Investors Reap the Gains of Target-Date Funds

Asset managers do all right, too.

Morningstar's newly released annual study of the target-date-fund landscape shows the funds to be among the most effectively used investments in the fund industry. Investors' success with target-date funds refracts most brilliantly through the lens of the funds' Morningstar Investor Returns. Those returns take into account cash inflows and outflows to measure an investor's actual experience with a fund. They often differ from--and lag--funds' published total returns because investors tend to mistime their investments, pumping cash into funds after markets rise and pulling money out after they fall. (For the past few years, my colleague Russ Kinnel has looked at this discrepancy in returns across major investment categories in his "Mind the Gap" studies.)

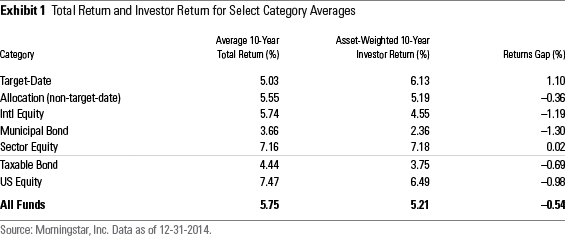

By the end of 2014, more than 10 target-date series had amassed a decade or more of investor-return history, making for an opportune moment to take a closer look at how investors have fared with the funds. The news is good: Target-date funds' annualized asset-weighted investor return during the last 10 years through December 2014 stood at 6.1%, 1.1 percentage points greater than the category's 5.0% gain. In contrast, as shown in Exhibit 1, most broad investment categories, such as U.S. equity, international equity, and taxable bond, had negative investor-return gaps.

Target-date investors have collectively reaped all of target-date funds' gains, and then some. That's largely due to the discipline inherent in regularly setting aside a portion of each paycheck into retirement savings accounts--the predominant means of investing in these funds. Instead of stopping their contributions or even redeeming out of funds, investors benefited from steadily adding to their accounts through all parts of the market cycle, including 2009 and 2011's market troughs.

Target-Date Funds Vital to Fund Companies Asset managers have benefited from those regular savings flows into target-date funds as well. True, the years of consistent double-digit organic growth have passed, but target-date funds have nevertheless become crucial sources of new assets for their firms. Target-date-originated flows accounted for about one third of overall flows to the firms concerned in 2014.

They made up an even bigger chunk of flows to active funds. Within the investment industry in general, actively managed mutual funds have experienced modest (and often negative) net new flows for more than a decade. Many firms that rely primarily on actively managed strategies would have been in net outflows last year absent target-date-originated inflows. Without the more-than $7 billion infusion from its target-date offerings, for instance, American Funds would not have been able to break its six continuous years of firm-level outflows (American saw an overall $345 million gain in mutual fund assets in 2014). Target-date flows similarly buoyed

In fact, out of the roughly 40 firms offering target-date mutual funds, only seven saw net outflows from those funds in 2014. Fidelity led that group in absolute terms, seeing about $7.7 billion in outflows (representing about 4% of its target-date funds' asset base) last year. Its flagship Fidelity Freedom series has struggled for multiple years to distinguish itself from peers, and retirement plan sponsors' increasing reluctance to automatically choose or stay with their record-keepers' proprietary offerings has exacerbated the situation. As a result, in July 2014, the firm ceded its 16-year reign as the largest target-date mutual provider to Vanguard. Together with T. Rowe Price, the three fund companies account for more than two thirds of target-date mutual fund assets.

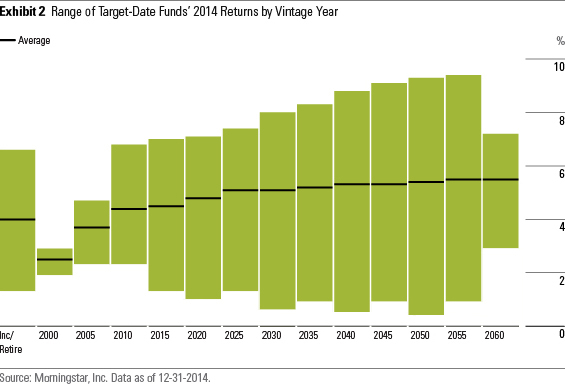

Varying Approaches Led to Surprises in 2014 Among these broad trends, it's still important to recognize that target-date funds aren't homogenous; 2014 offered another reminder of that. To illustrate, Exhibit 2 lays out the average 2014 return of each target-date vintage, as well as the range of returns.

Given last year's rally in U.S. stocks and bonds, the fact that every target-date vintage and fund notched positive returns was not unexpected. Moreover, given that U.S. stocks beat bonds, it makes sense that more equity-heavy target-date series, such as the longer-dated vintages, would post higher returns than nearer-dated vintages, explaining the upward slope of the average returns shown in Exhibit 2.

What might surprise some investors, however, is that the differences weren't starker. Consider that U.S. stocks, as represented by the S&P 500, rose 13.7% last year, or more than double the Barclays U.S. Aggregate Bond Index's 6.0% return. Yet, the average 2050 target-date fund, which had a roughly 90% equity stake at the end of 2014, delivered only about 1 percentage point over the average 2015 fund, which had close to a 40% stock stake. Even more unusual, a number of series saw their funds with shorter-dated vintages outpace their longer-date counterparts, a pattern more often associated with periods of market stress, such as 2008 and 2011. Target-date series' widely varying approaches to international equities and fixed-income subasset classes drove much of the variation in performance not only last year but also over longer periods.

This year's target-date paper, the seventh installment of a series that started in 2009, as well additional target-date fund-related articles coming this week and next, delves into more of the factors and nuances behind some of those surprising results. Knowing each series' quirks and placing them in the context of the broader target-date fund landscape can help investors set expectations in a more informed way. As target-date funds cement their place as the retirement vehicle of choice for American workers, that insight should prove especially helpful in ensuring that savers continue to reap the full rewards of investing for the long haul.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)