The 2021 Proxy Voting Season in 7 Charts

Support for environment and social proposals hits new heights.

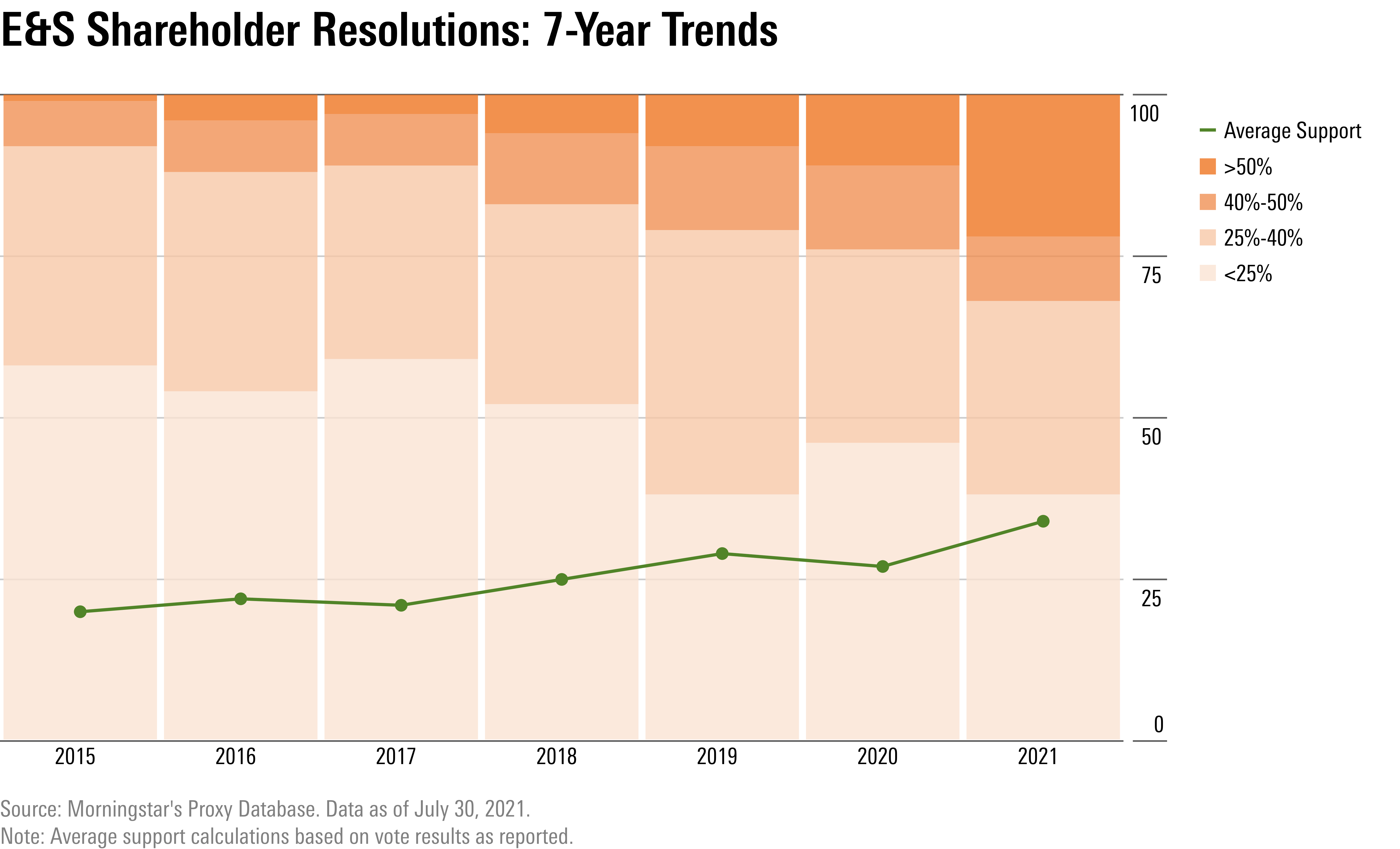

Investor support for environmental and social (or E&S) ballot proposals has reached new heights in 2021, capping years of incremental gains. At the same time, key votes on pay practices and board governance point to a changing dynamic between shareholders and corporate management.

An important lever for changing corporate behavior is the corporate proxy ballot, where shareholders propose resolutions aimed at improving disclosures and changing company behaviors. These votes aren’t binding, but they carry significant weight when backed by a majority of shareholders.

