Ultimate Stock-Pickers' Top 10 Buys and Sells

We see opportunity within the consumer cyclical sector.

For the past nine years, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through the Ultimate Stock-Pickers' purchasing activity during the first quarter of 2019. The piece itself was an early read on the purchases—focused on high-conviction and new-money buys—that were made during the period, based on the holdings of almost all our top managers. Although our slowest-reporting manager has not disclosed their holdings yet, we still think it is appropriate to look at the conviction purchases and sales. As stock prices have changed since our Ultimate Stock-Pickers chose to purchase or sell the holding in the first quarter, we urge investors to analyze a security at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors make these decisions.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this long-standing trend may be more indicative of capital flowing into passive products than our managers taking a more bearish stance. Despite the net selling, our Ultimate Stock-Pickers still made several high conviction purchases as well as sales.

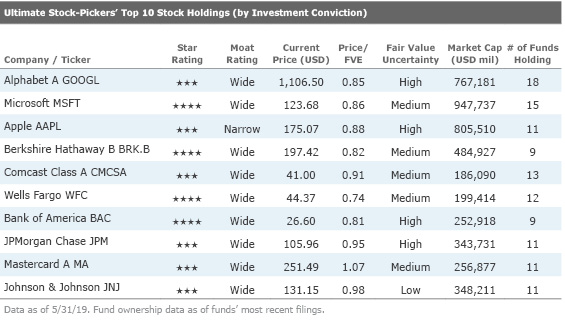

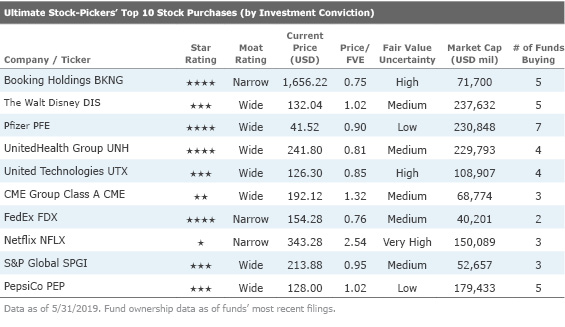

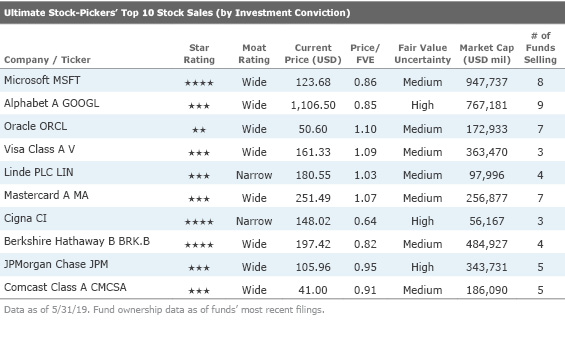

The thing that stood out on all three of our top 10 lists is that our Ultimate Stock-Pickers continued to buy, sell, and hold high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have an economic moat and that nine of the 10 conviction holdings have a wide economic moat. Additionally, all the companies composing the top 10 conviction purchases list and the top 10 conviction sales list have also been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, the aggregate weightings of our Ultimate Stock-Pickers are somewhat more in line with the S&P 500 than they were last quarter. The Ultimate Stock-Pickers used to be meaningfully overweight in the technology sector as well as meaningfully underweight in real estate and healthcare but are now within 100 basis points of the S&P 500 for each of these sectors. The Ultimate Stock-Pickers remain meaningfully overweight industrials, financial services, and basic materials and remain meaningfully underweight in the utilities, energy, and consumer cyclical sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings remained similar to the last period's composition. We did notice two additions to the list this quarter.

