Credit Market Outlook: Demand Rises for Higher-Yielding U.S. Dollar-Denominated Debt

Considering the historically low interest rates on sovereign bonds in developed markets, corporate bonds should perform well on a relative basis.

- Historically low interest rates in Europe spur demand for higher-yielding U.S. dollar-denominated debt

- Slow but steady economic growth should support corporate credit returns

- Long-term interest rates unlikely to rise rapidly

The ECB's long-awaited quantitative easing program finally began in early March. Yields on sovereign debt across Europe have steadily fallen since the beginning of 2015, which we attribute to speculative buying of debt in anticipation of flipping the bonds to the European Central Bank for a profit.

In many developed markets, shorter-dated bonds are trading with a negative yield. For example, Germany recently sold 5-year Bunds at a yield of (0.08)%. While the German 5-year has traded in the secondary market at a negative yield before, this was the first time bonds were issued with a negative yield. This means that investors are locking in a guaranteed loss if they hold the bonds until maturity, which we think only makes economic sense if an investor is expecting a significant deflationary event that would decimate other asset values across the world. Otherwise, the only way for an investor to make money on these bonds is to sell them to another investor at a price that locks in an even greater loss. In this case, speculators are expecting to be able to sell the bonds to the ECB, which has stated that it would buy debt trading at a negative yield.

As the ECB began its QE program, interest rates across Europe hit all-time lows. The yield on the German 10-year Bund had dropped as low as 0.20%, the 10-year French OAT as low as 0.48%, and even the lower-rated peripheral eurozone countries such as Italy and Spain have declined to unprecedented levels of 1.13% and 1.14%, respectively. Investors looking to reduce their exposure to the plummeting euro are willing to lock in negative interest rates in Swiss bonds whose 10-year traded at a negative yield of (0.09)%. There is reportedly over EUR 1.5 trillion of euro-area government bonds that are currently trading at negative yields. Most of these bonds are issued from the core European governments with maturities of up to seven years. Among other developed markets, Japanese 10-year government bonds don't provide much additional yield either, as they currently yield only 0.40%.

Considering the historically low interest rates on sovereign bonds in developed markets, we think corporate bonds should perform well on a relative basis. The proceeds from the ECB's purchases of sovereign debt and asset-backed securities will need to be reinvested somewhere, and the path of least resistance will be the corporate bond market. This demand is likely to drive corporate credit spreads tighter. As corporate credit spreads in Europe contract, we think it will pull credit spreads tighter in the United States as well.

Over the past year, the differential in yield between the Morningstar Corporate Bond Index and the Morningstar Eurobond Corporate Index has doubled. Currently the average yield of our U.S. corporate bond index is 3.01% as compared with our European corporate bond index at 0.79%. Even after adjusting for the longer duration of the U.S. index, investors are picking up significantly more yield in the United States.

In addition to the higher yield, the purchasing power of assets invested in U.S. dollar-denominated bonds has greatly appreciated as the U.S. dollar has risen 14% versus the euro since the beginning of the year. Demand for high-quality U.S. corporate bonds has also reportedly been coming from Asian investors as the Bank of Japan continues to weaken the yen with its own asset purchase plan. Among those global fixed-income investors that can purchase debt denominated across multiple currencies, the higher all-in yields and the rising value of U.S. dollar have driven up demand for U.S. corporate bonds.

Although high-yield fund flows were negative for the two weeks ended March 18, there had been a remarkably strong amount of cash flowing into the sector. Prior to this reversal in flows, the cumulative amount of inflows over the preceding six weeks marked the greatest amount of new funds flowing into high-yield open and closed-end mutual funds since the 2008/09 credit crisis.

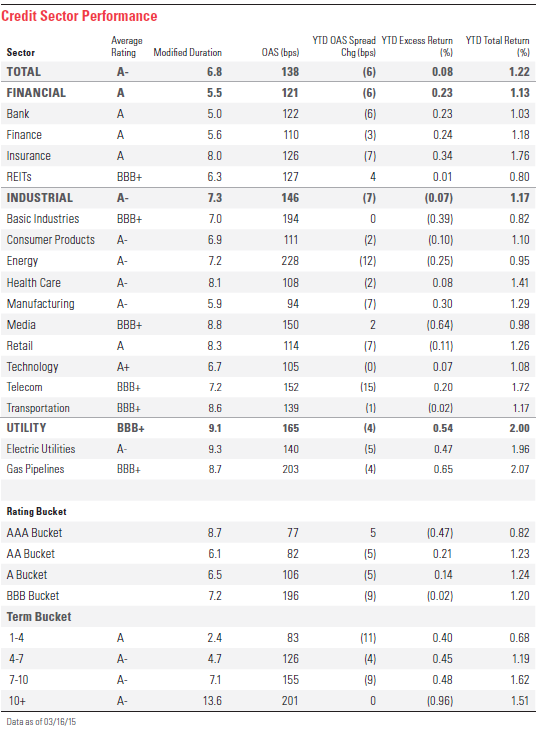

Slow but Steady Economic Growth Will Support Corporate Credit Returns Last quarter, we opined that credit spreads were at the wide end of the range that we thought was fair value and that high-yield bonds would outperform investment-grade. Year-to-date through March 16, the total return of Morningstar Corporate Bond Index is 1.22%, whereas the total return of the Bank America Merrill Lynch High Yield Master II Index is 1.93%. Since the end of last year, investment-grade credit spreads have tightened 5 basis points to +135 while high yield spreads have tightened 32 basis points to +472.