Just a few years ago, it was relatively rare for shareholders to vote against company management on corporate ballot issues, especially among the largest mutual fund companies who cast votes on behalf of investors in their funds. Now, as companies find themselves losing a record number of votes, environmental, social, and governance advocates have a stronger hand when it comes to direct engagement with company managements over policies they are seeking to change.

Here are some of the highlights from 2021 proxy season. Morningstar Direct Clients can view the full report here.

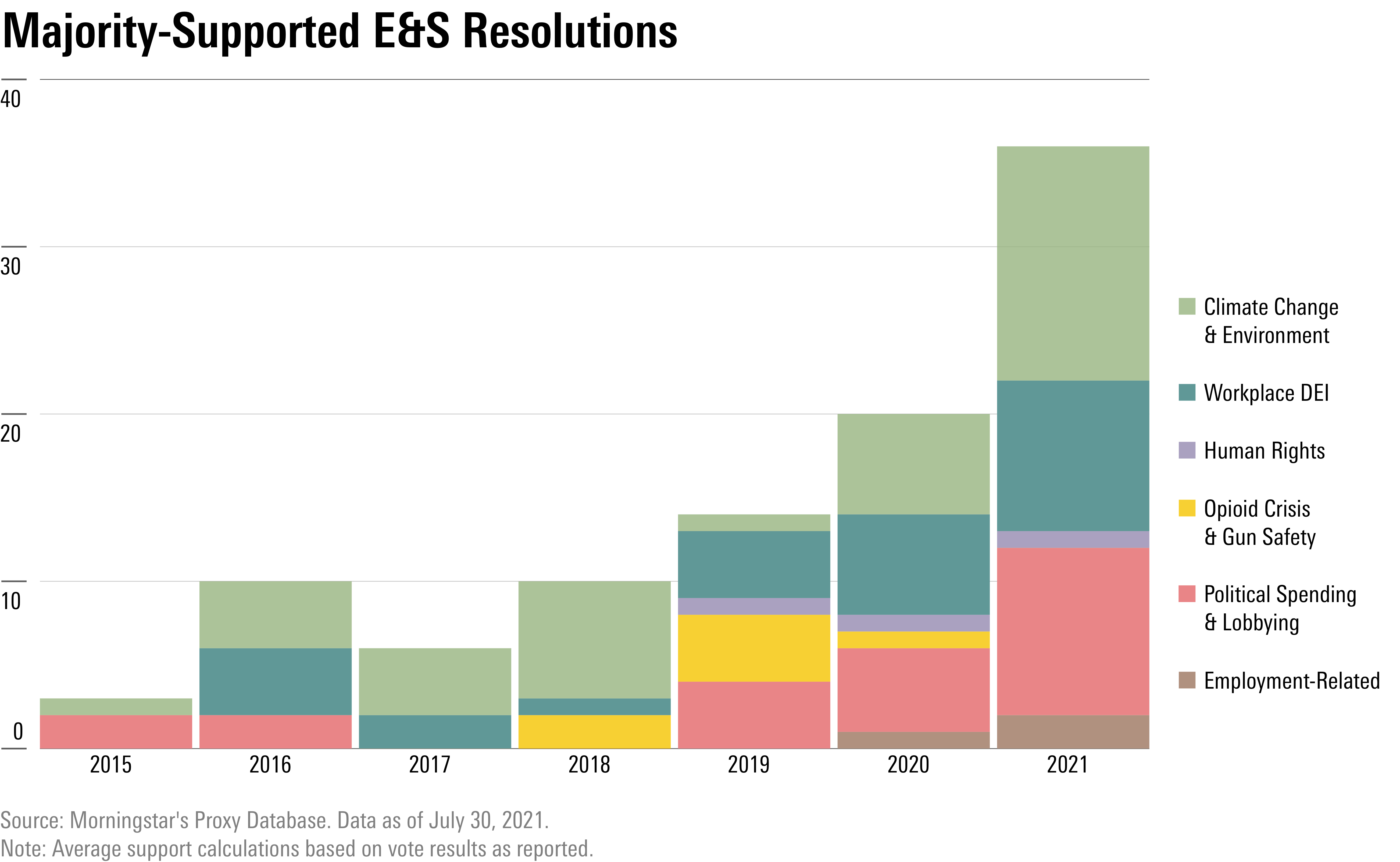

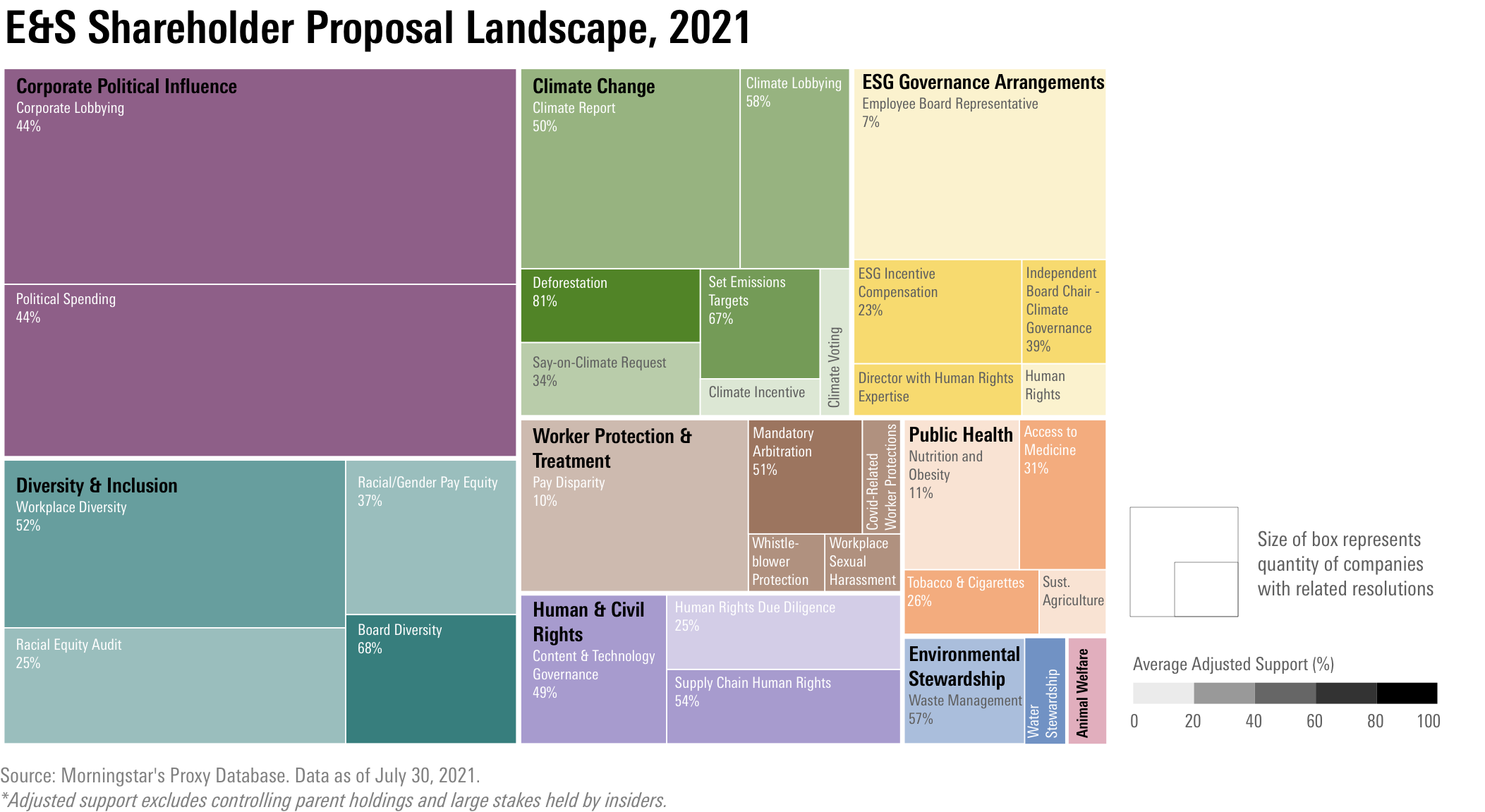

- Average support for E&S shareholder resolutions rose to a record 34% in the period from July 1, 2020, through June 30, 2021. A record 36 resolutions passed with majority support.