Ultimate Stock-Pickers' Top 10 Stock Holdings (by Investment Conviction)

The Markel Corporation made a new-money purchase into wide-moat rated Wells Fargo this quarter, which makes the stock a holding in 12 of our 26 Ultimate Stock-Pickers portfolios. The stock also constitutes almost 10% of the equity portfolio of Berkshire Hathaway. Though Berkshire sold some of its Wells Fargo shares this quarter, Morningstar analyst Gregg Warren (who covers Berkshire Hathaway) noted that the insurer trimmed its stake so that it would not own more than 10% of the outstanding shares, which would invite additional regulatory scrutiny. Although Wells Fargo is struggling to overcome various scandals involving its retail sales practices, Warren Buffett continues to be positive on Wells Fargo's overall competitive dynamics, noting in a recent interview with the Financial Times:

If you look at Wells, through this whole thing they're uncovering a whole lot of problems, but they aren't losing any customers to speak of. They are losing the ones in the public sector . . . but one household out of every three does business with Wells one way or another.

These comments are in line with Morningstar analyst Eric Compton's research on Wells Fargo. Compton notes that despite years of negative headlines related to scandals, Wells Fargo remains one of the top deposit gatherers in the United States, with the number-one or -two share in over 40% of the roughly 430 metropolitan statistical areas that it operates in and arguably has the best branch network in the United States. Compton believes the bank still has an attractive lineup of business units and a core group of loyal, longtime customers. He supports this with evidence of limited account closures, particularly since the initial spike during the worst of its sales problems, which demonstrates that the majority of customers are willing to stick with the bank. Though Compton recognizes that there are issues at the bank that run deep, with potentially years of additional work still outstanding, he points out that Wells easily out-earned its cost of equity for decades and continues to do so today.

To Compton, three major challenges face Wells Fargo today: getting its legal expenses under control, getting the asset cap removed, and returning back to offense on the organic growth front. Recent evidence on expenses is mixed. While operating losses shrank to their lowest levels in a year and the company reiterated its 2019 total expense guidance, management did admit that it needs to outperform on the original cost-saving expectations to make up for more than $1 billion in extra regulatory expenses this year and noted that its 2020 expense guidance is no longer official. Second, though it is tough to say exactly when the asset cap will get lifted, management recently stated that the asset cap will continue until 2020 at a minimum and Wells Fargo recently received additional negative public comments from regulators.

Compton also points out that investors should appreciate that reforming Wells Fargo has been and will continue to be a massive undertaking and therefore is not an easy process. This includes changing a culture that has been in place for decades and reworking internal risk and compliance controls, which has involved the hiring of thousands of extra employees, the creation of new committees, and reworking and creating new internal processes to satisfy regulators. While progress has seemed slow and sometimes disappointing, management has not been completely idle, and the bank is making progress. This is a key risk with Wells—if it takes several more years for the bank to turn itself around, any excess return that can be had at today's prices would then be stretched out over those years, which may not be very compelling for certain investors. As such, Compton believes the stock is cheap—but not amazingly cheap as it trades within 4-star territory—and investors need to understand they may be signing up for a turnaround that could take years longer to complete.

Ultimate Stock-Pickers' Top 10 Stock Purchases (by Investment Conviction)

As we previously mentioned, our Ultimate Stock-Pickers' Top 10 Conviction Stock Purchases list was entirely composed of names that have been given moats by Morningstar Equity analysts. We found that our Stock-Pickers focused a good chunk of their buying activity into the consumer cyclical sector this quarter, possibly taking advantage of the depressed prices for cyclical stocks early in the first quarter. We have recently covered several of the undervalued names on the conviction purchases list in the previous edition of Ultimate Stock-Pickers. The only name that we have not examined recently is wide-moat rated

The largest detractor to performance was Pfizer (PFE), a diversified, global biopharmaceutical company. For its most recent quarter, the company noted continued progress in its transition of its drug pipeline and ultimately anticipates more sustained revenue growth beginning in late 2020. Despite the less than favorable reaction in the stock price, we continue to believe the investment thesis for the company is solid and that its position in the Fund is warranted.