We continue to expect the high-yield market to outperform investment-grade for the remainder of the year. Based on our expectation that GDP growth in 2015 will range between 2.0% and 2.5%, macroeconomic fundamentals in the United States should be generally supportive of credit risk and dampen defaults through the rest of the year. The combination of modest economic growth and low interest rates should keep default rates from rising meaningfully this year.

While we don't expect long-term interest rates to spike higher in the short term, we continue to think that interest rates will rise once the Fed begins to normalize monetary policy and yields approach historical norms relative to inflation, inflation expectations, and the shape of the yield curve. With their shorter duration, high-yield bonds are less correlated to movements in interest rates.

In our view, the greatest risk to bondholders will continue to be idiosyncratic risk leading to credit rating downgrades, as opposed to macroeconomic risk. However, global events that would precipitate a general widening in credit spreads include the recessionary environment in the euro area, which could presage sovereign debt and banking concerns. There are also the risks of rapid deceleration of economic growth in China and the other emerging markets--which would pressure countries reliant on commodity exports--or financial dislocations stemming from Japan as the yen has depreciated significantly over the past six months.

Long-Term Interest Rates Unlikely to Rise Rapidly Long-term interest rates in the United States declined in January and early February on global economic fears that drove the flight-to-safety trade. However, over the past month, interest rates have begun to rise anew as investors price in a higher probability that the Fed will begin to raise short-term rates this year. We continue to think that interest rates should migrate slowly back toward historical norms given current inflation, inflation expectations, and the shape of the yield curve. However, we think there are numerous exogenous factors, including actions taken by other central banks, that may cap the amount interest rates will rise in 2015.

The employment market has continued to heal and payrolls expanded by 295,000 in February. With unemployment dropping to 5.5%, the unemployment rate is now at the upper end of the Fed's longer-run estimate of central tendency for unemployment. We expect real GDP growth in 2015 for the United States will continue to expand at a 2.0%-2.5% pace as the decline in oil prices should provide a tailwind for consumer spending by the second half of the year to help spur economic growth. Personal consumption expenditures, or PCEs (reportedly the Fed's preferred measure of inflation) have dropped precipitously in recent months. That drop will reverse as oil prices stabilize. Excluding the impact of declining oil prices from the headline consumer price index and producer price index, year-over-year inflation continues to run between 1.0% and 1.6%.

As such, we think it is becoming increasingly more difficult for the Fed to justify keeping short-term rates at zero percent. The original intent for the zero-interest-rate policy was to be an emergency measure to support the entire financial system in December 2008 when then economy was in a free-fall, and that this policy would only be kept in place during the financial crisis and would normalize soon thereafter. With declining unemployment and modestly positive economic growth, we expect this backdrop will be sufficient to encourage the Fed to begin raising short-term rates by the middle of 2015. As short-term rates adjust upward to incorporate rising Fed funds rates, we think the normalized rate for 10-year Treasuries is between 3.0% and 3.5%.

However, we also recognize that several exogenous factors are playing a role in making U.S. Treasury bonds increasingly attractive to foreign investors. The outlook for European growth remains moribund while sovereign interest rates in the eurozone have fallen to record lows because of the ECB's EUR 1.1 trillion sovereign debt purchase program. In fact, with German 10-year bonds as low as 0.20%, the yield is below even that of Japanese interest rates that heretofore had perennially been the lowest among the developed markets. Meanwhile, for foreign investors, U.S. Treasuries are providing both a pickup in yield as well as offering relative safety from further depreciation in foreign exchange rates as many global central banks attempt to weaken their own currencies in relation to the U.S. dollar.

Among the emerging markets, China's economic growth continues to decelerate. Its GDP growth is running at the slowest pace in the past five years as the country suffers through a weakening real estate market and a deteriorating manufacturing sector due to slowing exports. Chinese officials have reduced their expected economic growth rate for 2015 and are forecasting GDP growth this year of around 7.0%. In the medium term, we expect growth is likely to slip even further.

More Quarter-End Insights

- Stock Market Outlook: Proceed With Caution

- Economic Outlook: More Slow Growth but Labor Scarcity

- Basic Materials: China Will Keep a Lid on Most Commodities

- Consumer Cyclical Investors: Shop Carefully in 2015

- Consumer Defensive: Attractive Companies, Top-Shelf Valuations

- Energy: Coping With Lower Oil and Gas Prices

- Financial Services: Bank Worries Are Overdone

- Health Care: 3 Picks in a More Expensive Sector

- Industrials: A Few Bargains Still Remaining

- Real Estate: REITs That Can Weather a Rising Rate Environment

- Tech and Telecom Sectors: Time to Be Selective

- Utilities: Bloody February Brings Valuations Back In Line

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)