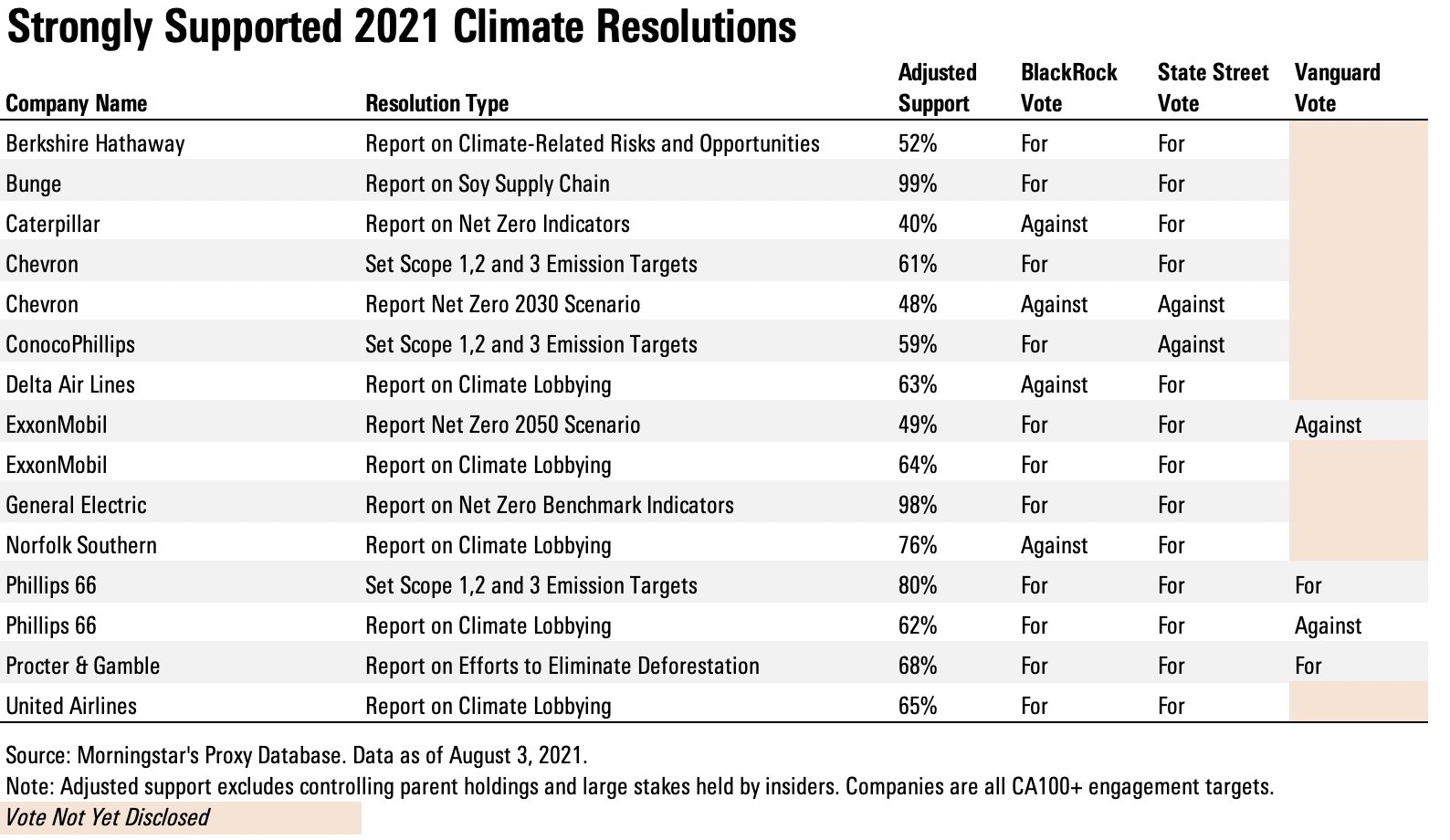

- The 26 climate-related resolutions saw average support rise to 51%, with 14 earning majority support. Average support for 34 diversity, equity, and inclusion resolutions was 43%, with nine passing.

- More 'for' votes from BlackRock and Vanguard may have substantially contributed to the rise in overall support--early disclosures indicate that their support for E&S issues is higher in 2021 than previous years.