Biopharmaceutical company Pfizer, Inc. underperformed after the company reported mixed quarterly results. Pfizer has seen improved productivity from its pipeline in recent years, and that should continue this year with potential new approvals and several readouts of late-stage results on the oncology side. The new CEO has remained disciplined with capital deployment, which we believe is another key aspect of long-term return profile for the stock.

This analysis is in line with Morningstar analyst Damien Conover's research on the drug maker. Conover maintains that Pfizer's shares are undervalued and believes that the investment community is likely not appreciating Pfizer's strong pipeline and is confident enough in Pfizer's story to give the company a wide moat and a low uncertainty rating.

Conover sees patents, economies of scale, and a powerful distribution network as the source of the company's competitive advantage. Conover notes that Pfizer’s patent-protected drugs carry strong pricing power and that the patents give the company time to develop the next generation of drugs before generic competition arises. Conover is also positive on Pfizer's ability to continue leveraging its substantial financial resources into research power. He remarks that after many years of struggling to bring out important new drugs, Pfizer is now launching several potential blockbusters in cancer, heart disease, and immunology. Finally, Conover thinks the company's powerful distribution network sets up the company as a strong partner for smaller drug companies that lack Pfizer’s resources.

Though Conover recognizes there are near-term challenges, specifically the loss of patent protection of its nerve pain medication, Lyrica, he anticipates that Pfizer's operations can withstand the upcoming generic competition. He particularly likes Pfizer's strong position in the vaccine industry because vaccines tend to be more resistant to generic competition due to the manufacturing complexity and relatively lower prices of vaccines. Conover also recognizes that the company is through the worst of its patent cliff and is well positioned to launch new drugs.

Ultimate Stock-Pickers' Top 10 Stock Sales (by Investment Conviction)

The Top 10 Ultimate Stock-Pickers conviction sales list is a familiar list of standbys in the Ultimate Stock-Picker's portfolios. As has been the case in many prior periods, many of the conviction sales are also conviction holdings. This quarter six of the 10 conviction sales stocks were present on the conviction holdings list, which leads us to believe that many of the conviction sales were profit-taking on what remain high-conviction stories. Much of the selling activity came from the technology and financial services sectors, which contributed three and four names to the conviction sales list, respectively. From a valuation perspective, the greatest disagreement between our research and the Ultimate Stock-Pickers' sales was narrow-moat rated

Though one of the Ultimate Stock-Pickers trimmed its position, Morningstar analyst Jake Strole thinks that there is value to be found in Cigna. He notes that the company's shares look attractive at current prices, but given Cigna's ongoing integration of Express Scripts and the loss of Anthem's pharmacy benefits business, he emphasizes his high uncertainty rating for the name.

Strole thinks Cigna's story over the past decade has been one of ever-increasing emphasis on its healthcare operations while de-emphasizing its other less moatworthy insurance businesses. Strole sees the culmination of this strategy in the company's $65 billion merger with Express Scripts in late 2018, which gave it a leadership presence in U.S. pharmacy benefits management. Though Strole expects the transaction to help Cigna win more business by combining its benefits offerings while improving the stickiness of its relationships, he understands that mergers of this magnitude do not come without risks to shareholders.

On the positive side, Strole sees substantial synergies between Cigna and Express Scripts’ businesses, primarily through improved selling capacity and improved cost advantages. Specifically, he anticipates that Cigna will be able to cross-sell Express Scripts’ leading pharmacy benefit manager business with the company's existing health insurance business, which he expects will deepen the strength of its customer relationships. Second, he sees the combination of a pharmacy benefit manager, which consolidates purchasing power to obtain discounts from drug providers with a health insurance business as sensible because the firm's combined benefits offering will likely reduce total benefit expenses for its members, thus strengthening the cost advantage. Strole points to more integrated competitors, such as

On the negative side, Strole sees risk stemming from spending $65 billion to acquire a politically sensitive target, and that Express Scripts will lose its largest customer,

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Burkett Huey has an ownership interest in Berkshire Hathaway. Eric Compton has no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)