000 domestic units sold. More important, these consumers are more likely to be new Harley riders rather than existing brand loyalists, providing a lifetime of new replacement bike buyers. Our conservatism regarding the potential of this market segment is due to bike replacement rates, as young adults could replace bikes at a slower rate--with a focus on experiences rather than things, the incremental sale on a future unit will have to be facilitated by a product that is differentiated and can enhance the experience-obtaining preference. However, even if outreach consumers replace every 10 years, at an average age of 36 years, this could lead to incremental replacement units three additional times before motorcyclists age out of the market. This could equate to as many as 180,000 units that would have not been sold without a focus on outreach over the next three decades (60,000 outreach units replaced three times, every 10 years). While no average replacement cycle data is offered by Harley, we think Harley bikes should easily survive for 10 years, since owners generally take care of high-ticket items well, but compelling new models ultimately drive new sales, and major overhauls in the lineup occur more frequently than once per decade, stimulating replacement demand.

However, we believe there could be a difference between the initial adoption rate and the replacement cycle for these groups. We suspect the initial acquisition phase could be higher than in the past on a unit basis, but the replacement cycle could be lower if the product is used less frequently or more sparsely than prior generations. That said, outreach unit sales should still continue to grow faster than core over the next decade, as demand from Caucasian males between 35 and 74 should slow with tepid population growth in the category, while the population in other outreach segments grows robustly, supporting overall unit growth and domestic brand relevance.

We believe management understands that it is imperative to focus on new opportunities and product preferences to strengthen the brand, as domestic outreach can stave off share losses from the phase-out in demand of the sizable baby boomer generation. While the number of core riders (Caucasian men 35-74) in the aggregate is set to decline over the next 35 years, outreach is set to rise nearly 40%, in our estimation, with the Hispanic population between ages 35-74 rising more than 100%. Tapping into these consumers as they move up through income demographics should provide some support to unit sales ahead.

Outreach Population Set to Grow About 40% Between 2015 and 2050

Source: U.S. Census

Additionally, we believe the product lineup will change in tandem with new demographic consumer demand. We expect Harley's research and development team will remain diligent in catering to evolving trends; the launch of the Street model in 2014 has been a testament to the firm's willingness to think outside the box and to do so without hurting the brand or alienating the core rider contingency. Upon the Street product launch in 2014, the shipment mix from the Sportster/Street category jumped by 9,900, and the segment as a percentage of total unit sales now represents more than 23%, up from just 19% in 2013, at the expense of the custom segment. The success of the lower-priced products will weigh on average selling prices over the next few years until segment proportion stabilizes, but they should be equally profitable, with lower input costs associated with these models than some of the higher-priced products. The awareness of new trends that can drive unit sales, like urbanization or the preference for smaller chassis, could continue to tap into new markets that were previously unreachable, bringing new lifetime riders to the brand.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)