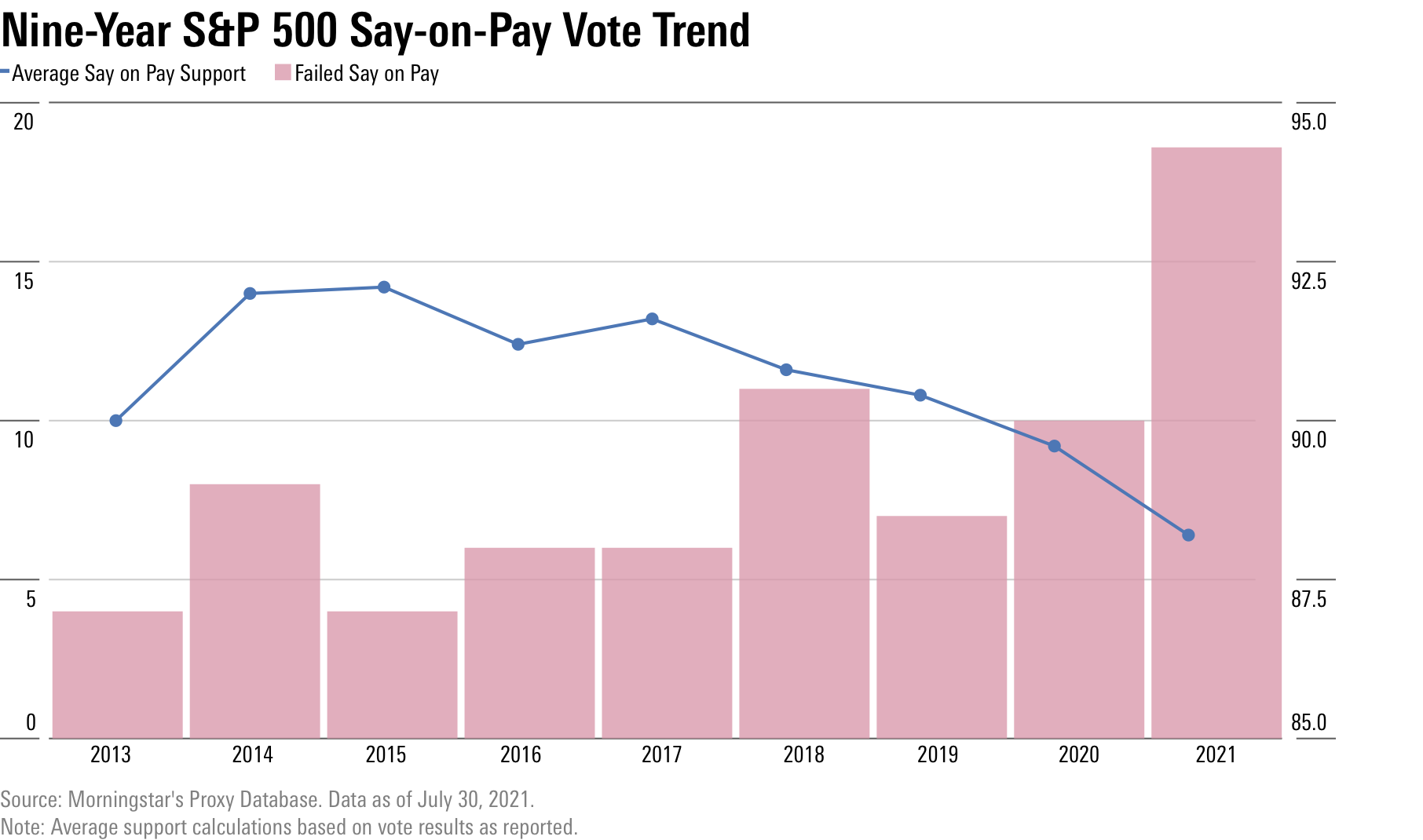

- CEO compensation came under more pressure in 2021, with average support for S&P 500 say-on-pay proposals from company management dropping to 88.3%. This marked a record low level of support for executive pay packages in these advisory votes, accelerating the four-year decline.

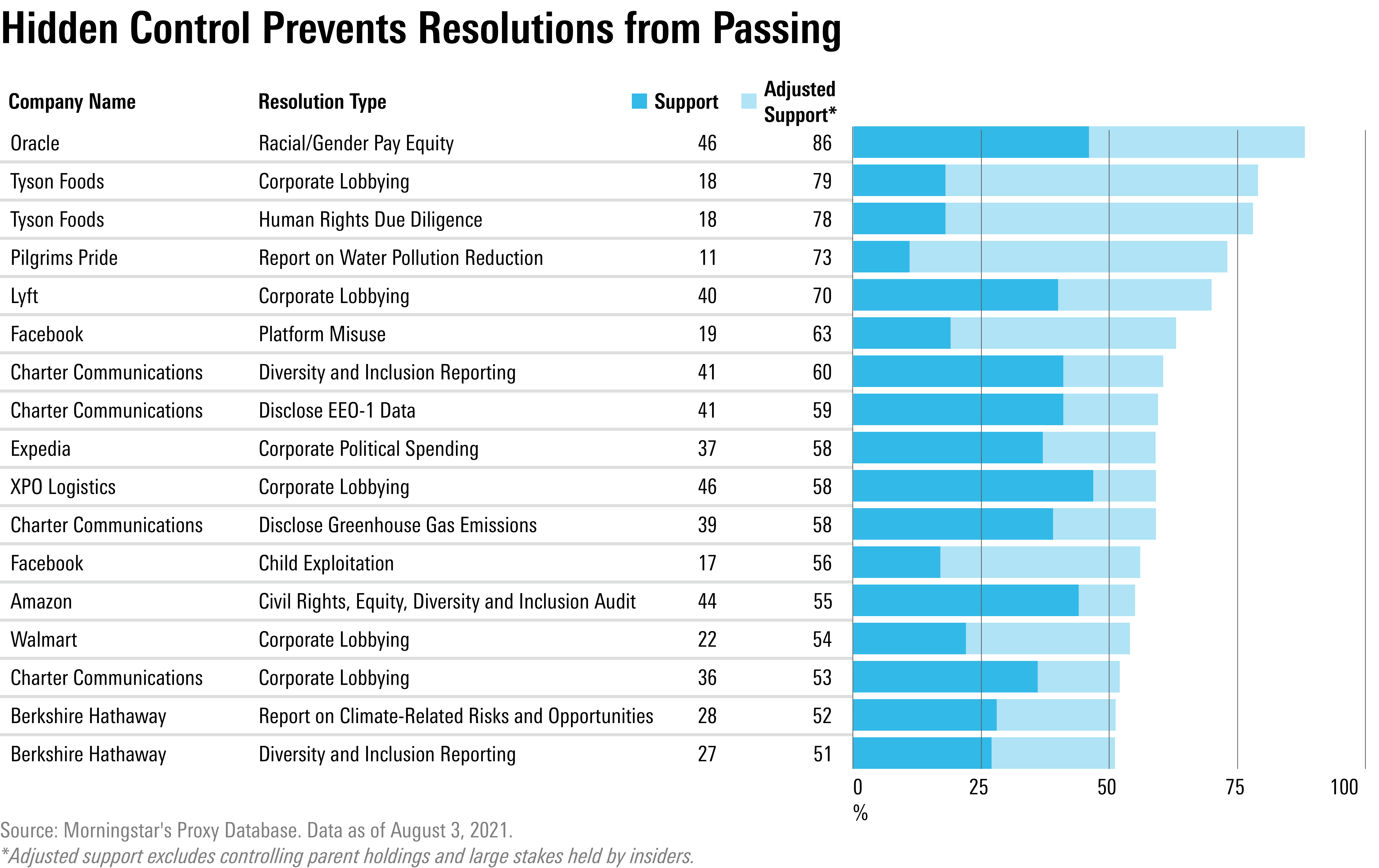

- General shareholder support for E&S issues was even stronger than the headline numbers suggest. A Morningstar analysis shows large ownership stakes held by insiders and controlling parent companies at companies like Amazon.com AMZN, Facebook FB, and Berkshire Hathaway BRK.A likely prevented 19 additional resolutions from passing.

Record High Support in 2021

Vote results for the 2021 proxy calendar reflect a changed landscape. Average support across 171 shareholder-sponsored resolutions averaged 34%, roughly 5 percentage points above the previous high set in 2019.

This came against a backdrop where the total number of proposals voted declined from around 220 in 2017.

Shareholder advocates say this doesn’t reflect a lack of issues to address, but instead is partly owing to hurdles introduced by the SEC under President Donald Trump which made it more difficult for shareholders to bring climate resolutions. More importantly, advocates also say that growing levels of shareholder support for ESG policies are leading to more willingness on the part of corporate management to consider policy changes and increased transparency, which in turn has led a greater number of proposals being withdrawn by proponents before they hit the ballot.

Based on companies’ reported votes, 36 resolutions earned majority support--more than 20% of all E&S items voted from July 1, 2020 through June 30, 2021.

Climate change, diversity and inclusion, corporate lobbying, and corporate political spending were the dominant issues addressed by resolutions that passed.

Dialing Down Support to Turn up Pressure on Executive Pay

During the coronavirus pandemic, employment became far more precarious for large swathes of the U.S. labor force, exacerbating inequality along racial and gender lines. Yet, compensation data reported in 2021 corporate proxies reveals numerous examples where senior executive pay soared on the back of the rising equity markets.

Historically, investors have paid more attention to stock price performance than pay fundamentals when casting advisory votes on executive compensation--also called “say-on-pay.” This may be changing. While markets are way up, average support for say-on-pay at S&P 500 companies was 1.3 percentage points lower in 2021 than in 2020 at 88.3%, accelerating a four-year decline. Seventeen S&P 500 companies failed to attain the support of a majority of shares voted across the 2021 proxy calendar, topping the previous record for failed pay votes set in 2018.

Large Asset Managers Fuel Voting Momentum

The SEC requires that fund companies report their voting records just once a year by the end of each August. Through individual vote bulletins and quarterly voting updates, some of the asset managers with the greatest sway over vote outcomes have begun offering more transparency into their voting activities.

At the time of writing, BlackRock and State Street had already posted their complete vote records through the end of June 2021 and Vanguard had published its vote record through the end of March 2021. In addition, BlackRock and Vanguard published occasional vote bulletins through the proxy season to share perspectives on specific proxy ballot items.

From these early vote disclosures, there appears to be a discernable a shift in the voting stance of the largest institutional holders of U.S. public equities. In fourth-quarter 2020 Procter & Gamble PG was urged to strengthen efforts to prevent supply chain deforestation, and Oracle ORCL was asked to provide racial and gender pay gap reporting. Both resolutions were supported by BlackRock, Vanguard, and State Street.

During the 2021 proxy season climate change attracted the strongest overall support with the help of votes by large asset managers.

Official Vote Results versus Investor Sentiment

As strong as the overall 2021 results were for E&S resolutions, the reported vote outcomes at companies with controlling or significant insider stakes understate shareholder sentiment.

Large ownership stakes with votes controlled by insiders and parent companies, often via share classes with super voting rights, would be cast according to management’s recommended vote--which typically opposes shareholder proxy motions.

To get a clearer sense of how general shareholders feel about the spectrum of issues that came to vote, we analyzed adjusted support. Where insiders control large stakes, we removed the equivalent number of votes from the denominator of support calculations to compute a landscape view of general shareholder sentiment.

In several cases large stakes held by insiders or controlling parent companies prevented resolutions from passing with majority support. For some, this was via large holdings of the single class of common stock, such as Larry Ellison’s 38% stake in Oracle and JBS Wisconsin Properties’ 80% stake in food processor Pilgrim’s Pride PPC.

Dual class share structures afford insiders super voting rights that often mute minority shareholders. For example, Warren Buffet’s 39% stake in Berkshire Hathaway’s Class A common stock, which carries one vote for every 1/10000th of a vote carried by the widely held Class B Common stock BRK-B, afforded him control over 45% of the vote at this year’s meeting--enough to prevent two E&S resolutions from achieving majority support. At Tyson Foods TSN, the founding family controls the company via Class B common stock, carrying 10 votes for every one vote carried by the widely held Class A common stock, a stake that affords 70% of the vote--enough to prevent a resolution on human rights from passing and potentially disqualifying the issue from the proxy ballot in 2022 under new SEC rules coming into effect in 2022.

Trump-era revisions to shareholder resolution rules which raised support thresholds for resubmitted proposals protect companies where insiders or parent companies control a significant portion of the vote (see: SEC Sued by Shareholders). We find that resolutions addressing social issues like DEI and human and civil rights are most likely to be affected by insider control and the new filing thresholds.

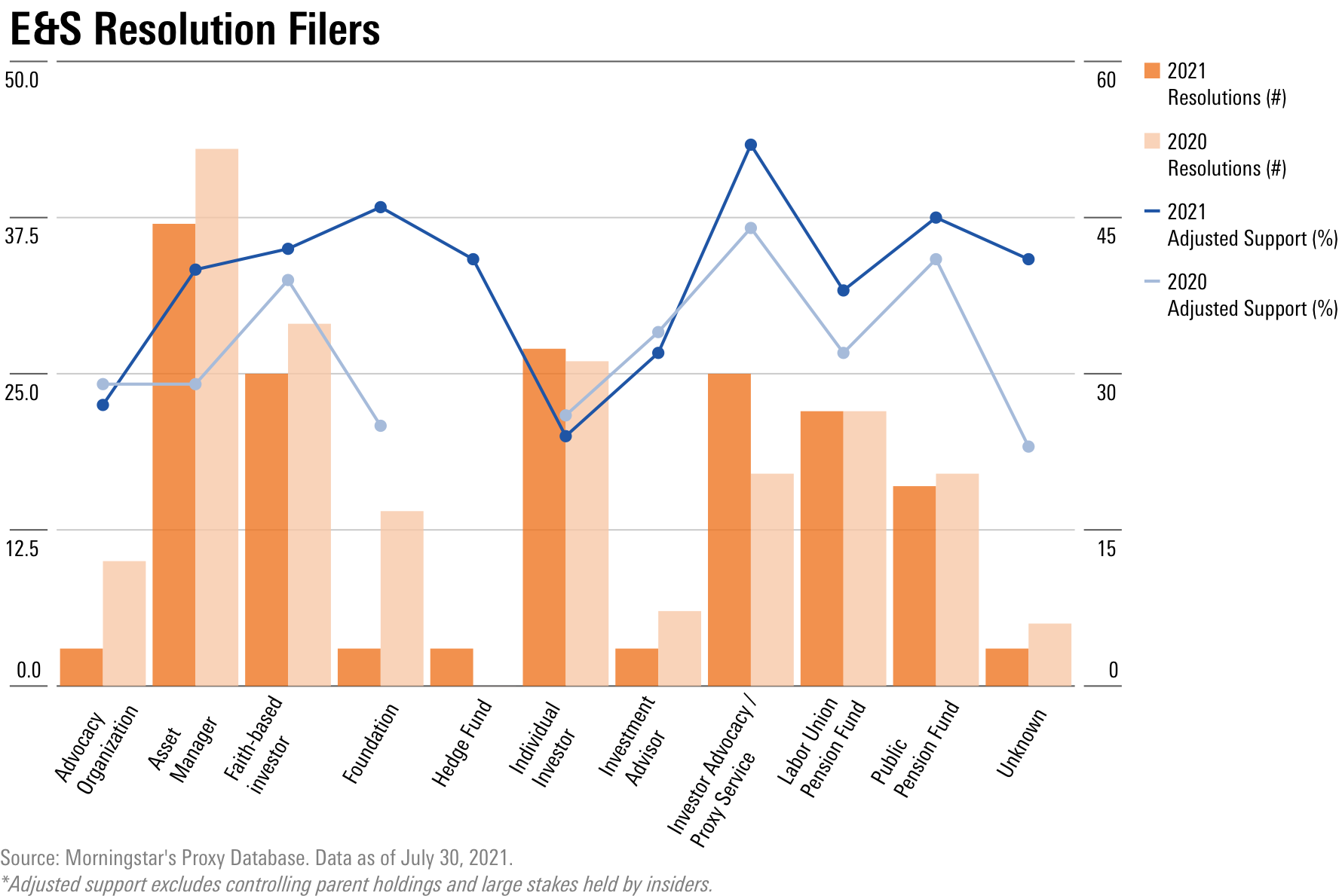

Who Files E&S Shareholder Resolutions?

A broad cross-section of investors, from individuals to large public pension funds, participates in the proxy process by filing shareholder resolutions. Thirty-eight resolutions that came to vote in the 2021 proxy calendar were filed by 16 different asset managers--all ESG asset managers with the notable exception of BNP Paribas and Amundi Asset Management, two large European asset managers. In 2020 BNP Paribas filed three lobbying resolutions at US oil and gas companies, and this year two more--asking companies to explain how their lobbying activities align with the goals of the Paris Climate Agreement.

Public pension funds have been increasingly active as filers of E&S resolutions and this year filed 15 of the resolutions coming to vote, including six that earned majority support.

A growing and international collective of investor advocacy groups like As You Sow, Follow This, Majority Action, Shareholder Association for Research and Education, The Shareholder Commons, ShareAction, and Investor Advocates for Social Justice often represent individual and institutional investors by filing shareholder resolutions on their behalf, tracking campaigns and defending company challenges via the SEC.

A common practice of co-filing resolutions blurs the classification of resolution by filer type, but demonstrates the broad investor appeal of many of the issues voted. For example, Pax World Funds and five New York City retirement and pension funds co-filed a resolution at Oracle asking the company to investigate and disclose whether there exists a gender or racial pay gap among its employees--the company faces a class action lawsuit brought under California’s equal pay law claiming discriminatory pay practices on behalf of thousands of present and former female employees. Amundi co-filed a resolution with Trinity College, Cambridge, at McDonald’s MCD asking the company to account for environmental and public health costs of antibiotic use in its meat supply chain.

What Comes Next?

With record support for climate resolutions, declining support for pay practices and the Exxon Mobil XOM headline-grabbing board elections, we anticipate that the coming 2022 proxy calendar will see much more scrutiny of board competence and incentive alignment at companies whose business is most at risk from the inevitable energy transition.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)